The shareholding of foreign portfolio investors was pegged at 20.5 per cent in Q1FY25, a 0.16 per cent decline from Q4FY24

Ajinkya Kawale Mumbai

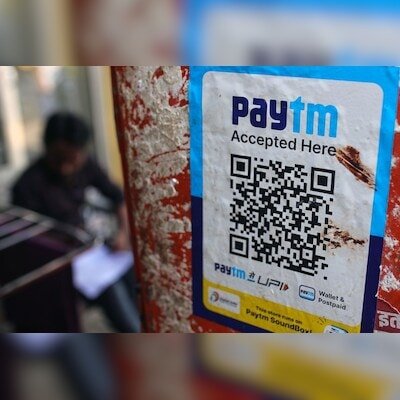

One97 Communications, the company that operates the brand Paytm, has recorded an increase in the shareholding of domestic investors, including mutual funds and retail shareholders, in the first quarter of the financial year 2025 (Q1FY25).

Sequentially, mutual funds increased their stake by 0.65 per cent from 6.15 per cent in Q4FY24 to 6.80 per cent in Q1FY25, led by investment from Mirae Mutual Fund and Nippon India Mutual Fund, the company said.

Click here to connect with us on WhatsApp

Meanwhile, the Foreign Direct Investment (FDI) shareholding in the company declined by two per cent from 39.77 per cent to 37.77 per cent on a quarter-on-quarter (Q-o-Q) basis.

The company said Softbank’s shareholding has come down below one per cent.

The shareholding of foreign portfolio investors was pegged at 20.5 per cent in Q1FY25, a 0.16 per cent decline from Q4FY24.

“Amongst FPIs, Treeline and UBS Principal Capital Asia expanded their shareholding to more than one per cent this quarter,” the company said in a statement.

The company is set to report its first-quarter earnings on July 19, nearly two quarters after the Reserve Bank of India’s (RBI) action on its associate entity Paytm Payments Bank.

One97 Communications reported a wider consolidated loss of Rs 549.6 crore in the fourth quarter (Q4) of 2023-24 (FY24), compared to Rs 168.4 crore in the same quarter last year (2022-23/FY23).

Sequentially, the loss doubled from Rs 219.8 crore in the third quarter (Q3) of FY24.

The Noida-based firm reported a loss of Rs 1,417 crore for the entire FY24, down from Rs 1,776.5 crore in FY23.

Net income declined by 2.6 per cent year-on-year to Rs 2,398.8 crore in Q4FY24 compared to Rs 2,464.6 crore in Q4FY23.