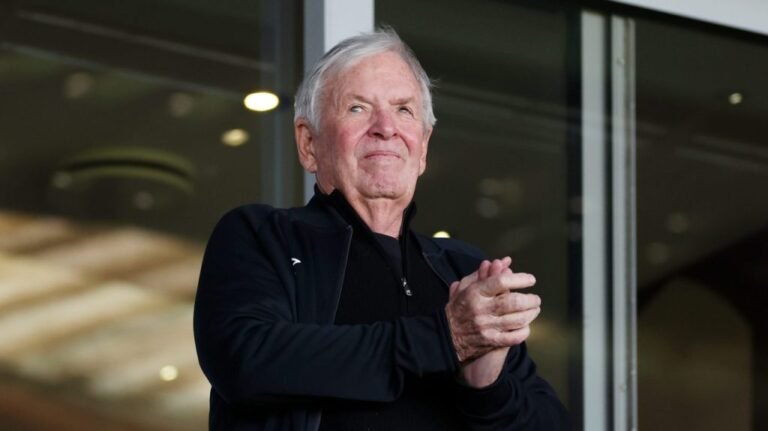

Vegas Golden Knights owner Bill Foley is betting on soccer.

Since acquiring the Premier League’s AFC Bournemouth in 2022, the billionaire businessman has developed a multi-club model under Black Knight Football Club, his holding company, in a remarkably short period.

“After we got the NHL’s Golden Knights franchise, I became fascinated by football, particularly the Premier League,” Foley said in a video call. His initial search yielded a few minority stake investments, but he ultimately decided to pursue a club where he could have complete control.

“I’d like to be in a situation where I can control my destiny,” Foley said. “If there’s a mistake made, it’s on me. It’s my fault. I can’t blame anybody else.”

Foley came across Bournemouth when the club was in the Championship, the second division of the English soccer pyramid. He was reluctant to buy the club at that time. “I’d rather buy a team that may risk being relegated,” he said. “And then it’s up to me to keep us in the Premier League.”

Bournemouth returned to the Premier League in 2022. Foley acquired the club for $147 million with several partners, including a minority ownership group led by award-winning actor and director Michael B. Jordan in December of 2022.

Since then, he has expanded his portfolio to include Auckland FC, a professional soccer club based in New Zealand that competes in the A-League Men, the top flight of Australian soccer. He also acquired a 40% stake in FC Lorient of the French Ligue 1 and a minority stake in Hibernian Football Club in Scottland. FC Lorient has since been relegated to the second division, but Foley believes he will bring the club back up. Once Lorient is promoted, BKFC has a path to acquire control of that team. Foley says he’s also close to buying a team in Portugal and is looking into clubs in the Netherlands. The idea is to have pathways for players to move through the BKFC system, develop and get playing time.

“If the multi-club model isn’t executed properly, it will fail, as a bunch of clubs will do what they want to do,” he said. “They have got to be coordinated. They’ve got to work together. Everyone’s got to listen to each other.”

In June, Foley hired Tim Bezbatchenko, president and GM of MLS’ Columbus Crew, as BKFC’s first president. Under Bezbatchenko’s leadership, the Crew achieved significant success, winning two MLS Cups (2020 and 2023), capturing the 2021 Campeones Cup, and reaching the 2024 CONCACAF Champions Cup final. With Bezbatchenko leading BKFC, Foley is considering the potential of affiliating with an MLS team primarily to transition players into the league. Additionally, he is exploring the idea of establishing an academy in Las Vegas to connect with the Hispanic, mainly Mexican, market.

Foley is best known for bringing the first major professional sports franchise to Las Vegas when the Golden Knights were established as an NHL expansion team in 2017. His portfolio of sports and entertainment properties also include the Henderson Silver Knights of the American Hockey League and the Vegas Knight Hawks of the Indoor Football League. Several of Foley’s teams are branded as “knights,” an ode to the nickname of Army’s college teams at West Point, Foley’s alma mater.

Last year, Foley brought Ryan Sports Ventures, the sports investment division of the Chicago-based Ryan family, to Black Knight as minority investors.

Before venturing into European soccer investments, Foley considered purchasing an MLS expansion club in Vegas but opted against it due to the hefty price tag, which totaled $1.3 billion, including the $500 million franchise fee and stadium costs. “I have a lot of admiration for the MLS and their ownership groups,” he said. “For us, it just wasn’t the right situation. I couldn’t get enough bang for the buck, frankly.”

On Saturday, Foley’s Bournemouth will face Ryan Reynolds’ Wrexham AFC for a preseason match at UC Santa Barbara’s Harder Stadium. The squad will include USMNT captain Tyler Adams, who has recovered from a recent hamstring injury. Foley will host both teams at Hotel Californian, his luxurious beach front hotel. There will be pre- and postgame parties and a jersey launch designed by actor Jordan.

“We’ve got our Ryan Reynolds counterpart,” Foley said. A Welcome to Wrexham-like reality show is in the works as well, he adds.

The Premier League club will continue its preseason tour in the U.S. with a match against Arsenal on July 24, at LA Galaxy’s Dignity Health Sports Park in Los Angeles.

“I have big plans for Bournemouth,” Foley said. “Our goal is to move up in the [EPL] table and play in Europe” for Europa League and Champions League titles.