Djerriwarrh Investments Limited’s (ASX:DJW) investors are due to receive a payment of A$0.08 per share on 26th of August. Based on this payment, the dividend yield on the company’s stock will be 4.9%, which is an attractive boost to shareholder returns.

View our latest analysis for Djerriwarrh Investments

Djerriwarrh Investments Doesn’t Earn Enough To Cover Its Payments

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, the company was paying out 103% of what it was earning. This situation certainly isn’t ideal, and could place significant strain on the balance sheet if it continues.

Looking forward, EPS could fall by 0.9% if the company can’t turn things around from the last few years. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 96%, which is definitely a bit high to be sustainable going forward.

Dividend Volatility

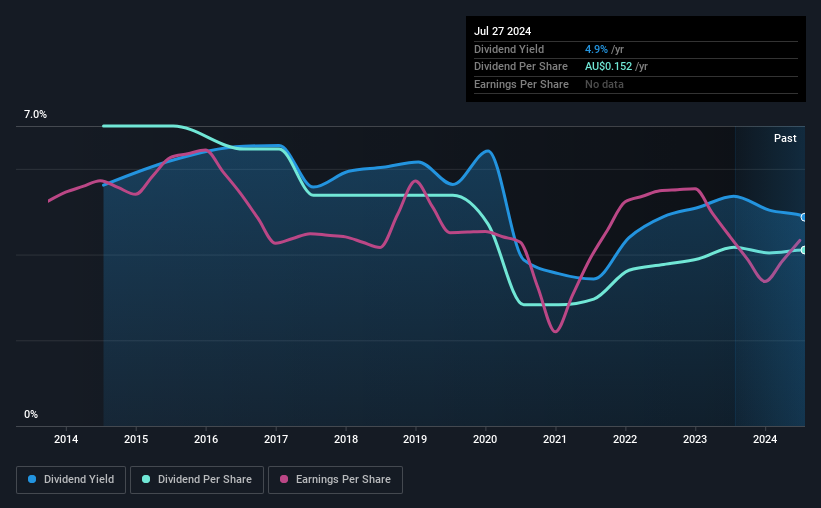

The company’s dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the annual payment back then was A$0.26, compared to the most recent full-year payment of A$0.153. The dividend has shrunk at around 5.2% a year during that period. A company that decreases its dividend over time generally isn’t what we are looking for.

The Dividend’s Growth Prospects Are Limited

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Although it’s important to note that Djerriwarrh Investments’ earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

Djerriwarrh Investments’ Dividend Doesn’t Look Great

Overall, this isn’t a great candidate as an income investment, even though the dividend was stable this year. The company’s earnings aren’t high enough to be making such big distributions, and it isn’t backed up by strong growth or consistency either. Overall, the dividend is not reliable enough to make this a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we’ve identified 1 warning sign for Djerriwarrh Investments that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com