(Bloomberg) — Hedge funds look to have pulled back from their most bullish yen bets but are still paying high prices to hedge positions at current levels, a sign of increased uncertainty as to where the currency will go next.

Most Read from Bloomberg

Dovish comments by Bank of Japan Deputy Governor Shinichi Uchida Wednesday brought the relative cost of hedging yen gains over the next month about a third lower, according to Ruchir Sharma, London based global head of FX option trading at Nomura International PLC. But notably pricing for hedges close to where the forward market was remained elevated, even as the currency itself fell, he said.

Uchida pledged to refrain from hiking interest rates when markets are unstable, a strong signal in the wake of historic financial market volatility in Japan, which was triggered in part by the yen’s recent surge.

“There has been a sharp repricing lower of the premium the market will pay to buy yen calls versus selling yen puts in the one-month tenor,” Sharma said. “Fast money are actively engaged for the past 48 hours but corporates and real money have stayed on the side lines waiting for more stability before engaging.”

The yen has swung in a wide range this week, initially surging as leveraged funds continued to exit short positions in the currency brought on by last month’s BOJ rate hike, before rapidly retreating after Uchida spoke. The currency traded below the 142 per dollar level on Monday before approaching 148 on Wednesday.

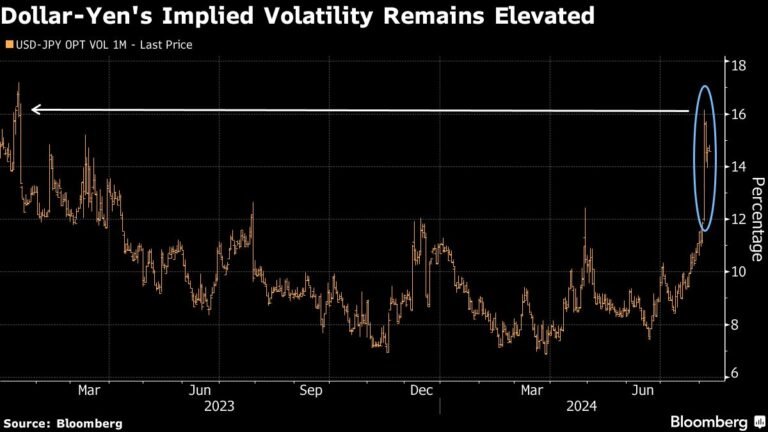

A measure of the dollar-yen’s expected movement over the next month remains near its highest level since January 2023.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.