“As the debt manager of the government, we are watchful of what exactly is happening. If something needs to be done, we will interact with the government and deal with it,” the RBI governor said.

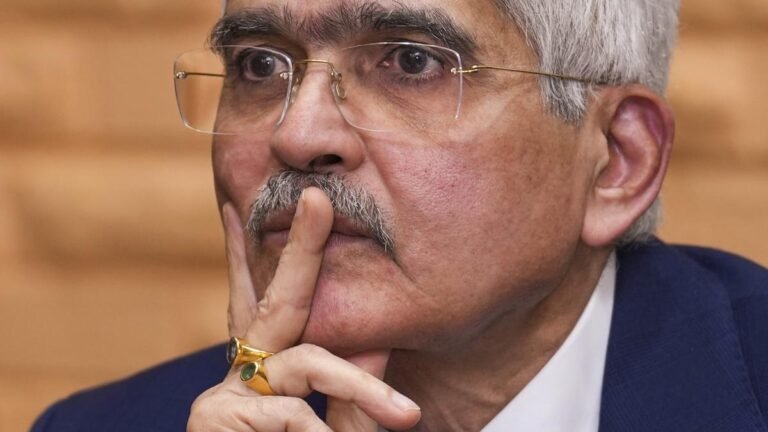

| Photo Credit: PTI

Reserve Bank of India (RBI) Governor Shaktikanta Das on Saturday (August 10, 2024) said trading of sovereign green bonds can commence at the International Financial Services Centre in Gujarat during the second half of the current fiscal.

“We are in discussion with the IFSC, it will be operationalised very soon. I think in the second half (of the current financial year), it will be possible,” Mr. Das said.

In April, the RBI announced that it would issue a framework to enable the trading of sovereign green bonds in Gujarat International Finance Tec-City (GIFT City). The government has been raising funds through green bonds since 2022-23 and has raised a total of ₹36,000 crore in the last two years.

So far in the current financial year, the government has raised only ₹1,697 crore out of the stipulated ₹12,000 crore scheduled to be raised in the first half ending in September through green bonds as it did not find favourable bids.

When asked about the tepid response from investors to such bond issuance, Mr. Das said, “as the debt manager of the government, we are watchful of what exactly is happening. If something needs to be done, we will interact with the government and deal with it.” He further said one major announcement in this year’s budget about developing a climate taxonomy.

Also Read: Reassuring resolve: On the RBI’s Monetary Policy Committee’s move

“I think that will have a significant long-term impact on mobilisation of funds for the green sector, not only through green bonds but also overall financing of the green sector,” he said.

“We will develop a taxonomy for climate finance to enhance the availability of capital for climate adaptation and mitigation. This will support the achievement of the country’s climate commitments and a green transition,” Finance Minister Nirmala Sitharaman had said in her Budget speech for 2024-25.

Earlier in the day, Sitharaman addressed the board members in the post-budget 609th RBI’s Central Board Meeting held here.