Insights into the Investment Shifts of a Hedge Fund Titan

John Paulson (Trades, Portfolio), the President and Portfolio Manager of Paulson & Co. Inc., has made notable changes to his investment portfolio in the second quarter of 2024. Known for his expertise in merger arbitrage, Paulson’s recent 13F filing reveals strategic exits and acquisitions, reflecting his deep analysis of market dynamics and company fundamentals. With a distinguished career that includes being a Baker Scholar at Harvard Business School and a managing director at Bear Stearns, Paulson’s moves are closely watched by investors for insights into market trends.

Summary of New Buys

John Paulson (Trades, Portfolio)’s portfolio welcomed a new entrant in the second quarter of 2024:

-

The significant addition was Everbridge Inc (EVBG), with 1,225 shares valued at $42.86 million.

Key Position Increases

Paulson also strategically increased his stakes in existing investments:

-

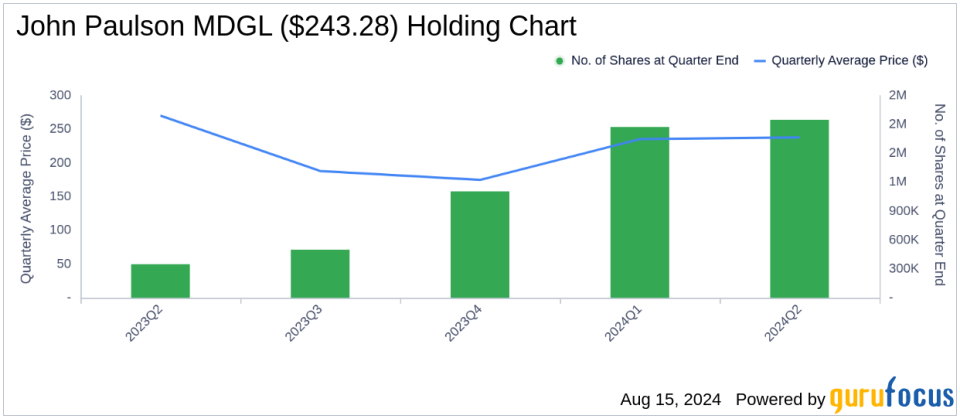

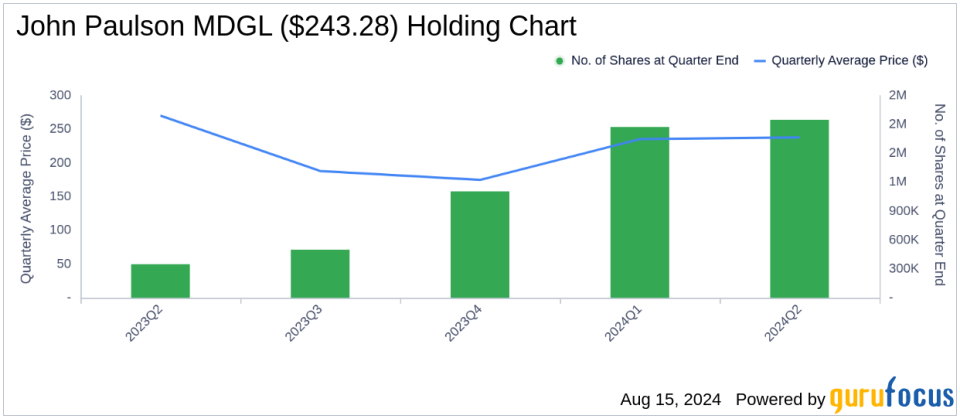

The most notable increase was in Madrigal Pharmaceuticals Inc (NASDAQ:MDGL), where he added 75,000 shares, bringing the total to 1,850,000 shares. This adjustment represents a significant 4.23% increase in share count and a 1.55% impact on his current portfolio, totaling $518.3 million.

Summary of Sold Out Positions

John Paulson (Trades, Portfolio) completely exited several positions in this quarter, highlighting a shift in strategy or taking profits:

-

Newmark Group Inc (NASDAQ:NMRK): All 3,000,000 shares were sold, resulting in a -2.3% impact on the portfolio.

-

Alibaba Group Holding Ltd (NYSE:BABA): The complete liquidation of 50,000 shares caused a -0.25% impact on the portfolio.

Key Position Reductions

Reductions were also part of Paulson’s Q2 strategy:

-

Anglogold Ashanti PLC (NYSE:AU) saw a reduction of 1,000,000 shares, marking a -34.1% decrease in shares and a -1.53% impact on the portfolio. The stock traded at an average price of $23.73 during the quarter and has returned 26.97% over the past three months and 66.74% year-to-date.

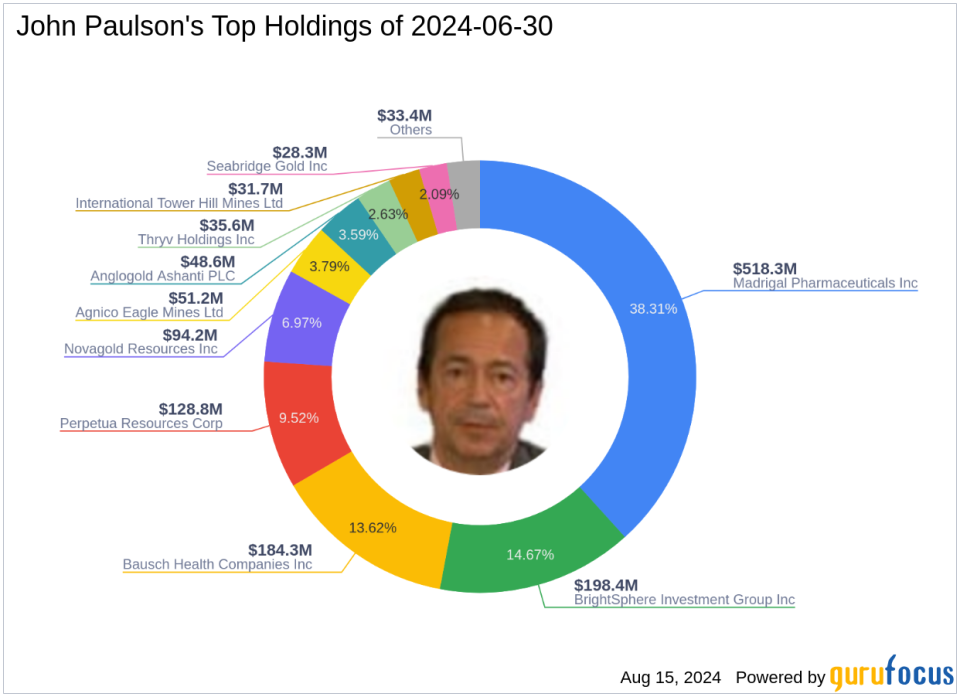

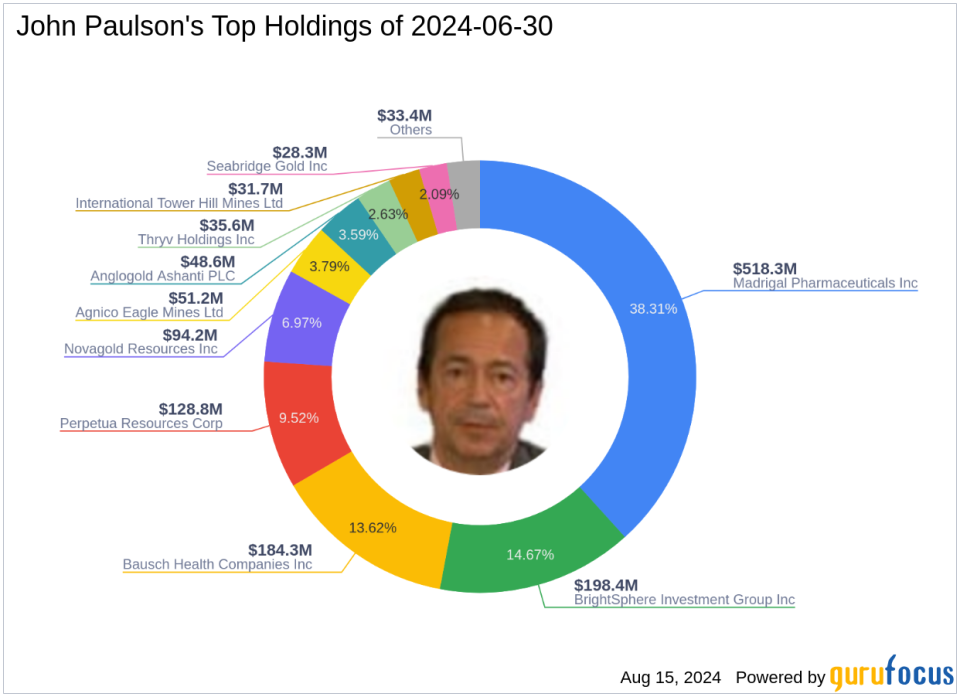

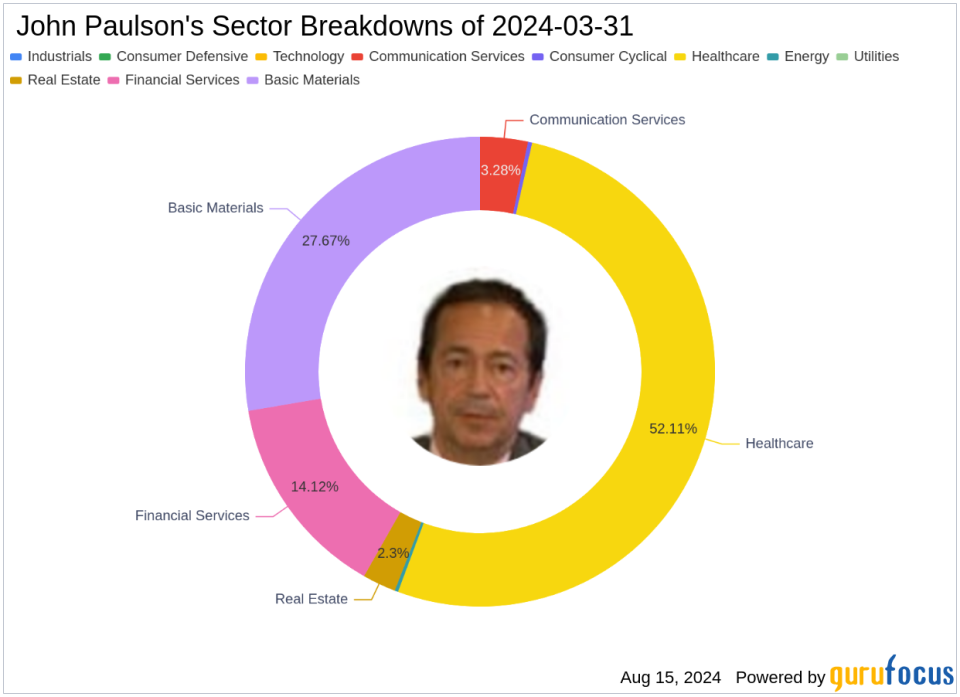

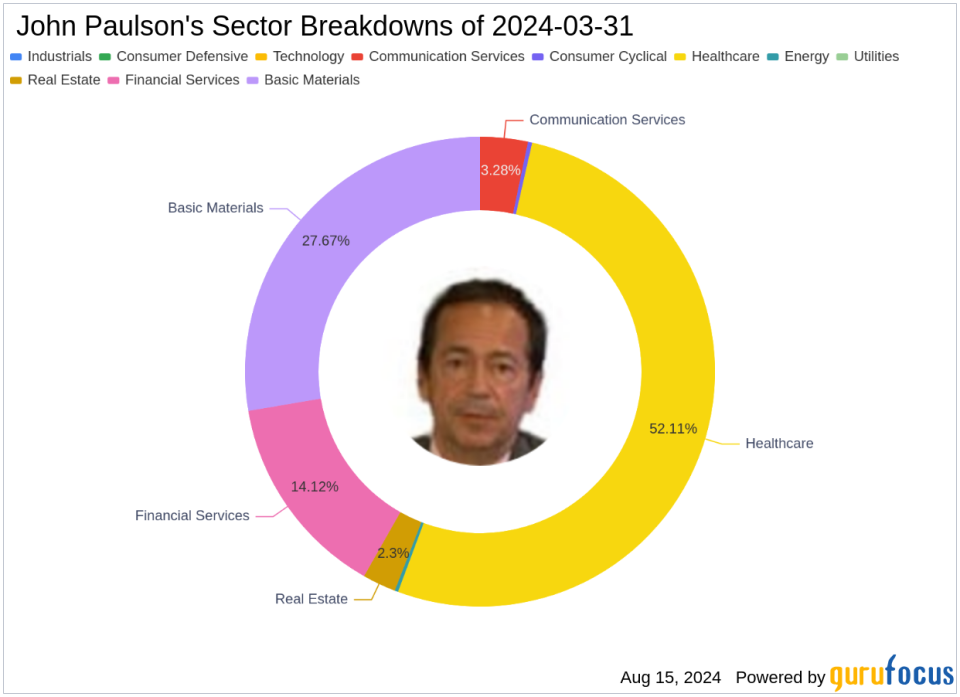

Portfolio Overview

As of the second quarter of 2024, John Paulson (Trades, Portfolio)’s portfolio included 16 stocks. The top holdings were:

-

38.31% in Madrigal Pharmaceuticals Inc (NASDAQ:MDGL)

-

14.67% in BrightSphere Investment Group Inc (NYSE:BSIG)

-

13.62% in Bausch Health Companies Inc (NYSE:BHC)

-

9.52% in Perpetua Resources Corp (NASDAQ:PPTA)

-

6.97% in Novagold Resources Inc (NG)

These holdings are mainly concentrated in five industries: Healthcare, Basic Materials, Financial Services, Communication Services, and Energy.

This detailed analysis of John Paulson (Trades, Portfolio)’s latest 13F filing not only provides a snapshot of his current investment landscape but also offers valuable insights into his strategic thinking and market predictions. Investors and market watchers will find these shifts and strategies crucial for understanding potential market movements and aligning their investment strategies accordingly.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.