Buying the dip can be a smart move, but it’s not always right for everyone.

The stock market has been on a wild ride the last few weeks, and many investors are feeling the whiplash from the sudden ups and downs.

Despite how stomach-churning market downturns can be, they can also be fantastic buying opportunities. Many stocks are essentially on sale right now, making it a smart time to buy. If the market has further to drop, you could snag stocks at an even steeper discount.

However, there are situations where it may not be the best idea to invest in the stock market — no matter how attractive the lower prices may be. If any of these three factors apply to you, it may be wise to avoid investing right now to protect your finances.

Image source: Getty Images.

1. You don’t have an emergency fund

A robust emergency fund is crucial, especially during periods of market volatility. If you invest all of your spare cash and the market falls, you may have no choice but to pull your money out at a less-than-ideal time if you face an unexpected expense.

Selling your investments can not only lock in any potential losses, but it could also come with hefty taxes or fees. Even if you’re only investing through a company 401(k) or IRA, withdrawing your savings before age 59 1/2 could result in a 10% penalty and income taxes on the amount you withdraw.

Ideally, you’ll have enough cash socked away in an emergency fund to cover at least three to six months’ worth of living expenses. That way, if you face a hefty cost or lose your job, you can still make ends meet without having to pull your money out of the market.

2. You can’t keep your money in the market for the long haul

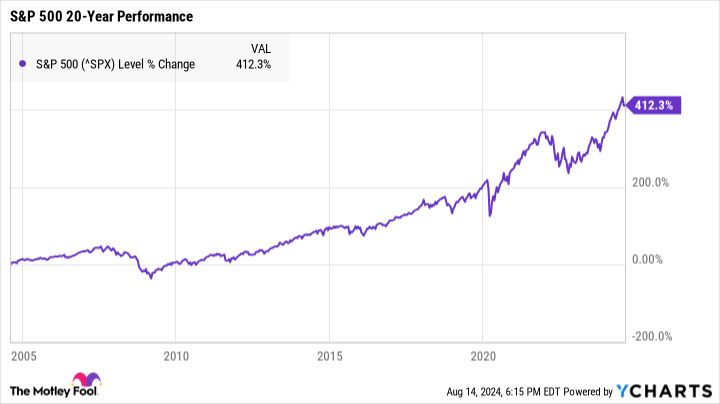

To maximize your returns in the stock market (while also minimizing risk), it’s wise to keep your money invested for at least several years. Ideally, it’s best to stay in the market for decades.

A long-term strategy can keep your money safer while helping reduce the impact of volatility. If you can only stay invested for two or three months, there’s a chance that stock prices will have dropped substantially by the time you’re ready to sell. But if you stay in the market for 20 years, it’s extremely likely the market will have earned positive total returns in that time.

In fact, research shows that the longer you stay invested, the lesser the chance that you’ll lose money. Researchers at investment firm Capital Group analyzed S&P 500 historical data and found that if you were to invest in an S&P 500 index fund and hold it for only one year, there’s a 27% chance that you’ll lose money.

However, by holding that investment for three years, there’s only a 16% chance of seeing negative returns. Over a 10-year period, that chance drops down to just 6%. A long-term outlook can keep your money far safer, and if that timeline doesn’t work for you right now, it may be best to hold off on investing for the time being.

3. You have high-interest debt

It is possible to invest in the stock market while paying down debt, and in many cases, that can be a very smart move. The more time you give your investments to grow, the more you can potentially earn. Waiting until you’re completely debt-free to begin investing, then, can set you far behind.

That said, if you’re saddled with loads of high-interest debt — such as credit card debt — it can be wise to pay that down before you invest.

The stock market as a whole has earned an average annual return of around 10% per year, historically. Meanwhile, the average credit card interest rate is 24.92%, according to 2024 data from Lending Tree. If you’re paying far more in interest than you’re earning on your investments, it may not make much sense to invest until that debt is paid down.

Investing in the stock market is a fantastic way to build wealth, but the right strategy is key. Not everyone will be in the right place financially to invest right now, and that’s OK. By taking steps to improve your financial health before you invest, you can maximize your earnings once you are ready to dive into the stock market.