Torsten Asmus

Putnam Focused Large Cap Value ETF (NYSEARCA:PVAL), launched on 05/25/2021 and managed by Putnam Investment Management, LLC., is an actively managed ETF that measures its performance against the Russell 1000 Value Index.

Though it hasn’t been active for long, there is enough information to explain its outperformance in the last 3 years and provide a reasonable basis for expecting the trend to continue. The fees are high but about average for an actively managed fund, and the valuation of its holdings can more than offset them.

Methodology

The focus of PVAL is U.S. stocks that are undervalued in the large-cap space. Although the issuer doesn’t share specifics in regard to the indicators that managers use to identify them, it states that they may consider other indicators beyond valuation, such as financial strength, competitive position, growth potential, cash flows, and projected future earnings.

We also don’t have fresh information when it comes to the holdings of the fund, since it is exempt from being required to provide this by the SEC due to its nature as an actively managed ETF. So, instead of disclosing its portfolio each business day, it opts for what it calls a “tracking basket”, which closely tracks the daily performance of the ETF and has some of its holdings but is not its actual portfolio.

In any case, the number of holdings that was disclosed the last time shouldn’t be too far from the current one, and it’s interesting to note that it’s only 45:

Of course, these are all large-cap stocks, and the weighted average market cap of the portfolio was $226.40 Billion as of 07/31/2024. But I think that 45 large-cap holdings still make for a very well-diversified portfolio, and it’s fascinating that the managers can identify value opportunities that result in such outperformance in the area of the market that is the most efficiently valued.

Performance & Cost

In the last 3 years, the fund delivered an average annual return of 13.96% as measured by its market price, while the benchmark reflected a 5.52% return. The performance spread is also very significant when looking at the more recent results; PVAL returned 25.69% in the last year, while the benchmark reflected a return of 13.06%.

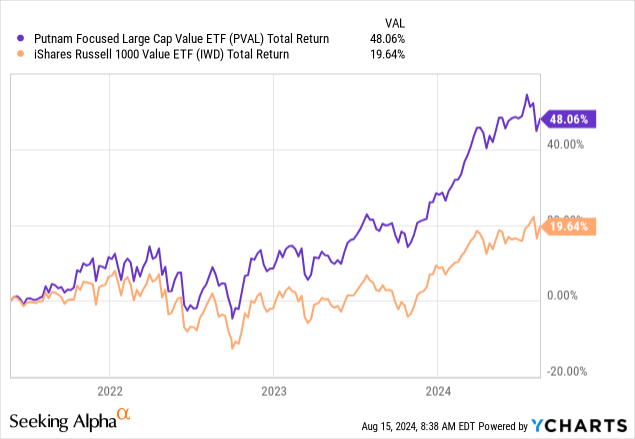

Below, I compare the fund to the iShares Russell 1000 Value ETF (IWD) since PVAL’s inception date to illustrate better the degree of its outperformance:

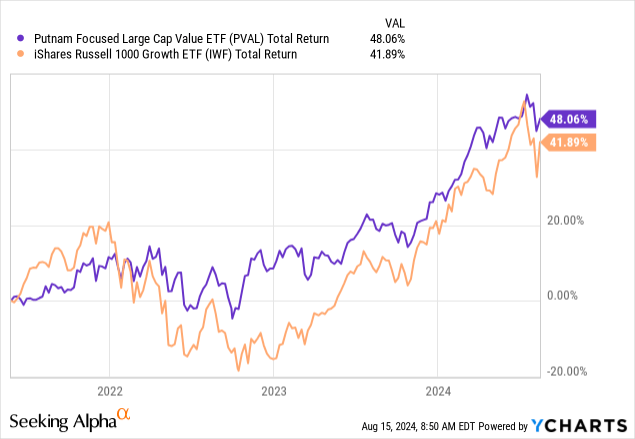

It was also interesting to observe that it outperformed the iShares Russell 1000 Growth ETF (IWF) and that it was pretty consistent at that:

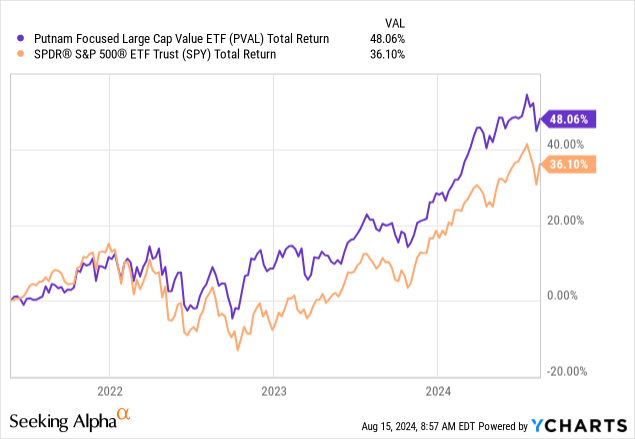

You might have noticed how PVAL seems less volatile in the chart above. The same thing can be seen when comparing it against the SPDR S&P 500 ETF (SPY) which seems to have been more volatile during the last 3 years as well, albeit to a lower degree:

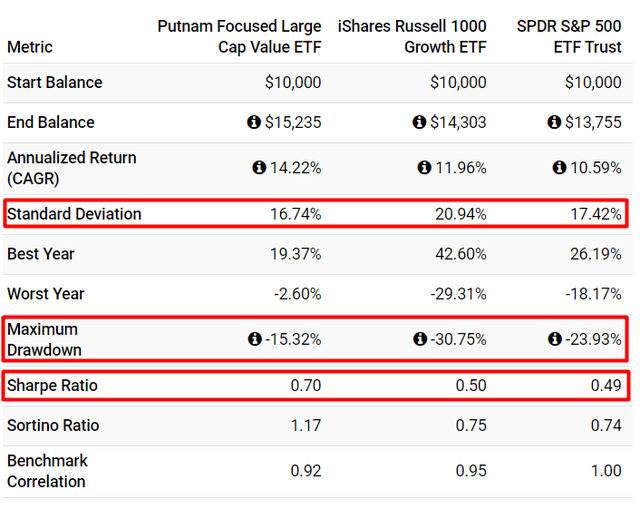

More specifically, PVAL had a standard deviation of 16.74%, but its growth counterpart and SPY had one of 20.94% and 17.42%, respectively. Additionally, its maximum drawdown was only 15.32% when IWF and SPY had one of 30.75% and 23.93%, respectively. So, while the performance spread may be less impressive here, it manages to seem exceptional on a risk-adjusted basis (Sharpe was 0.7 for PVAL):

That also clearly illustrates the fact that undervalued stocks don’t necessarily outperform because they are “riskier” securities.

Now, consider that the fund’s portfolio has a book value premium of 130% and an earnings multiple of 14.87x. In contrast, SPY has a 358% premium to book and an earnings multiple of 22.53x. The relative undervaluation here is significant, and it supports the expectation of continuous outperformance.

Last, during 2023 PVAL realized a turnover ratio of 37% which is quite high. Coupled with an expense ratio of 0.56%, this is arguably an expensive fund to hold on an absolute basis. However, within the context of active management and the solid track record thus far, I believe both ratios are fair.

Risks

One of the biggest risks I identify here comes from the lack of transparency in regard to the methodology and the relatively short track record. Because of these, it’s hard to feel comfortable enough selecting the fund as a core option. That being said, the first issue is justified considering that this is actively managed, and the second one is somewhat offset by the abundance of evidence that the value factor has delivered higher-than-average returns over the long run.

There is also concentration risk here because 19.70% of the holdings operate in the Financials sector. However, if interest rates are indeed decreasing soon, such holdings will be most sensitive to those changes, so it makes sense to be overweight here.

Verdict

All in all, DVAL has been successful so far and its fees should also be looked at from the value standpoint; is holding a broad-market index fund that is much cheaper worth it if the constituents are so much overvalued on a relative basis? Not for me, so I’ll have to rate this ETF a buy.

What’s your opinion? Do you own this or prefer some other value ETF? Let me know below. Thank you for reading!