Dragon Claws

Weekend Reading

Here are three things I think I am thinking about this weekend:

1) Three Terrible Ideas That Won’t Die

The Great Financial Crisis was wonderful because it got people interested in economics. And it was terrible in that it convinced a lot of people that mainstream economics was wrong about almost everything. This led to a revival in some heterodox ideas that the mainstream had long thrown in the dustbin. Unfortunately, some of these ideas have crept into the national policy debate and others have even been enacted.

Luckily, we have Cliff Asness on our side to remind us how bad some of these ideas are. Cliff took to Twitter to remind us of three things that almost all mainstream economists agree about. I won’t put words in his mouth, so feel free to go over there and read what he had to say. It’s quite good. In short:

- Rent control (and price controls more broadly) are bad and never work the way politicians claim they will. Price controls create shortages by distorting prices and disincentivizing production. You might think that capping rents would result in lower prices, but all it does is disincentivize new builders who rent those apartments out, which ends up driving prices up in the meanwhile.

- The greedflation narrative is enticing and intuitive, but that narrative really only applies to monopolies and uncompetitive markets. In a competitive market, blaming inflation on corporations is like blaming plane crashes on gravity. I mean, did the “greedflationists” just realize that corporations try to maximize profits?

- Tariffs and trade wars are the equivalent of putting boulders in your own harbors thinking you’ve made your economy more accessible to everyone when all you’ve really done is make things more difficult for everyone.

2) The Age in Bonds Rule is Wrong

As you may or may not know – I have an obsession about time within financial planning processes. It’s the current thing that my OCD won’t stop trying to solve at the moment. As someone who works with a lot of retirees and people entering retirement, I constantly find myself trying to help people navigate this challenging period in people’s lives. And one thing I’ve become convinced of is that this is the absolute most challenging period in someone’s financial life because that’s the period where your time horizon becomes most uncertain.

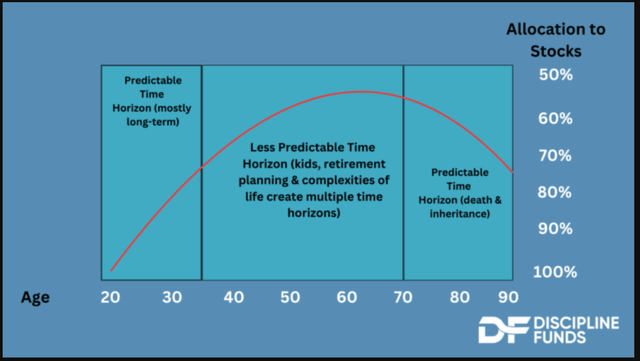

When it comes to asset allocation, the old rule of thumb is roughly “your age in bonds”. The basic thinking is that you should get more conservative as you get older. But I think this is wrong. I think your bond/cash allocation should peak right around retirement. My basic thinking is that that’s the time in your life when you have the most temporal uncertainty. In other words, when you’re young and old, investing is easier because you have a lot more clarity on your time horizons. When you’re young, you have a lot of time and runway to make mistakes. When you’re old, you have less time and less runway, but you have greater clarity over the specific time horizons. You’re either going to pass away soon or the assets will become someone else’s. The messy part is when you’re middle-aged and nearing retirement because you accrue a lot of financial liabilities that have different time horizons. This is compounded by your dependents, who require short-term and long-term planning.

This is a very general way of thinking about things and there are always circumstances that require greater customization, but the above image is how I think of this more broadly.

3) When ETFs Become Weapons of Financial Destruction

I am a big fan of boring ETFs because I think asset allocation should be boring. ETFs are great for helping people create low cost, diversified and boring savings portfolios. I am not a fan of overly fanciful ETFs that prey on people’s emotions and entice them to gamble. Asset allocation should be mostly boring. Build a financial plan, allocate the assets that correspond to that financial plan, diversify, reduce taxes/fees, etc. ETFs are the perfect vehicle for this, but as John Bogle often noted, they can be weaponized to entice people to do things they shouldn’t.

One disconcerting trend in the ETF space is that it’s becoming increasingly popular to create ETFs that help people trade in a manner that looks more like gambling than investing. For example, Bloomberg had a piece out about the 1.75X leveraged Microstrategy ETF. This is a fund that seeks to replicate 175% of the daily volatility of MicroStrategy Corp, the well-known Bitcoin company that does some enterprise analytics on the side. It’s an enormously volatile stock because it’s become levered to Bitcoin, an enormously volatile asset. And now you can get even more volatility for the not so low expense ratio of 1.3%. Oh boy.

Look, I am all for free markets. If someone wants to start a fart jar ETF that costs 10% in annual fees and there’s a market for that, then great. People like weird stuff, and some people like to burn their money on fire. That’s all well and good. And there’s nothing wrong with gambling for fun. But regulated financial markets are not casinos, and I think the line between gambling and savings is being distorted when we position products like this as “investment” products. They are gambling products. And again, that’s fine. There’s nothing wrong with gambling. I have no problem with stock picking, speculating, day trading, whatever. I don’t think you should do those things in large quantities, but if you need to scratch an itch, then scratch that itch. But just be sure not to confuse the process of prudent asset allocation with something that reflects imprudent gambling.

Anyhow, I don’t love this trend. Gambling appears to be an increasingly problematic endeavor in this country and I don’t love that our financial markets look increasingly like casinos instead of places where firms fund investment and savers allocate savings…

I hope you have a great weekend.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.