Iberdrola, Europe’s largest electricity provider, through its U.S. subsidiary New York State Electric & Gas (NYSEG), has successfully issued a 10-year green bond worth $525 million (EUR 490 million). The company reported massive demand for the bond that exceeded EUR 2 billion. This high demand allowed Iberdrola to reduce its benchmark interest rate to 135 basis points. As a result, the transaction cost was set at 5.332%.

Investor Confidence Fuels Iberdrola’s U.S. Bond Success

Iberdrola has once again shown financial supremacy under Ignacio Galán’s leadership with a successful bond issue in the U.S. this month. The company smartly capitalized on the recent decline in U.S. long-term interest rates, issuing a green bond that drew participation from over 60 major American investors. Iberdrola will use the secured fund to expand its U.S. network business.

The press release notes that the bond issue was managed by several leading banks, including BNP Paribas, MUFG, Wells Fargo, Santander, SMBC, Intesa, and Commerzbank.

It also highlighted that the current transaction is part of a series of successful financing activities by Iberdrola this year. It follows the EUR 500 million syndicated green loan secured on August 1 with ICO, Sabadell, and HSBC, backed by Cesce.

Furthermore, it has added green loans with the European Investment Bank (EIB) and the World Bank to its portfolio. As a result, the company’s total green bonds outstanding now amount to approximately €23 billion.

Earlier this year, Iberdrola unveiled a major investment program focused on electrification. From 2024 to 2026, the company plans to invest €41 billion in its network and renewable energy projects. The investment will be split 60:40, with the majority going to network growth—covering distribution and transmission—and the remaining portion directed to the U.S.

Additionally, Iberdrola has already completed three other significant financing operations in 2024: a EUR 700 million hybrid bond in January, a CHF 335 million bond in the Swiss market in June, and a EUR 750 million senior bond in July.

Ignacio Galán, chairman of Iberdrola group said,

“As the main issuer of green bonds and provider of renewable energy, Iberdrola supports sustainable finance as a way of speeding up energy transition, along with any other initiative that seeks to tackle climate change.”

Dominating the Green Bond Market

Green bonds are used to fund or refinance sustainable projects including renewable energy, clean transportation, energy efficiency and waste management, etc. Notably, Iberdrola has established itself as the world’s largest issuer of green bonds! In early 2021, the company made history by issuing the largest hybrid green bond ever, valued at €2 billion. In another major move in 2022, the energy house issued a 10-year, €1 billion green bond to support its offshore wind projects in France and Germany.

Moving on, green financing aligns perfectly with Iberdrola’s environmental goals. It supports the company’s investment plan by providing investors with transparency, enabling them to allocate funds effectively and measure their contribution to sustainability. Notably, the “Iberdrola Framework for Green Financing” ensures that its green financing efforts are right in place.

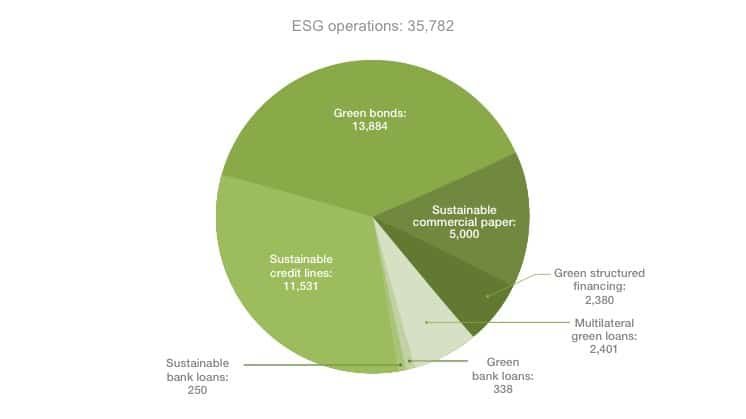

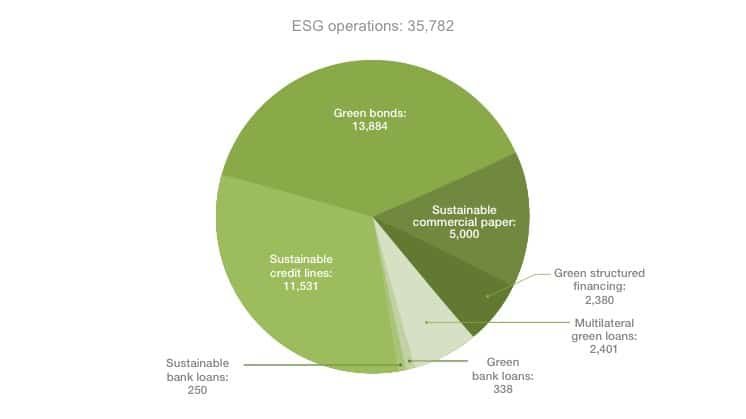

Image: Green and sustainable financing chart

source: Iberdrola

source: Iberdrola

Iberdrola’s Climate Action and Net Zero Goals

The electricity sector plays a crucial role in achieving the Paris Agreement’s goal of limiting global temperature rise to 1.5ºC. Iberdrola’s Climate Action Plan, aligned with the Paris Agreement, includes ambitious Science Based Targets initiative (SBTi) goals. They include:

- achieving carbon neutrality for scopes 1 and 2 by 2030

- net-zero emissions across all scopes, including scope 3, by 2040

For over 20 years, Iberdrola has been proactively developing sustainable solutions to support the global shift towards electrification. The company focuses on cleaner energy, increased storage, stable power backup, smarter grids, and enhanced digitization to meet its decarbonization goals.

Most recently, the company has taken a giant leap in the green hydrogen space. It has more than 50 green hydrogen projects, including ammonia and green methanol, spanning across the UK, Australia, Brazil, and the U.S. These initiatives aim to meet the electrification and decarbonization needs of industries and heavy transport.

source: Iberdrola

Four Key Levers Driving the Climate Action Plan

Environmental protection and sustainable development have been top priorities for the energy leader. Its sustainability report reveals that in the last four years, the company has invested over €140 billion in the energy transition. These investments have transformed the electric system, resulting in a more decarbonized generation mix and significantly reduced emissions.

Iberdrola’s Climate Action Plan focuses on four main levers to reduce emissions across all three scopes:

1. 100% Renewables

Iberdrola is heavily investing in renewable energy, expanding storage capacity, and advancing new technologies like hybrid systems and long-term storage. The goal is to achieve 52 GW of installed renewable capacity, primarily reducing Scope 1 emissions while also impacting Scope 3.

2. 100% Smart Grids

By 2025, Iberdrola aims for over 83% of its grid to be smart, making it a key component of a decarbonized and electrified energy system. These actions will directly reduce Scope 2 emissions and indirectly affect Scope 3.

3. Green Solutions for Customers

It is promoting the electrification and decarbonization of energy demand through initiatives like green hydrogen, sustainable mobility, and strategic alliances in green technologies. This lever is focused on reducing Scope 3 emissions.

4. Green Purchases

Iberdrola is committed to buying renewable energy for its use and forming partnerships to reduce emissions and accelerate the development of green products. These actions target reductions in both Scopes 2 and 3 emissions.

All in all, Iberdrola’s ability to attract investors across various markets is evident. As confidence grows, their commitment to sustainability and strategic market timing strengthens.

Disclaimer: Data and content source- Iberdrola’s reports