The number of Bitcoin (BTC) millionaires has soared by 111% this year, driven largely by the rise of crypto exchange-traded funds (ETFs).

The approval of spot Bitcoin ETFs, followed by Ethereum (ETH) ETFs, has attracted institutional players to crypto, creating a new wave of demand beyond retail investors.

Bitcoin ETFs Fuel Increase in BTC Millionaires

According to research by Henley & Partners, there are now 85,400 Bitcoin millionaires globally, reflecting a 111% increase in just a year. The report attributes the rise in crypto elites to the impact of ETFs, noting that these financial instruments have solidified Bitcoin’s status as “digital gold.”

“The total market value of crypto assets has now reached a staggering $2.3 trillion, an 89% increase when compared to the $1.2 trillion reported in the firm’s inaugural report last year. The upper echelons of crypto wealth have also expanded dramatically, with the number of crypto centi-millionaires (those with crypto holdings of $100 million or more) rising by 79% to 325, and even the rarefied cohort of crypto billionaires seeing a 27% increase to 28 globally,” an excerpt in the report read.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Beyond Bitcoin, Ethereum is also gaining attention, with 172,300 people worldwide holding over $1 million in crypto assets. The report highlights a 95% increase in ETH millionaires since last year’s inaugural findings, reinforcing Ethereum’s role as a cornerstone of the market.

Wealth Mastery founder Lark Davis praises the blockchain for serving as a foundation for numerous projects, solidifying its importance in the crypto ecosystem.

“The majority of what is built in crypto is built on Ethereum, based on Ethereum, or bridges liquidity back to Ethereum,” Davis noted.

Dominic Volek, Group Head of Private Clients at Henley & Partners, also emphasized the growing anticipation for Solana ETF. He noted that these financial instruments have sparked a new era of crypto adoption, where digital assets increasingly intersect with traditional finance (TradFi) and global mobility.

Bitcoin Secures Its Digital Gold Status

Meanwhile, institutional interest in crypto markets continues to grow. The introduction of Bitcoin and Ethereum ETFs has driven both retail and institutional demand, with the resulting buying pressure contributing to the value surge in cryptocurrencies.

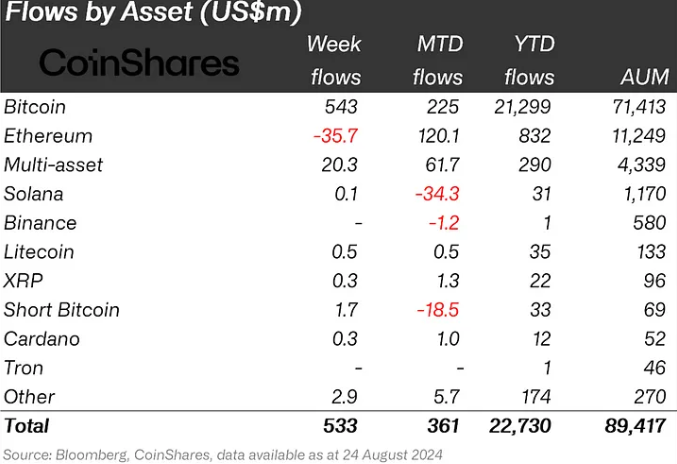

After the January approval, Bitcoin reached a new all-time high above $73,000, while Ethereum briefly touched the $4,000 psychological level. According to BeInCrypto, demand remains strong, with crypto investments totaling $533 million last week. Bitcoin led the inflows with $543 million, while Ethereum faced declines, partly due to Grayscale customer redemptions.

Nevertheless, increasing capital inflows into crypto investment products highlight the growing recognition of digital assets, further solidifying Bitcoin’s status as a legitimate investment.

Reflecting this interest, Bitcoin ETFs saw net inflows of $200.4 million on Monday, marking the eighth straight day of positive gains. In contrast, Ethereum ETFs experienced net outflows totaling $13.2 million.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

While this trend has contributed to Bitcoin’s recent price surge and sparked analyst speculation about a potential bull market, it’s important to note that September is historically Bitcoin’s worst-performing month.

BeInCrypto data shows Bitcoin is trading for $62,235, down 2.42% since the Tuesday session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.