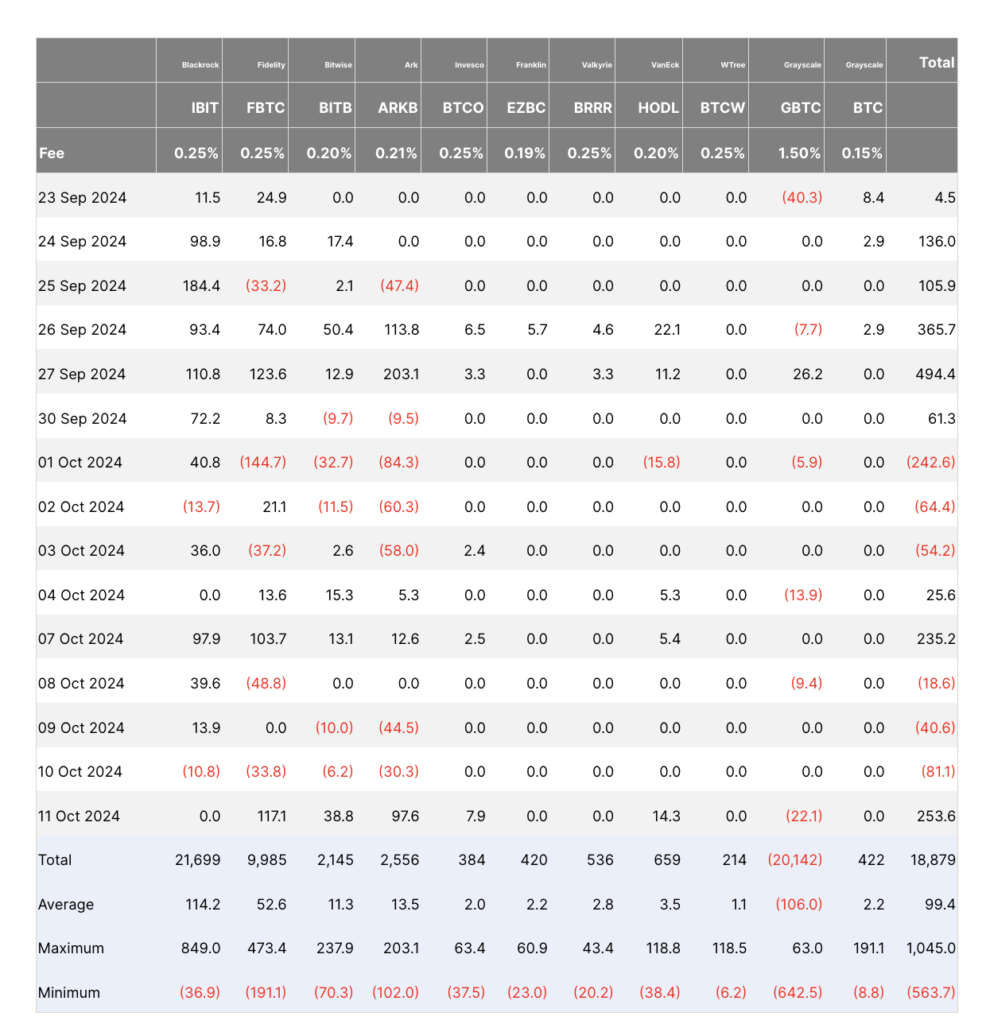

On Friday, U.S.-based spot Bitcoin exchange-traded funds (ETFs) saw net inflows of $253.6 million, breaking a streak of three consecutive days of outflows.

Leading the inflows was the Fidelity Wise Origin Bitcoin Fund, with $117.1 million, followed by ARK 21Shares Bitcoin ETF at $97.6 million, according to data from Farside Investors. The Bitwise Bitcoin ETF pulled in $38.8 million, marking its largest inflow in 11 trading days, while both Invesco Galaxy and VanEck Bitcoin ETFs also recorded inflows.

BlackRock’s iShares Bitcoin Trust (IBIT), along with Bitcoin ETFs from Franklin Templeton, Valkyrie, and WisdomTree, recorded no inflows for the day. This marked the third-largest combined inflow day without BlackRock’s IBIT contributing. Meanwhile, the Grayscale Bitcoin Trust saw an outflow of $22.1 million.

Source: Farside Investors

These inflows on October 11 more than offset the $140 million in outflows between October 8 and 10. The surge followed a 7.3% rally in Bitcoin, which reached a local high of $63,360 before settling at $62,530, according to CoinGecko data.

BlackRock remains the leader among spot Bitcoin ETF issuers, with total net inflows of $21.7 billion, while Fidelity is close to surpassing $10 billion. ARK 21Shares and Bitwise are the only other issuers with net inflows exceeding $2 billion.

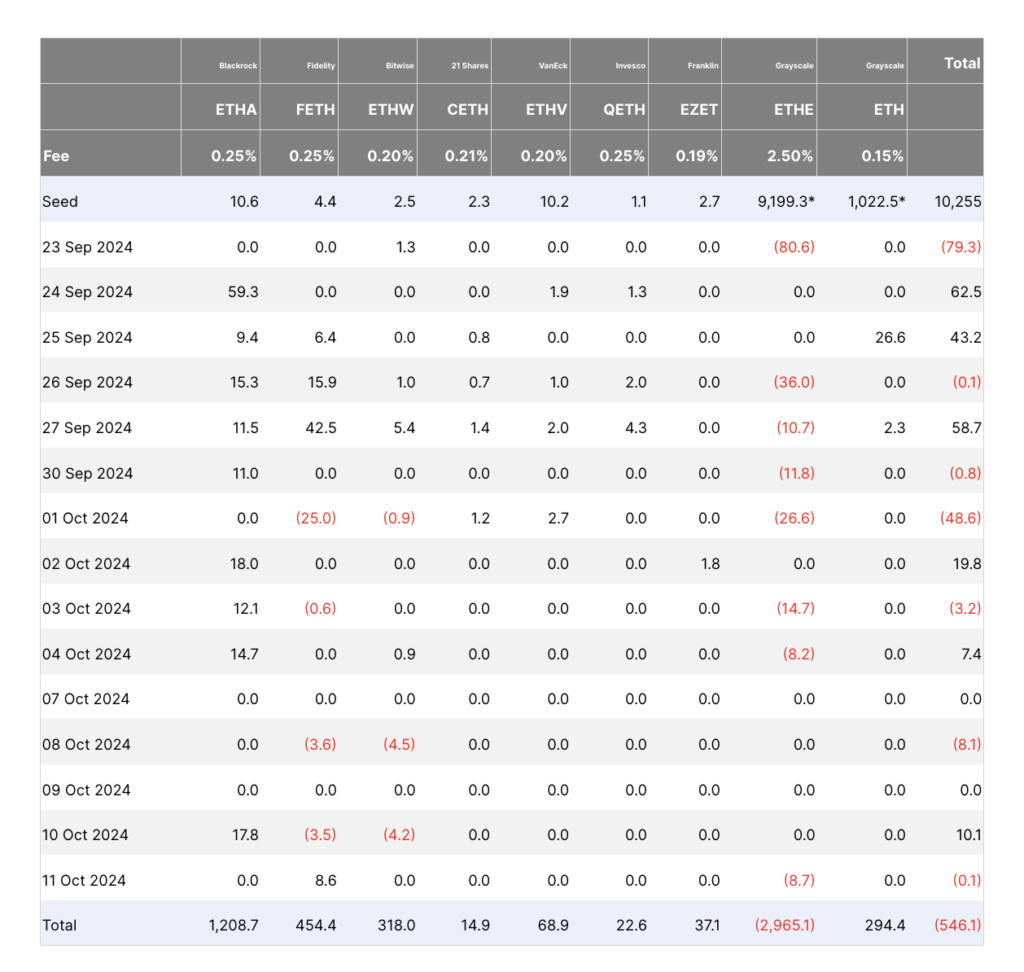

ETH ETFs continue to Lag

On the same day, U.S. spot Ether ETFs underperformed, with seven of the nine recording no inflows. The combined net outflow was $0.1 million, with all inflows coming from the Fidelity Ethereum Fund, while the Grayscale Ethereum Trust experienced an outflow of $8.7 million. According to Bitstamp CEO Bobby Zagotta, the low demand for Ether ETFs could be due to market uncertainty and investors’ lack of understanding of Ethereum’s technical roadmap.

Source: Farside Investors