Malaysian property investors often struggle with high-rise apartments that fail to generate enough rental income to cover mortgages. Poor management and inconsistent short-term rentals further erode property value, making it difficult to achieve optimal resale and disadvantaging both owners and investors.

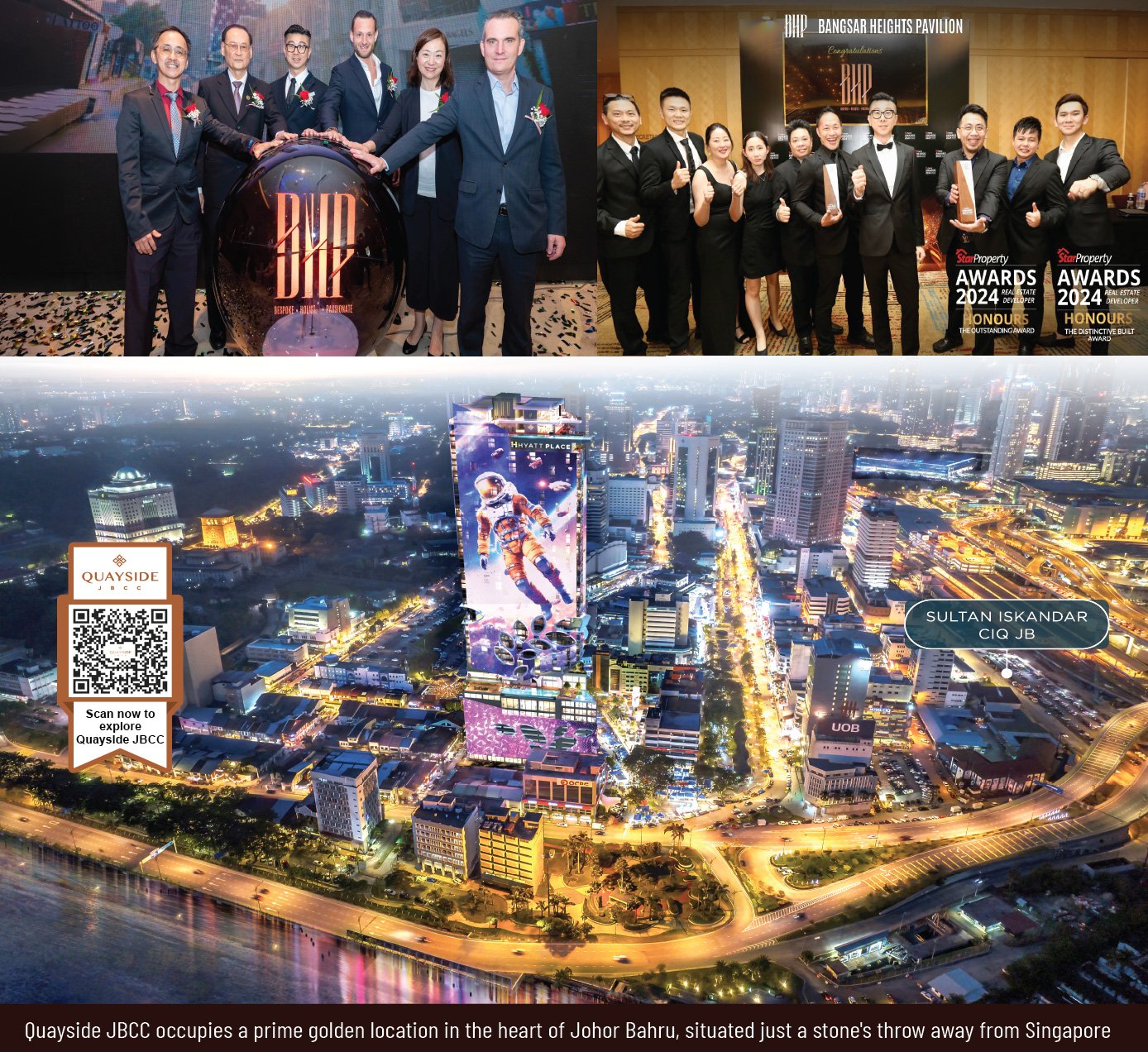

BHP [Bangsar Heights Pavilion], a subsidiary of Bangsar Heights Group with over 30 years of experience in Malaysia’s property industry. Under the leadership of Aaron Yap, CEO and Executive Director, BHP is transforming property investment by focusing on development, operation, and services.

Property investment is a long-term commitment, with short-term investments spanning 3 to 5 years, medium-term investments lasting 10 years, and long-term investments stretching over decades. Investors opting for short-term rentals should treat it as a business venture.

BHP’s Revolutionary Property Investment Model

As an international hotel & branded residences developer, BHP follows a “Backward Impact Strategy” to create a comprehensive investment ecosystem aimed at maximizing return on investment. Aaron Yap has identified the key elements of a successful project:

Prime Location Selection: Prioritizing bustling urban centers and commercially viable land with untapped potential.

Value Creation: Leveraging BHP’s expertise to maximize value and ensure sustained long-term growth.

Cutting-Edge Design: Developing high-end buildings with sophisticated architectural features.

Partnership with Premium Brands: Collaborating with globally recognized hotel and serviced residence brands for superior property and lease and serviced management, safeguarding asset value.

Comprehensive Services: Supporting investors throughout the investment process to ensure long-term success.

Prime Land Bank

BHP possesses prime land in strategic locations, poised to develop more high-end branded projects in the coming years.

| Jalan Sultan Ismail (KLCC) | Premier destination for five-star luxury hotels. |

| Changkat Bukit Bintang, Kuala Lumpur | Internationally renowned bar street and nightlife hub. |

| Johor Bahru City Center | Exclusive locale by the RTS Link Station. |

| Mount Austin, Johor Bahru | Bustling commercial district. |

Malaysia’s Property Market

According to Knight Frank’s “Real Estate Highlights First Half of 2024” report, Malaysia’s residential property market improved in Q1 2024, recording 62,823 transactions valued at RM 25.25 billion, a 16.6% increase. The high-end condominium market in Klang Valley showed significant growth, with increased sales and new projects.

Johor Bahru’s high-rise market is also on the rise, boosted by the Rapid Transit System (RTS) Link, which is expected to further enhance demand.

Knight Frank’s research highlights Malaysia as a key overseas investment destination, with Penang as a hub for foreign companies. MIDF Research indicates that decreasing housing oversupply and a stable overnight policy rate of 3% are improving market prospects, while the RTS and Johor-Singapore Economic Zone (JSSEZ) enhance the outlook.

Aaron Yap’s Visionary Leadership

Aaron Yap, CEO and Executive Director of BHP, has dedicated 25 years to construction and property development, gaining extensive experience in China, Hong Kong, Singapore, and Dubai. His expertise has enabled high-end projects and unlocked new market opportunities.

Over the years, he has refined his skills in construction, development, and strategic partnerships, effectively adapting to market trends and leveraging his knowledge to strategize.

Currently, the market is saturated with short-term rental properties, leading to price wars and declining quality, which depress overall property values. Lower entry barriers for new projects have intensified competition.

However, Aaron has noted that established 4- and 5-star international hotels remain resilient despite the pandemic, as high entry barriers deter new entrants. As Malaysia progresses toward becoming a high-income nation, both travellers and locals are raising their expectations for short-term accommodations, boosting demand for personalized and luxurious experiences.

Transitioning from market expansion to refined management, BHP aims to address gaps in property construction, investment, and management, developing a unique full-scenario model to establish more high-end international hotels and branded residences in Malaysia.

Find out more information at:-

BHP Website: bangsarheightspavilion.com

Quayside JBCC Website: quaysidejbcc.com

Discover Quayside JBCC video: bangsarheightspavilion.com/discover-quayside-jbcc