Quick Take

Lookout politics columnist Mike Rotkin endorses all 13 of the local taxes and bonds on the ballot on Nov. 5. No one loves paying, he writes, but the combination of 1978’s Proposition 13 and the current tax structure that gives breaks to corporations at the expense of homeowners is to blame. Local cities need more money to provide services, he writes.

Have something to say? Lookout welcomes letters to the editor, within our policies, from readers. Guidelines here.

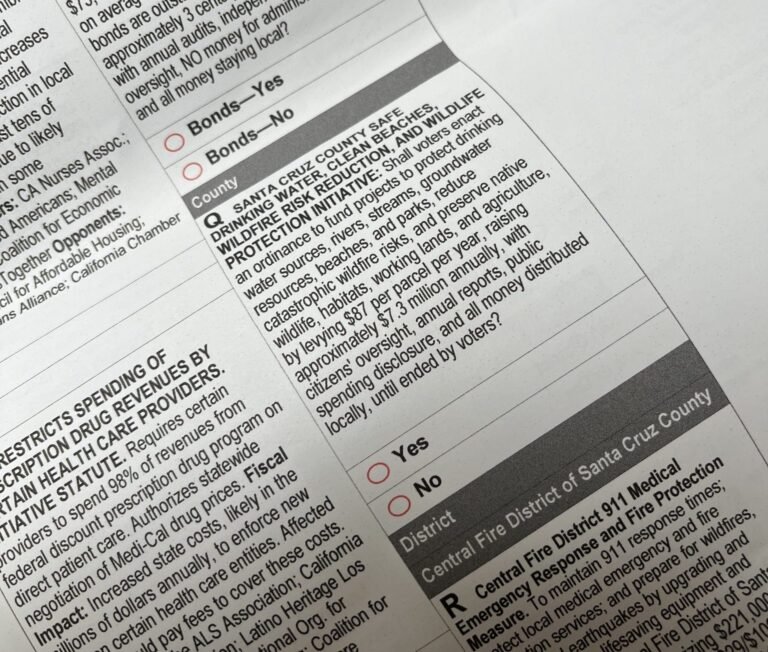

Once again, there is a boatload of local taxes and bond measures on ballots in Santa Cruz County. Thirteen of the 16 measures on Santa Cruz County ballots propose an increase to local taxes or bonds that will eventually have to be paid off with local taxes. The one exception is Measure U in the San Lorenzo Valley, which ignores the reality of rising costs for water production and proposes to reduce the necessary fixed fees for water customers in the Valley.

Fortunately, all of these taxes and bonds, with the exception of Measure Q, are applied only to specific local jurisdictions. So voters will face only one or two local measures on their individual ballots.

Measure Q is a countywide tax that will raise funds for clean water and fire protection purposes. Its only organized opposition comes from several fire chiefs, who, according to spokesperson Boulder Creek Fire Protection District Chief Mark Bingham, support what the measure will do, but are upset that it doesn’t set aside a specific amount of funding for fire districts.

There is no reason to believe that the Santa Cruz County Board Supervisors will not spend the funds raised by Measure Q on clean water and fire protection. The supervisors have already demonstrated their support for fire protection in county budgets and have pledged to use a significant portion of the funds raised by Measure Q for this purpose. The reason the measure doesn’t include specific allocations for particular fire departments is that including such specificity in the measure would trigger the requirement for a two-thirds rather than a simple majority vote to pass.

NOVEMBER BALLOT MEASURES: Find Lookout’s local and state coverage here

So, unless you are deeply suspicious of the motives of our county board of supervisors, I suggest a yes vote on Measure Q.

Two of the local ballot measures would amend the Watsonville city charter. One of the charter changes is a minor and innocuous update. The other, Measure V, would change the Watsonville charter to allow the city council to appoint non-citizens to boards and commissions, which is currently not allowed. While it makes total sense to limit voting to citizens of the United States, Watsonville has a large number of undocumented residents who contribute to the local community, pay taxes and otherwise should be allowed to participate in local community affairs. Youth who are not old enough to be citizens and participate in Watsonville boards and commissions under the current charter should be allowed to participate if the elected council members who make these appointments believe young people will contribute to community well-being.

But why are there so many local taxes on every election ballot? As I have written before in Lookout, the passage of Proposition 13 in 1978 took away property taxes that used to fund local government, schools and special districts. That left local governments and other elected bodies with a lack of necessary funding for essential services. This problem is exacerbated by the state blocking local cities from passing income taxes, which would be a less regressive form of taxation.

So local agencies are forced to increase their financing through local taxes like business taxes, parcel taxes, sales taxes, utility taxes, admission taxes and other more regressive forms of taxation. If local citizens really want essential services, which do increase in cost over time, they have little option but to support these local taxes and bonds.

What could be an answer to this? I have advocated a split tax roll that protects residential property from taxes based on runaway inflation of property values in California, but would place a fair tax burden on corporations that own over half of the property in the state. With such revenue, we would not need all of these local taxes. But that has proved difficult to pass at the state level because of the huge campaign contributions of large corporations.

So my message is simple: With the exception of Measure U in the San Lorenzo Valley, vote yes on all of the local measures that appear on your ballot this fall. Our communities need your support.