If you’re looking for a simple way to generate wealth in the stock market with little effort, you can’t go wrong with an exchange-traded fund (ETF).

ETFs trade like stocks, meaning you can buy individual shares. However, each of those shares contains a stake in dozens or even hundreds of stocks. That means that with just one investment, you can instantly build a diversified portfolio.

While all ETFs are different, there are two Vanguard funds I personally own and plan to continue buying for decades.

Image source: Getty Images.

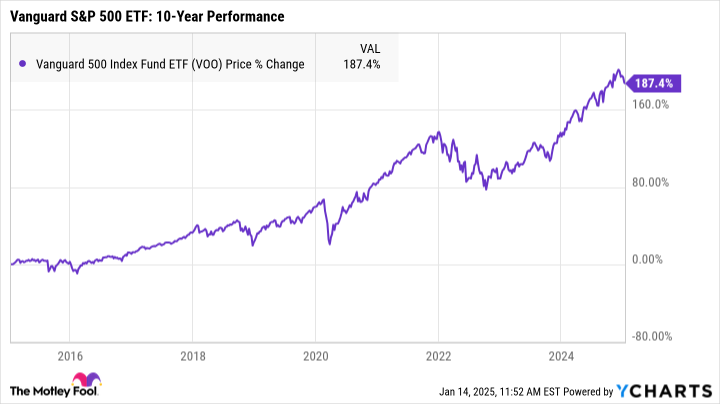

1. Vanguard S&P 500 ETF

An S&P 500 ETF tracks the S&P 500 (^GSPC 1.00%), meaning it includes all the stocks within the index. These stocks come from 500 of the largest companies in the U.S. across all corners of the market.

The Vanguard S&P 500 ETF (VOO 0.96%) can be a particularly smart investment because of its low expense ratio of just 0.03%. With some funds charging fees of around 1% or more, this can save you thousands of dollars over time.

Investing in an S&P 500 ETF also provides ample diversification. While a decent portion (31%) of this fund is allocated to stocks in the tech sector, the rest is spread fairly evenly across 10 other industries. In general, the more variety you have within your portfolio, the more protected you are against volatility.

One potential downside, though, is that this fund cannot earn above-average returns. The S&P 500 itself is generally considered to represent the overall stock market, and because this ETF is designed to follow the market, it can’t beat the market.

That said, the market itself has earned an average rate of return of around 10% per year over decades. If you were to invest, say, $200 per month while earning 10% average annual returns, here’s approximately how that could add up over time:

| Number of Years | Total Portfolio Value |

|---|---|

| 20 | $137,000 |

| 25 | $236,000 |

| 30 | $395,000 |

| 35 | $650,000 |

Data source: Author’s calculations via investor.gov.

The Vanguard S&P 500 ETF can be a smart option for those looking for a safer investment that still packs a punch. While you may not earn above-average returns, you can still generate hundreds of thousands of dollars by investing consistently for at least a couple of decades.

2. Vanguard Growth ETF

If you’re looking for an investment that has a history of beating the market yet can still limit your risk, the Vanguard Growth ETF (VUG 1.32%) could be a good fit for your portfolio.

This ETF is designed to earn above-average returns, and all of the stocks within the fund have the potential for serious growth. It contains 182 stocks, with nearly 57% of the fund allocated to stocks in the technology industry.

The tech sector often experiences explosive growth, but it can be more volatile than many other industries. So be aware that you’re likely to see more severe ups and downs with this type of investment if you choose to buy.

However, the long-term earnings may make that turbulence worthwhile. Over the past 10 years, this ETF has earned an average rate of return of 15.76% per year.

Growth ETFs can be somewhat unpredictable, though, so it’s unclear whether this fund will be able to keep up with these returns going forward. Let’s say you could earn average returns of 15%, 13%, or just 11% per year. If you were to invest $200 per month, here’s roughly what you could accumulate over time:

| Number of Years | Total Portfolio Value: 11% per Year | Total Portfolio Value: 13% per Year | Total Portfolio Value: 15% per Year |

|---|---|---|---|

| 20 | $154,000 | $194,000 | $246,000 |

| 25 | $275,000 | $373,000 | $511,000 |

| 30 | $478,000 | $704,000 | $1,430,000 |

| 35 | $820,000 | $1,312,000 | $2,115,000 |

Data source: Author’s calculations via investor.gov.

One other advantage of the Vanguard Growth ETF is its mix of blue chip stocks and smaller corporations. The top 10 holdings — which include household names like Apple, Microsoft, and Nvidia — make up close to 57% of the entire fund.

These stocks are larger and more stable than many others in this ETF, which can help limit your risk. At the same time, though, if any of the smaller stocks in the fund take off, it could supercharge your earnings.

There are countless ETFs to choose from, and everyone will have different goals and preferences. But these two ETFs have been in my portfolio for years, and I’m not planning on selling anytime soon.

Katie Brockman has positions in Vanguard Index Funds-Vanguard Growth ETF and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, Vanguard Index Funds-Vanguard Growth ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.