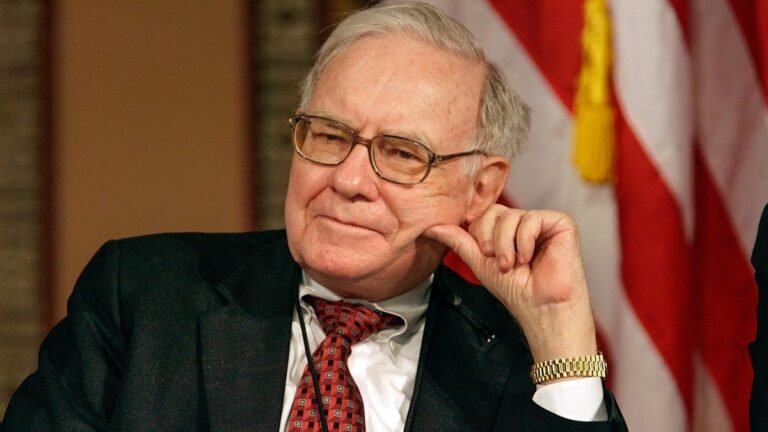

With the effects of inflation lingering and recession concerns top of mind, many Americans, whether already retired or planning for retirement, are looking for safe, reliable ways to protect their savings. Warren Buffett is one of the most trusted investors to look to during times of uncertainty. The chairman of Berkshire Hathaway has built his fortune by staying calm during market downturns and investing in high-quality, income-generating businesses.

You don’t need Buffett’s billions to take a similar approach. The investments below either come directly from his portfolio or reflect the same long-term thinking.

Find Out: 10 Genius Things Warren Buffett Says To Do With Your Money

Read Next: 5 Types of Vehicles Retirees Should Stay Away From Buying

A staple in Buffett’s portfolio since 1988, Coca-Cola remains one of the most recognized and in-demand consumer brands throughout the world. In fact, Buffett is frequently seen sipping a can of Coke during interviews as a subtle nod to one of his most iconic investments.

Coca-Cola’s global reach and consistent sales make it especially valuable during recessions. It also offers a reliable dividend, making it ideal for income-focused investors. Even during economic downturns, people continue to buy everyday beverages, making the company a steady performer in rough markets.

Be Aware: 15 Investments Warren Buffett Regrets

Buffett made Chevron one of Berkshire Hathaway’s largest holdings in recent years. The company offers a dividend yield above 4% and has raised its dividend for 38 straight years. Energy demand tends to persist through downturns, and Chevron’s long dividend history makes it a reliable income source.

Buffett’s own company offers built-in diversification. Berkshire Hathaway owns a wide range of businesses, from insurance and utilities to railroads and consumer goods. Though it doesn’t pay a dividend, its stable leadership and broad exposure to essential industries make it a dependable choice during market volatility.

While Buffett invests in individual companies, the Vanguard Dividend Appreciation ETF offers a practical way for everyday investors to follow the same principles of stability, dividends and long-term value. It holds companies with a solid record of raising their dividends over time, an indicator of financial health and long-term reliability.

While VIG focuses on companies with a history of increasing their dividends, VYM targets companies that currently offer above-average yields. These high-yielding dividend stocks can provide steady income even during market downturns. VYM gives investors exposure to mature, cash-rich businesses that can help cushion a portfolio in volatile markets.