Mid-cap mutual funds have been the favourites of many investors on Dalal Street. The remarkable wealth-creation potential of midcaps is behind the popularity. Over the last 10 years, the Nifty Midcap 150 – Total Return Index (TRI) has delivered 19.1% returns as of 12 June 2025.

Mid-cap companies, as you may know, are smaller than largecaps but have the potential to be tomorrow’s largecaps or bluechips.

If you choose mid-cap mutual funds appropriate for your portfolio, it can prove to be a rewarding experience.

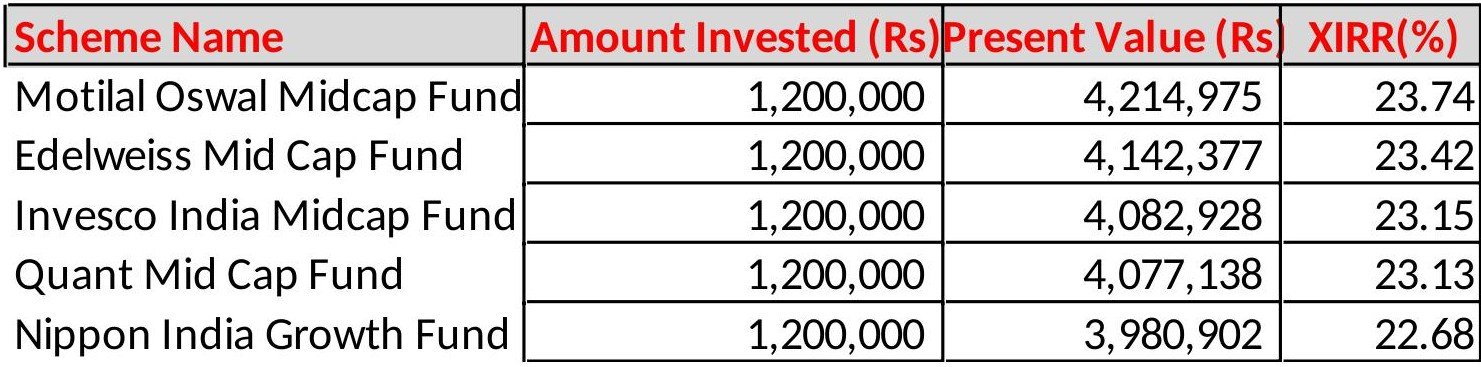

In this article, we will explore the highest return mid-cap mutual funds in the last 10 years, based on SIP returns.

Mid Cap Funds – 10 Year SIP

Direct Plan-Growth option considered.

XIR returns are calculated assuming a monthly SIP of Rs 10,000 over a 10-year period.

Please note, that returns here are historical returns.

Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Source: ACE MF

#1 Motilal Oswal Midcap Fund

This scheme was launched in February 2014 and its assets under management (AUM) today is Rs 304 billion (bn).

It invests in quality mid-cap companies that have long-term competitive advantages and growth potential. In line with this, the fund stays invested in quality companies for the long term and holds a concentrated portfolio.

Currently, Motilal Oswal Midcap Fund has 26 stocks in its portfolio (as of May 2025) with top-10 stocks comprising 55.6%. The top holdings include names such as Coforge (10.1%), Persistent Systems (9.7%), and Kalyan Jewellers (8.0%) among others.

The scheme’s top sectors are capital goods (33.6%), finance (14.5%), and retail (13.3%). Motilal Oswal Midcap Fund follows an active growth-oriented style and its portfolio turnover is usually in the range of 130-180%.

This agile approach has led to a superlative performance for the fund. The 10-year SIP returns delivered are 23.7%. A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 million (m), is now valued at Rs 4.21 m.

#2 Edelweiss Mid Cap Fund

This scheme was originally launched in December 2007 as a small and mid-cap fund maintaining on-par exposure to mid and small-cap stocks.

After the regulator’s categorisation and rationalisation norms for mutual funds, this was recategorised as a mid-cap fund. Today it manages assets worth around Rs 100 bn. Edelweiss Mid Cap Fund aims to identify strong and quality businesses primarily in the mid-cap space.

The fund aims to identify stocks with good earnings growth potential, profitable products and services, and are run by good management. It adopts a bottom-up approach to pick stocks that have the potential to compound wealth over the long term.

The scheme holds a diversified portfolio of 76 stocks as per the May 2025 portfolio. The top 10 holdings comprise around 27% of the portfolio and include names such as Max Healthcare Institute (3.4%), Coforge (3.3%), and Persistent Systems (3.2%) among others.

The top 3 sectors are finance (14.4%), IT (11.2%) and healthcare (10.7%) comprising 40.3% of the portfolio.

A majority of the stocks are held with a long-term view to derive their full potential. This is reflected in the low portfolio turnover, which is in the range of 40-50%. The strategy has proved rewarding for its investors.

The 10-year SIP return delivered by the scheme is 23.4%. A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 million (m), is now valued at Rs 4.14 m.

#3 Invesco India Midcap Fund

This scheme was launched in April 2007 and is a growth-oriented mid-cap fund investing in high-quality midcap companies. Its AUM is worth about Rs 66 bn as of May 2025.

Invesco India Mid Cap Fund follows the bottom-up and top-down approach to stock picking. While picking stocks, the fund managers look for stocks of companies with high-growth potential.

Currently, it is holding 46 such stocks in its portfolio, wherein 66% are midcaps, around 19% are smallcaps, 13% are largecaps, and 1% is other equities. The top 10 holdings comprise around 40% of the portfolio and include names such as BSE (6.1%), L&T Finance (4.3%), Prestige Estates (4.2%), etc.

The top 3 sectors are finance (20.4%), healthcare (17.8%) and retail (9.1%), which comprise 47.3% of the fund’s portfolio. The focus on fundamentally sound midcaps by maintaining a portfolio turnover of 45-80% has helped the fund reward its investors on a risk-adjusted basis.

In the last 10 years, the fund has delivered a SIP return of 23.2%. A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 million (m), is now valued at Rs 4.08 m.

#4 Quant Mid Cap Fund

This scheme was launched in February 2001 by Escorts Mutual Fund, which was later acquired by Quant Group in 2018. It was earlier called Quant Opportunities Fund. With effect from 20 October 2018, it was renamed as Quant Mid Cap Fund.

The fund identifies and invests in attractive and high-growth opportunity stocks across sectors and follows a very active investment style.

It constantly hunts for attractive opportunities by focusing on the ‘buy-on-dips’ strategy. Thus, its portfolio turnover ratio is among the highest in the mid-cap funds category, ranging from 180% to as high as over 300%.

The fund follows its in-house VLRT (Valuations, Liquidity, Risk, and Timing) framework. This has enabled the scheme to understand the various investment trends, allowing it to select high-growth potential stocks.

Quant Mid Cap Fund is selective in stock picking and holds a compact portfolio of about 20-30 stocks. As of the May 2025 portfolio, the fund is holding 28 stocks making it concentrated. 68% of the equity portfolio is held in midcaps, 17% in largecaps, and around 15% in others.

The top 10 stocks comprise 57.8% of the portfolio and include names such as Reliance Industries (9.9%), Aurobindo Pharma (7.6%), and IRB Infra (7.3%) among others.

The top 3 sectors are oil & gas (13.0%), infrastructure (11.2%), and FMCG (9.9%).

The fund’s strategy has worked well. In the last decade, it has clocked a SIP return of 23.1%. A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 million (m), is now valued at Rs 4.07 m.

Being one of the highest performing mid-cap funds, the AUM of the scheme has grown multi-fold over the years and is currently around Rs 90 bn.

#5 Nippon India Growth Fund

Launched in October 1995, Nippon India Growth Fund is one of the oldest and most popular schemes in the Mid Cap Fund category.

Until 2017, the fund followed a multi-cap strategy, maintaining a balanced exposure across large-cap, mid-cap, and small-cap stocks.However, after the re-categorisation, it now focuses on maintaining a mid-cap biased portfolio.

The scheme follows a Growth at Reasonable Price (GARP) strategy to identify high-potential stocks and hold them with a long-term perspective. It predominantly allocates to sound midcaps (66%), along with some strategic investments in largecaps (20%), smallcaps (12%), and others (2%).

It holds a well-diversified portfolio, currently of 95 stocks. The top 10 stocks comprise 24.1% of the fund’s portfolio and include names such as BSE (3.8%), Cholamandalam Financial Holdings (2.7%), and Fortis Healthcare (2.5%) among others.

The top 3 sectors are finance (16.1%), auto (12.9%), and healthcare (10.9%). Nippon India Growth Fund has delivered a decent SIP return of 22.7%. A monthly SIP of Rs 10,000 in the fund over 10 years, i.e., a total investment of Rs 1.2 million (m), is now valued at Rs 3.98 m. The performance has led to the scheme being the largest in the category with an AUM of Rs 368 bn.

Conclusion

Mid-cap funds offer a high return potential. However, they aren’t for the faint-hearted; it is important to have a high-risk appetite if you are considering them.

Moreover, given that midcaps are more volatile than largecaps, it is necessary to have a long investment horizon of at least 8-10 years.

In the case of SIPs, regular investments over a longer investment horizon would potentially help in compounding your money.

Happy investing.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.