The S&P 500 is up 7% year to date after plunging in April. Investors are enthusiastic about the state of the economy and its resilience in the face of tariffs and inflation, and the gains are holding despite another round of new tariffs announced this week.

The index recently hit new highs, and investors might be wondering what to do now. Is it a good time to buy S&P 500 exchange-traded funds (ETF)? If you already own one, is now the time to sell?

Buy at the high?

Ideally, when investing, you buy low and sell high. But that’s an oversimplification for many reasons. One is that it’s not always clear what’s low and high; you won’t know when a stock has bottomed out, or how much higher it has to go. Every investor has to make decisions about timing, but you can’t time the market.

Instead of focusing on the right timing, it makes more sense to focus on the fundamentals of the instrument, its opportunities and risks, and its general valuation. That can help you determine when the timing works for you.

Image source: Getty Images.

Since this is an ETF and not a stock, the fundamentals are going to look different than metrics like revenue growth and operating margin. Here are some worthy tidbits to track: The market has gained an annualized average of 10.7% over the past 20 years, or 700% in total.

Investing in an ETF that tracks the S&P 500 gives you exposure to 500 or so of the largest and best companies on the market, essentially giving you the opportunity to grow your money along with the market. The large number of stocks, plus the index’s regular changing of its components based on how they grow or shrink, minimizes your risk.

Since index funds are passive instead of actively managed, the fees are generally quite low, so you keep more of your gains. The largest S&P 500 ETF is the Vanguard S&P 500 ETF (VOO 0.16%), which has an expense ratio of 0.03%, while the original ETF, the State Street SPDR S&P 500 ETF Trust (SPY 0.15%), has an expense ratio of 0.09%.

Moving with the market

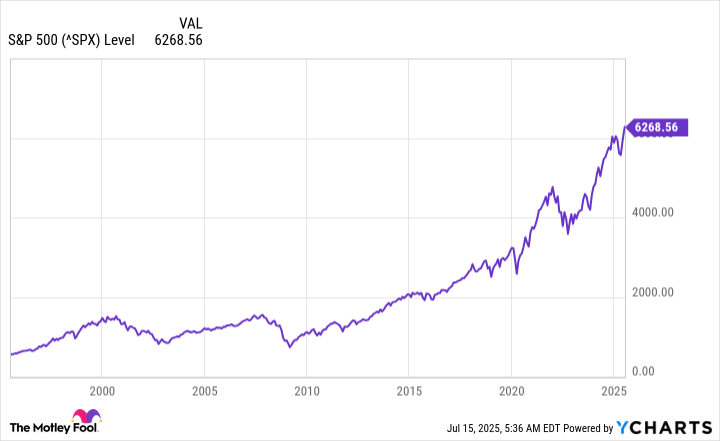

Let’s go through a bit of history to see how the S&P 500 has fared over a long time since that could help inform your decision.

Note how many times the index fell back from its high before reaching a new high over the past 30 years. My point isn’t that you should expect the market to fall again, although you should; that would be the argument against buying now. My point is that no matter how many times it has fallen, it has always bounced back and gone much higher. So if your worry is buying at a high and then seeing the market drop, relax. You need to stay cool and not panic-sell when that happens and ride out volatility.

If you’re planning a one-time buy, you might want to wait for a better entry point. If you plan to hold for decades, though, the more important part is just being in the market. Going back to not being able to time the market, for an instrument you have determined will be a positive addition to your portfolio and you plan to hold for a long time, now is as good a time as any to buy.

If you consistently add funds to an ETF you already own, keep at it. Investing consistently and letting your money compound is part of the magical formula for investing success.

Hold forever?

Assessing whether or not now it a good time to sell is much of the same analysis; I would only add in that you should evaluate your investing needs on a regular basis, like annually, and make sure your portfolio reflects them. If you are moving into retirement and passive income is becoming a more important goal, you might want to sell certain stocks or ETFs at a high and reinvest your funds in dividend stocks.

There could also be a situation where someone needs their money very soon, for example, for a large purchase they’ve been saving for or because they’re getting older and can’t afford to lose money.

An experienced investor might sell at a high and keep the funds in high-yielding instruments like T-bills and then reinvest at a low. That seems to be what Warren Buffett might be doing. However, Buffett himself cautions the average investor against many of the actions he takes, since this is his day job, giving him a different perspective.

Buffett recommends that most people park most of their money in a fund that tracks the S&P 500. If you believe in the U.S. economy and the market, it’s a great option for most investors even today.