News about the State Pension is rarely out of the headlines. Neither is speculation over future living standards for retirees, emphasising the importance of long-term financial planning with pensions or savings products like the Individual Savings Account (ISA).

Britain isn’t alone in facing a retirement crisis. Deteriorating public finances, combined with ageing populations, raise questions about how governments across the world will be able to fund future pensions.

It’s a sobering thought. But it’s never too late to start building wealth to avoid financial hardship in later life. Let me show you how a diversified fund could help safeguard one’s financial future.

Comments on Monday (21 July) from the UK government underline the ticking timebomb facing Britons today.

According to Department for Work and Pensions (DWP) research, people retiring in 2050 will be 8% — or £800 — worse off than those exiting the workforce today.

To address this crisis, the government said it’s resurrecting the Pensions Commission, which will “examine the complex barriers stopping people from saving enough for retirement“. But that’s not all — its role will also be to “examine the pension system as a whole and look at what is required to build a future-proof pensions system that is strong, fair and sustainable“.

On top of this, another government review will analyse the age at which people can begin claiming the State Pension.

The current pension age of 66 is scheduled to rise to 67 between 2026 and 2028, and again to 68 between 2044 and 2046. But some economists and industry experts are warning these changes could be brought forward.

I don’t know about you. But I don’t want to put myself at the mercy of changing government policy. I want to retire at a decent age, and to enjoy a comfortable standard of living when I do.

My plan is to build my own retirement fund with cash, shares, trusts, and funds, using a range of ISAs and my Self-Invested Personal Pension (SIPP). By prioritising investing in the stock market, I think I can achieve a long-term average annual return of 8% while still effectively managing risk.

At that rate of return, a monthly investment of just £500 over 30 years would create a retirement nest egg of £745,180. At this level, one could enjoy an annual passive income of £44,711 in retirement if invested in 6%-yielding dividend shares.

And that’s excluding any possible support from the State Pension.

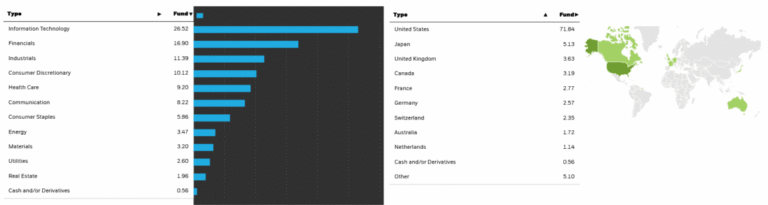

Global funds like the iShares Core MSCI World Index (LSE:IWDG) can be powerful weapons in helping me achieve this. Diversification across regions and sectors deliver excellent risk management while not compromising the opportunity to make life-changing returns.