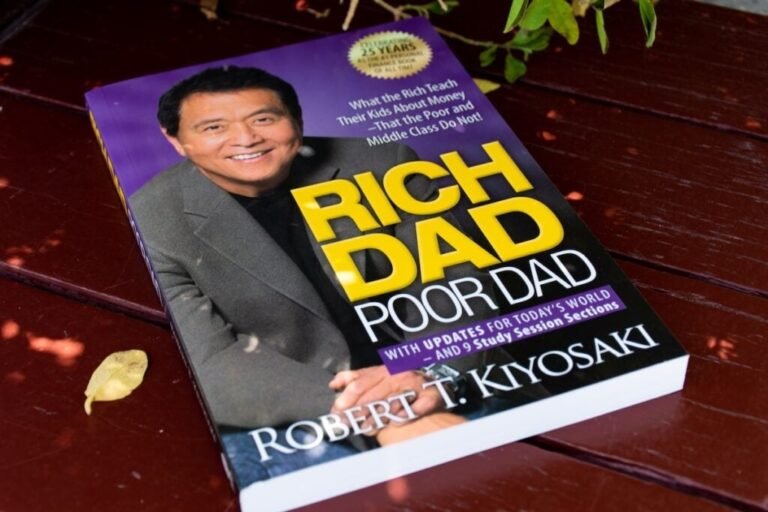

Robert Kiyosaki recently shared his views on Exchange Traded Funds (ETFs) on X, comparing them to “pictures of guns” and advocating for real assets.

On Friday, Kiyosaki shared his thoughts on ETFs. He acknowledged the ease they provide for average investors, even recommending gold, silver, and Bitcoin ETFs. However, he also issued a word of caution.

He likened owning an ETF to having a picture of a gun for personal defense, emphasizing the importance of holding real assets like gold, silver, Bitcoin, and even a gun.

Also Read: Robert Kiyosaki Predicts Gold, Silver, Bitcoin Crash Over Trump’s Tariffs—Says It’s A Buying Moment

“Know the differences when it is best to have real and when it’s best to have paper,” Kiyosaki posted.

Trending Investment Opportunities

His post underscores the ongoing debate between owning physical assets versus their financial counterparts. While ETFs offer liquidity and ease of trading, they lack the tangible security that physical assets provide.

His advice to “know the differences” suggests the importance of understanding the unique benefits and risks associated with each type of investment.

It also implies that a savvy investor should be able to strategically utilize both to maximize returns and safeguard their wealth.

Read Next

Image: Shutterstock/hamdi bendali

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.