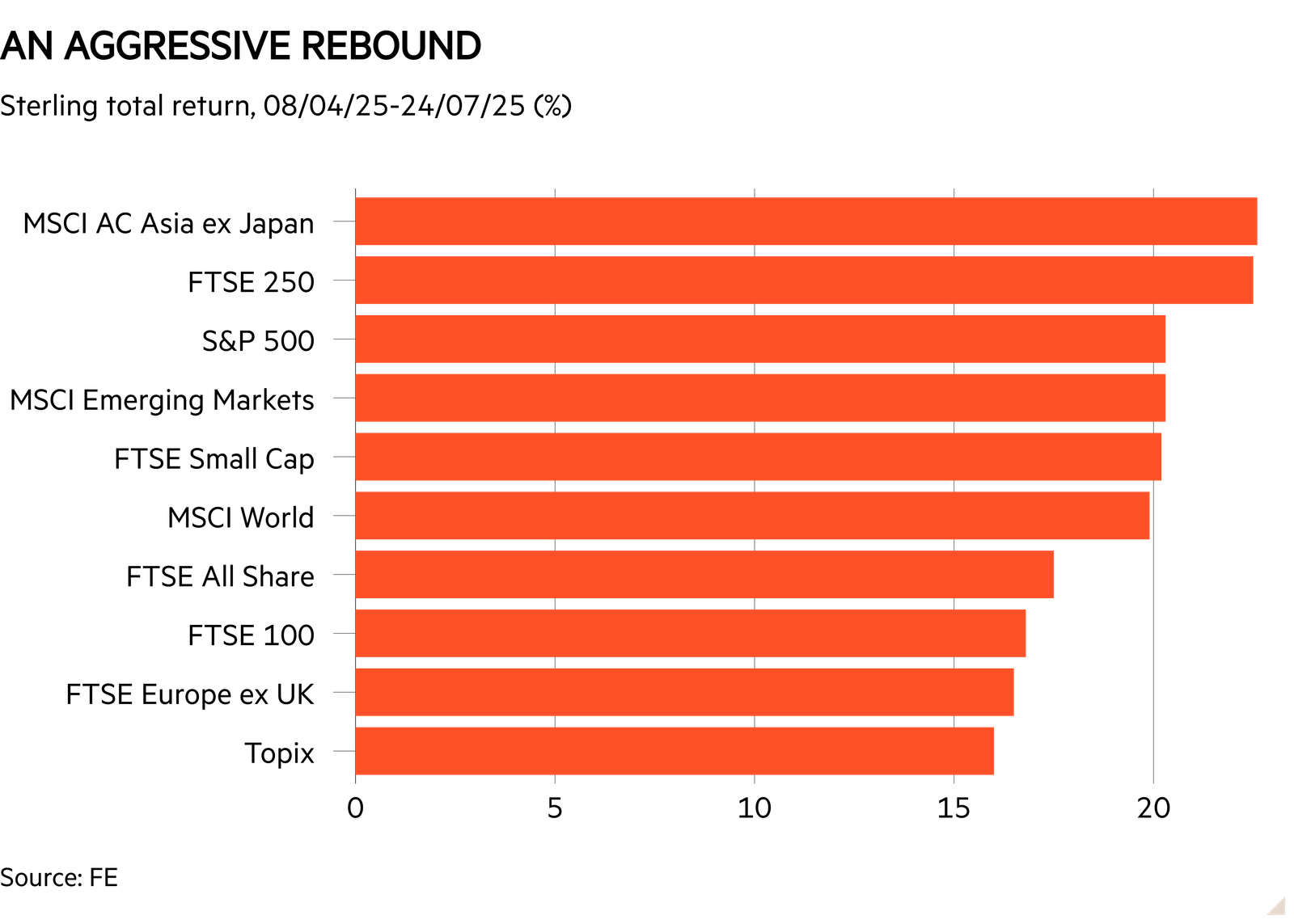

Donald Trump’s ‘liberation day’ tariff onslaught may have stunned markets but the recovery since then has been fierce. Indices initially tumbled on the back of the 2 April announcements but rallied aggressively once trade war measures were walked back.

This has been a pretty widespread trend, with major indices enjoying double-digit returns from 8 April to late July.

When it comes to individual investments, many portfolio holdings will have made handsome returns. Those have been substantial in the funds space, prompting some to consider taking profits.

Cash out?

Stifel analysts recently noted that huge swaths of investment trusts had made substantial gains from 8 April to 17 July, with 31 trusts returning between 0 and 10 per cent, 64 returning between 20 and 30 per cent, and 22 returning more than 30 per cent. This, they warned, could signal a time to take profits.

“With many investment company share prices close to all-time highs, discounts narrowing, and investors seemingly blasé about risks, we do wonder if it is time to take heed of Warren Buffett’s words ‘Be fearful when others are greedy and greedy when others are fearful’,” they said.

The analysts said investors could take profits, sit on some cash and wait for valuations to fall, adding: “It also feels as though we are reaching that point in the year when markets can be prone to ‘wobbles’ in thin summer trading – remember the Japanese ‘flash-crash’ last August.”

Read more from Investors’ Chronicle

So many winners

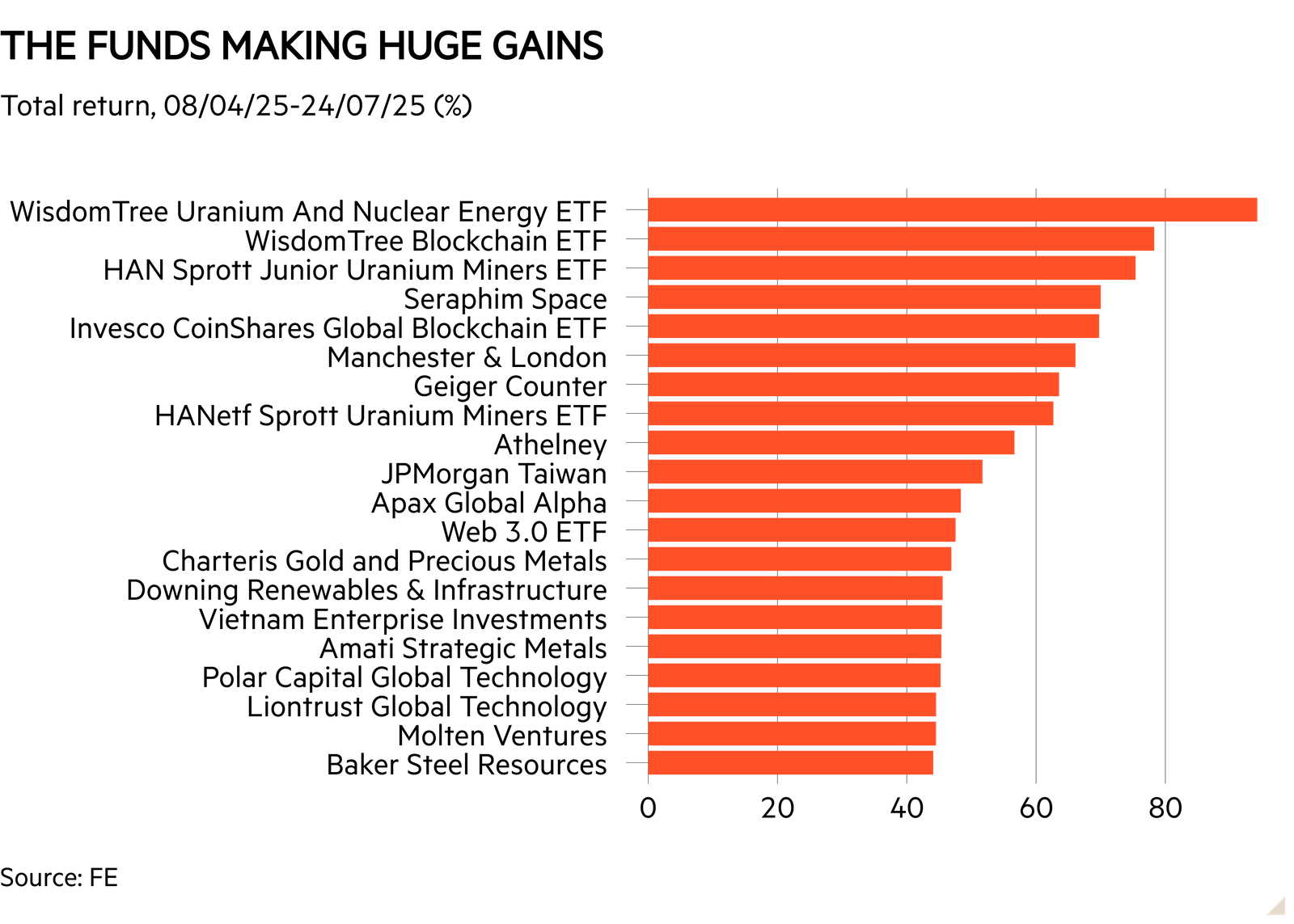

If we cast the net wider and look at open-ended funds, the number of winners is huge.

Performance data for all the funds in the Association of Investment Companies and Investment Association sectors shows that, from 8 April to 24 July, hundreds of names have returned more than 25 per cent. There are 10 names in our sample that have returned more than 50 per cent.

As the chart shows, commodity funds of various types have made enormous gains, which has prompted some to take profits.

Mick Gilligan, head of managed portfolio services at Killik & Co, said: “Commodity trusts have seen a big re-rating in the last three months. BlackRock World Mining (BRWM) has moved from a 14 per cent discount in April to now trade at par. I would look to reduce exposure in this one but maintain a position.”

While Gilligan sees now as a good moment to “lighten up” on commodity exposure, he acknowledges the likelihood of a new commodity cycle driving further gains. Iron ore, which provides the majority of earnings at top miners BHP (BHP) and Rio Tinto (RIO), has gone back above $100 a tonne for the first time in two months, while the copper price remains elevated.

Rob Morgan, chief analyst at Charles Stanley, saw more substance in the commodities rally than in other areas.

“There’s been a shift in the supply/demand dynamics with demand remaining high but new supply slow to appear,” he said.

“It’s been brewing for a while, but investors are now starting to wake up to it and the area is very much under-owned. I’d therefore be inclined to keep exposure, make sure it’s diversified and add on any weakness.”

A few other areas stand out. Funds focused on both Taiwan and Vietnam have seen enormous gains, as has big tech via names such as Polar Capital Technology (PCT).

Corporate activity in the investment trust space also continues to distort the figures, as we see with bid targets Global Apax Alpha (APAX) and Downing Renewables and Infrastructure (DORE) appearing in the chart.

Investors could generally take some profit from big risers and deploy them into cheaper areas, such as unloved stocks or discounted investment trusts.

However there is always the risk of missing some further gains. Investors might, for example, see how close trusts are to recovering from previous losses.

Gilligan notes for example: “Vietnam trusts have re-rated a lot, but this market’s equity valuations remain cheap and our favoured play Vietnam Enterprise Investments (VEIL), although its discount has narrowed from 25 per cent to 14 per cent, is only back to its average rating since launch.”

The size of gains is also dependent on the purchase price, as always. Some names such as Seraphim Space (SSIT) have made huge recent gains but shareholders would still be underwater, had they invested at the 2021 IPO.

Some individual trusts may appear to have been caught up in the enthusiasm and may not hold their valuations. Gilligan, for one, has reduced exposure to UK income star Temple Bar (TMPL) and Asian income trust Henderson Far East Income (HFEL) “given the extent of the re-rating”. Temple Bar shares returned 27.5 per cent since the post-liberation day low, with Henderson Far East Income on 21.8 per cent.

Temple Bar in particular was on a strong run before April, and has returned around 75 per cent in the three years to 24 July 2025.

Having traded on small discounts in early April, shares in both trusts currently trade on a premium.