Picks include Fidelity Special Values, City of London and Personal Assets.

Choosing where to invest for the first time can be daunting. With thousands of open-ended funds and closed-ended investment trusts to choose from, knowing where to start can be difficult.

There are myriad investment companies with long-tenured managers who have weathered storms and guided investors through all sorts of different market conditions – a good place for new investors to start.

Below experts identified a range of trusts that could make a solid choice for the first-time investor covering global equities, UK equities and multi-asset.

UK equities

For domestic investors looking to stay close to home, experts identified two favourites – Alex Wright’s Fidelity Special Values and Job Curtis’ City of London trust.

Fidelity Special Values is the preferred choice of Laith Khalaf, head of investment analysis at AJ Bell, due to Wright’s long tenure as manager.

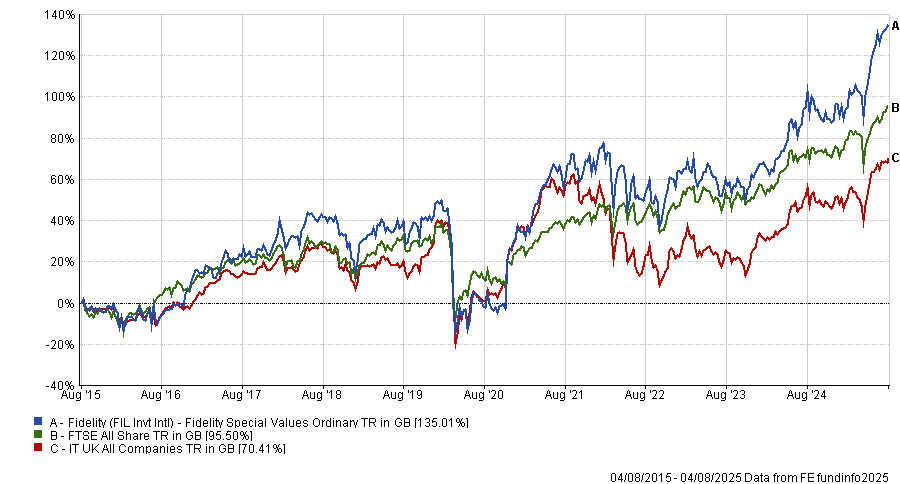

Under the FE fundinfo Alpha Manager, the trust has been the top-performing strategy in the IT UK All Companies sector over the past three, five and 10 years. During these timeframes, it has consistently outperformed not only its average peer, but also the FTSE All Share.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“If you’re a first-time investor, you probably want a safe pair of hands guiding your investment. With 13 years at the helm of this trust, Alex Wright can legitimately claim that mantle,” Khalaf said.

He added that it still had plenty of room left to run due to its multi-cap exposure. If “small and mid-caps start to motor”, the trust will benefit even more than the average index fund, Khalaf said.

For investors after an even longer track record, Paul Chilver, director at Birkett Long IFA, pointed to The City of London Investment Trust.

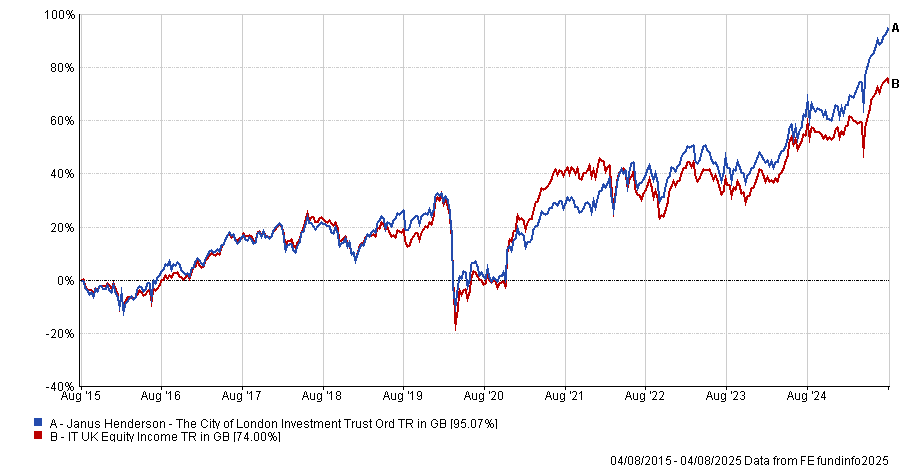

It has been around for more than 100 years, with manager Job Curtis heading the trust for almost 34 years, through many market cycles. Over most time frames, it has posted a second-quartile return or better in the IT UK Equity Income sector.

Performance of trust vs sector over past 10yrs

Source: FE Analytics

Hargreaves Lansdown head of platform investments Emma Wall added that Curtis favours “good quality, well-managed companies bought at reasonable share prices”. This is a “sensible, no-nonsense approach” to investing that may resonate for first-time investors.

Global equities

For a first-time investor seeking broad exposure to global markets, experts pointed to several compelling options. Philippa Maffioli, senior adviser at Blyth Richmond Investment Managers, identified F&C Investment Trust as a good choice.

It is a broad and well-managed portfolio, she said, which has achieved steady long-term capital growth as well as an attractive dividend income.

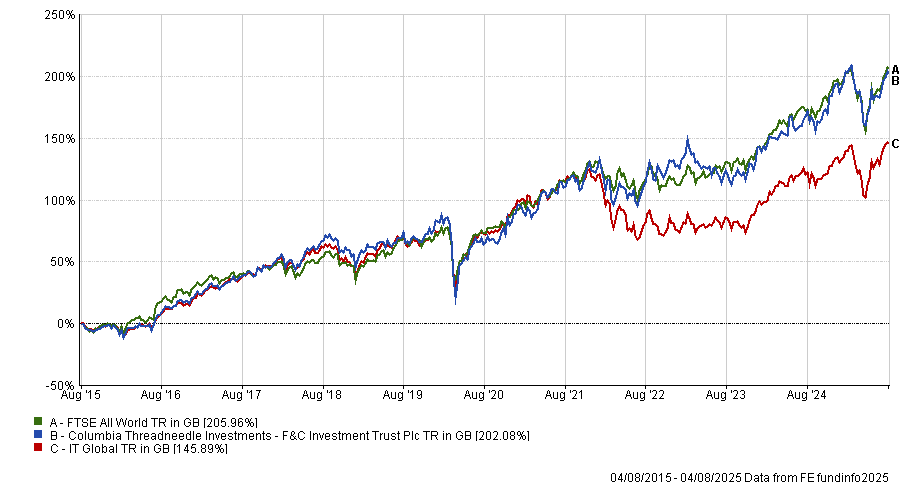

Under the helm of Paul Niven, it has outperformed the average peer in the IT Global Sector over the past three, five and 10 years.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“With its long history and proven track record, F&C offers a reassuring starting point for those looking to build their financial portfolios”, Maffioli concluded.

For investors who want to focus on income, Hargreaves Lansdown’s Emma Wall favoured the Scottish American Investment Company.

Led by experienced managers James Dow and Ross Mathison, they look for companies demonstrating two key traits: “a dependable income stream and the potential for above-inflation profit growth”, according to Wall.

It is an AIC dividend hero, having grown its payout consistently over the past 50 years to its current 2.25% level.

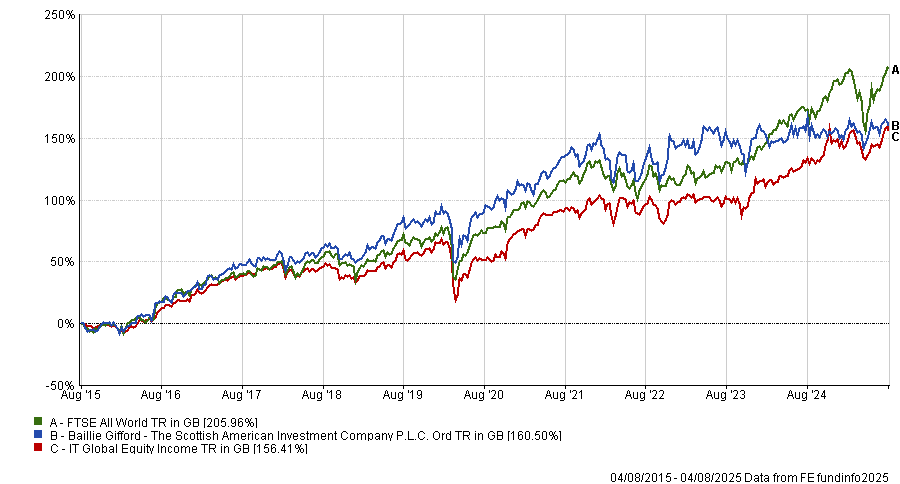

However, the fund has underperformed the average peer over the past one, three, five and 10 years, as well as underperforming the FTSE All World as demonstrated below.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Nevertheless, Wall maintains that it is a great “one-stop-shop trust for those with an appetite for risk” and a great starting point for investors’ portfolios.

For other options in the global equity space, experts pointed to were Murray International Trust, Brunner Investment Trust and Alliance Witan.

Capital preservation

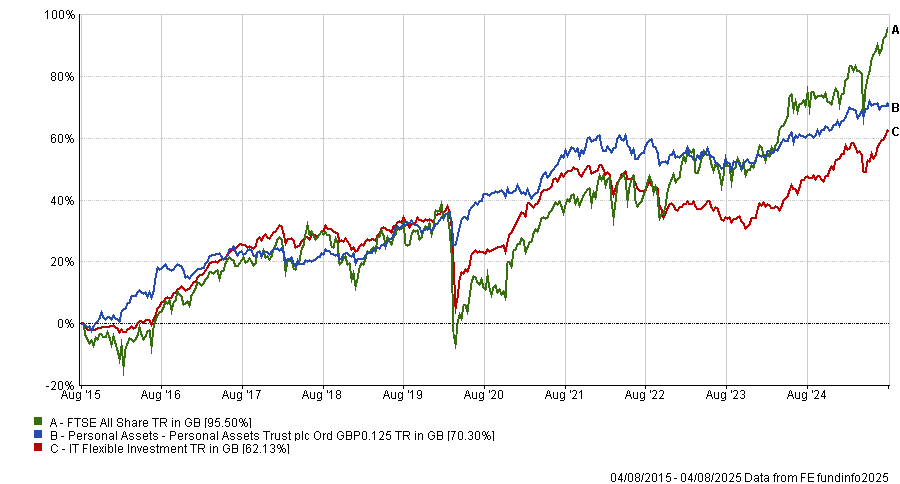

Finally, for a first-time investor thinking of moving out of a cash ISA, three experts favoured the Personal Assets Trust for its defensive qualities.

Chilver pointed to its long track record in “protecting investors’ money during periods of stock market volatility”, with the strategy currently having high exposure to defensive assets such as gold and government bonds.

Wall added that this emphasis on bonds and gilts helps “smooth returns”, allowing the trust to hold up much better during a down market. While this makes a great option for a first-time investment, it can also be compelling for a ballast in a more developed portfolio, she added.

Khalaf broadly agreed with his peers but added that the portfolio invests primarily in high-quality equities. This means it is “less volatile than the stock market but still aims to deliver capital growth over the long term”.

The trust has delivered a total return of 70.3% over the past 10 years, outpacing the average competitor in the IT Flexible Investment sector.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

For an alternative multi-asset strategy, interactive investor funds and investment education editor, Kyle Caldwell, picked Capital Gearing Trust. He explained that portfolios with “plenty of diversification are a sensible start as it helps keep a lid on risk.”

It invests a third of its assets in equities, a third in government and corporate bonds and a third in index-linked bonds. He noted it follows a similar approach to Personal Assets Trust, so either would make a good choice for a first-time investor.