Equities have displayed their wealth-creation potential over the long term.

Recognising this, individual investors – particularly since 2020 – have shown keen interest in mutual funds. The rise in mutual fund folios and demat accounts stands as a testimony to that.

However, in the present uncertain times (due to Trump’s tariffs, geopolitical tensions, and the impact of these on the economy and equity markets), it would be imprudent to go gung-ho and depend only on equities.

You need a multi-asset approach.

Along with some exposure to equities, you also need to have a tactical allocation to debt and gold. This can help you reap the benefits of diversification.

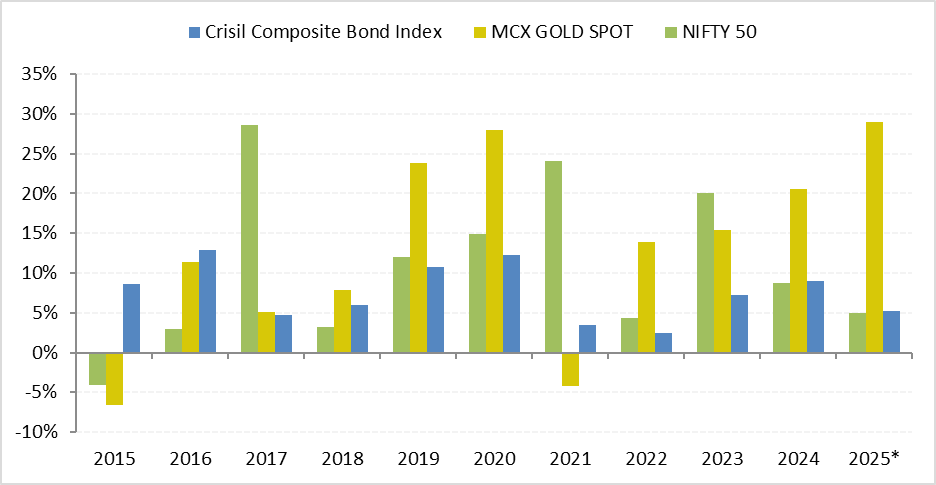

Performance of Equity, Debt, and Gold

(Source: ACE MF)

The graph above shows that not all years have been good for equities.

In some calendar years, like in 2015, 2016, 2018, and 2022, equities have disappointed investors while other asset classes, such as debt and/or gold, have fared better.

So far, in 2025, the Nifty 50 has clocked an absolute return of 5% as of 29 July.

In contrast, gold has outshone equities, delivering 29% absolute returns so far in 2025 as of 29 July, proving its trait of being a safe haven and a hedge.

Silver, which is also a precious metal and used in various industries, has clocked 31.9% as of 29 July 2025.

The point is, in volatile times, skewing your investment portfolio can be unwise and risky.

Also, not all asset classes always move in the same direction. Hence, following a multi-asset approach makes sense.

Multi asset allocation funds are a meaningful choice to tactically invest across asset classes. They are classified as hybrid funds by the capital market regulator and mandated to invest at least 10% each in these three asset classes – equity, debt, and gold.

The objective of a multi asset allocation fund is to generate modest capital appreciation/income by investing in a diversified portfolio of equity & equity-related instruments, debt & money market instruments, and gold.

Some even have exposure to exposure to derivatives, REITs & InvITs, silver, and overseas equities.

A multi-asset approach helps you reduce the overall investment risk.

In this editorial, we will take you through the top 3 multi asset allocation funds to add to your watchlist.

#1 Quant Multi Asset Allocation Fund

Launched in March 2001, theQuant Multi Asset Allocation Fund was originally a debt-oriented mutual fund scheme.

However, from 2018, it transitioned to a fund focusing on multi-asset investment after the change in the AMC sponsorship from Escorts to Quant Group.

It now has the mandate to invest dynamically into equity, debt, and commodities (gold and silver) — following the regulatory minimum threshold limits – to navigate the tides of volatility with an aim to offer satisfactory risk-adjusted returns.

The scheme follows the fund house’s proprietary VLRT (Valuations, Liquidity, Risk, and Timing) framework to determine allocation into each of the three asset classes.

As per its June 2025 portfolio, the fund has 36.7% of its total assets in domestic equities, 13.6% in derivative futures, and holds 18.9% in cash & cash equivalents.

Within equities, the fund is currently holding a major portion in largecaps and some in midcaps and smallcaps.

It holds a compact portfolio of around 30 to 35 securities, and within it has held around 10 to 15 stocks. Currently, it has 14 stocks in its portfolio, which include names such as Jio Financial Services, Premier Engines, LIC, and so on.

Insurance, finance, and electronic components are among the top 3 sectors comprising 27.1% of the portfolio.

The fund holds many of its stocks with a short-term view, and hence, the portfolio turnover ratio has ranged from 200-350% in the past. Its strategy is to identify momentum-driven stocks.

In addition, the fund is also holding 11.6% of its assets in debt & money market instruments. It holds high credit quality and liquid papers (certificates of deposits and treasury bills), including government securities.

The fund is also currently holding 15.4% in domestic mutual funds — mainly gold and silver ETFs and 3.8% in REITs & InvITs.

By following an agile approach, the fund over 3 years and 5 years has delivered an appealing compounded annualised rolling return of 22.5% and 30.9%, respectively – noticeably higher than the category average returns and the Nifty 50 – TRI.

That said, the volatility registered by the fund (as denoted by the standard deviation) is exceptionally high compared to some of its peers and the Nifty 50-TRI. Simply put, the fund is a very high-risk proposition.

Nonetheless, the fund has compensated its investors well by generating higher risk-adjusted returns as denoted by the sharpe ratio and sortino ratio.

#2 ICICI Prudential Multi Asset Fund

Launched in October 2002 as ICICI Pru Dynamic Plan, this scheme was recategorised and renamed as ICICI Prudential Multi Asset Fund in April 2018 pursuant to the market regulator’s categorisation and rationalisation norms.

It is one of the oldest schemes in the category with a track record spanning over 22 years.

The actual allocation to the asset classes is done considering the prevailing market conditions, the macroeconomic environment (including interest rates and inflation), the performance of the corporate sector, the equity markets, general liquidity, and other considerations in the economy and markets. In other words, it follows an active investment strategy.

For picking stocks, the fund follows a mix of top-down and bottom-up approach by focusing on business and economic fundamentals. It also does not shy away from taking exposure to derivatives (futures and options).

As per the June 2025 portfolio, the fund is holding 67.8% of its assets in equities (including overseas equities). Within equities, it has consistently held a largecap biased portfolio and some tactical exposure to midcaps and smallcaps.

It holds a diverse portfolio of over 100 stocks. Currently, it has 103 stocks in its portfolio, wherein the top 10 comprise 26.9% and include names such as ICICI Bank, Reliance Industries, Maruti, etc.

Banking & finance, auto & ancillaries, and oil & gas are the top three sectors comprising 35.6% of the portfolio.

The fund follows a buy-and-hold strategy, as indicated by its low portfolio turnover ratio, ranging between around 25-35%. The fund hasn’t held more than 10-15% in cash & cash equivalents.

The fund is currently holding around 13% in debt & money market instruments, comprising corporate debt, treasury bills (T-bills), certificate of deposits (CDs), PTC & securitised debt, and government securities. These are all high credit quality and liquid papers.

In addition, the fund has 7% allocation to gold ETFs and silver ETFs and 1.4% in REITs & InvITs.

With its dynamic strategy, the fund over 3 years and 5 years has delivered an appealing compounded annualised rolling return of 20.7% and 23.8%, respectively, which is higher than the category average returns and the Nifty 50 – TRI.

Moreover, to generate the returns, the fund has not exposed investors to very high risk as denoted by the standard deviation (SD). The SD of 6.64 of the fund is lower than the category average and the Nifty 50 – TRI.

The fund has rewarded its investors with superior risk-adjusted returns as indicated by the sharpe and sortino ratios.

#3 UTI Multi Asset Allocation Fund

Launched in December 2008, as UTI Wealth Builder Fund, after the mutual fund categorisation and rationalisation norms were renamed as UTI Multi Asset Allocation Fund and has since followed a multi-asset approach.

In equities, it follows a strategy of investing across market capitalisations based on, but not limited to, evaluation of the fundamentals of the company, management, valuation and other macro-economic considerations. It follows both a top-down and bottom-up approach to stock picking.

As per the June 2025 portfolio, the fund is holding 67.8% of its assets in equities and consistently higher in largecaps, and some tactical allocation to midcaps and smallcaps.

It is currently holding a fairly diversified portfolio of 80 stocks, wherein the top 10 constitute 25.7% of the portfolio. They include names such as ICICI Bank, HDFC Bank, Bharti Airtel, etc.

Banks, IT, and FMCG are the top 3 sectors of the fund, comprising 31.2% of the portfolio.

The fund, at times, has also taken cash calls, but not greater than 18% in the last one year. At present, the cash & cash equivalents are 10.9% of the June 2025 portfolio.

As regards the debt portion, the fund dynamically invests across maturities of corporate bonds, G-secs and includes money market instruments too.

The fund manager has the flexibility to invest in the short end or the long end of the curve based on the investment environment and market outlook. The exposure to debt is for generating a regular income.

Currently, it is holding 14.4% of its assets in debt & money market instruments, mainly in AAA-rated corporate debt papers and sovereigns.

In addition, the fund also invests in gold ETFs, REITs & InvITs and domestic mutual fund units.

While managing the portfolio and achieving its investment objective, the portfolio turnover ratio of the scheme has been in the range of 200-300%.

With this strategy, over 3 years and 5 years, the fund has clocked a compounded annualised rolling returns of 19.6% and 17.6%, respectively.

To generate such returns, the fund has exposed its investors to reasonable risk, as denoted by the SD of 7.61. The risk-adjusted returns of the fund are decent, as denoted by the sharpe and sortino ratios.

Performance of Top Multi Asset Allocation Funds

Rolling period returns are calculated using the Direct Plan-Growth option. Returns over 1 year are compounded annualised.

Standard Deviation indicates the risk, while the sharpe ratio and sortino ratios measure the Risk-Adjusted Return. They are calculated over 3 years, assuming a risk-free rate of 6% p.a.

Please note that returns here are historical returns.

*The top funds here in the table are based on past returns on 3-year returns. The list of schemes is not exhaustive.

Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Source: ACE MF

Conclusion

A muti asset allocation fund can be a meaningful option for tactical diversification across asset classes.

It is potentially suitable if you have a moderately high-risk appetite and an investment time horizon of 3 to 5 years.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.