Half of the top 20 exchange-traded funds (ETFs) in the United States are linked to digital assets, underscoring the sector’s growing appeal to investors.

On Monday, ETF analyst Nate Geraci said more than 1,300 ETFs have launched since the start of 2024, and crypto-linked assets dominated the top 20 investment products in inflows.

These include Bitcoin (BTC) and Ether (ETH) ETFs, funds tracking leveraged ETH positions and Strategy (MSTR) exposure products.

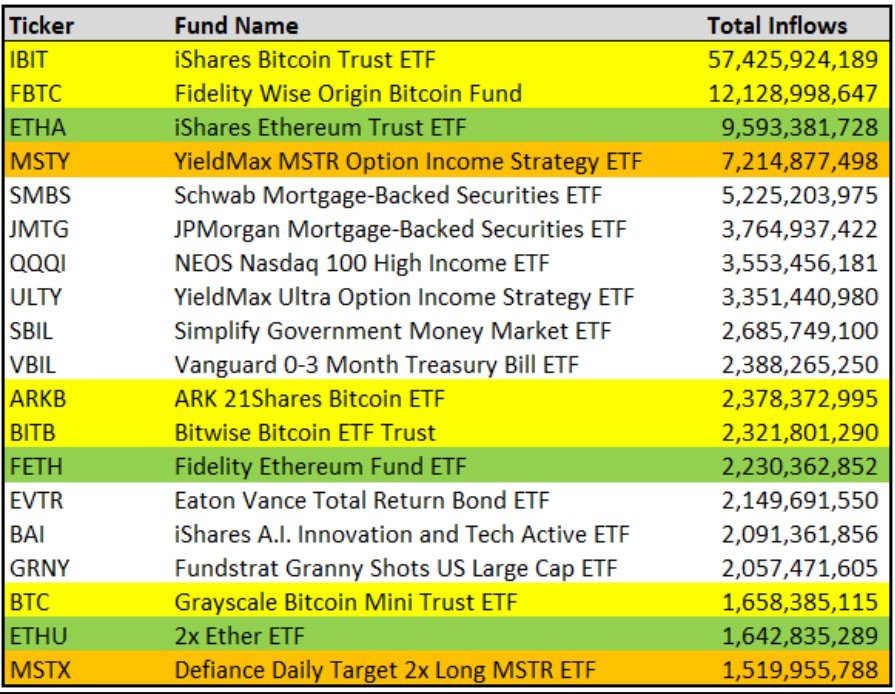

Geraci shared data that the top four overall assets by inflows are crypto-related, including BlackRock’s iShares Bitcoin Trust ETF (IBIT), which leads the pack with over $57.4 billion in inflows, outpacing others on the list.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with $12.1 billion, while the iShares Ethereum Trust (ETHA) attracted $9.6 billion.

The YieldMax MSTR Option Income Strategy ETF (MSTY), an ETF designed to generate monthly income with an options-writing strategy on MSTR stock, was in the top four rank with $7.2 billion in inflows.

While the stock isn’t directly crypto-related, the company is known for its Bitcoin treasury holdings.

Crypto-linked funds dominate ETFs launched since 2024

The top-performing crypto ETFs include five spot Bitcoin funds, two spot Ether funds, two Strategy-focused ETFs and one leveraged ETH ETF.

Outside the top four, the ARK 21Shares Bitcoin ETF (ARKB), the Bitwise Bitcoin ETF Trust (BITB) and the Fidelity Ethereum Fund ETF (FETH) were in the 11th, 12th and 13th spots, respectively, with over $2.2 billion in inflows each.

In addition, the Grayscale Bitcoin Mini Trust ETF (BTC), 2x Ether ETF (ETHU) and Defiance Daily Target 2x Long MSTR ETF (MSTX) made the 18th, 19th and 20th spots, respectively, with over $1.5 billion in inflows each.

The rise of crypto-linked ETFs reflects investor appetite for regulated, exchange-traded exposure to digital assets, a sector long dominated by more complex investment mechanisms.

Related: Michael Saylor is not sweating the rise of Ethereum treasury companies

Spot Ether ETFs record new highs

As crypto dominates exchange-traded products, spot Ether ETFs clock new record inflows as its underlying asset turns bullish.

In July, spot ETH ETFs recorded $5.4 billion in monthly inflows, a new all-time high for the ETH-based investment products. This was accompanied by a 20-day streak of inflows by spot Ether ETFs. However, this was broken in August, when ETFs showed their first outflows since the new record.

Despite this, spot ETH ETFs showed no signs of stopping, recording $1 billion in inflows on Monday, a new daily high for the investment products.

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’