PANAMA CITY, Fla. (WJHG/WECP) – Today, Panama City leaders met for their last commission meeting in August. During the meeting, city leaders had a lengthy discussion about FEMA Disaster Recovery Funding options. It’s been nearly seven years since this process began. Panama City has undergone three commissions, and there have been multiple administrative changes in D.C.

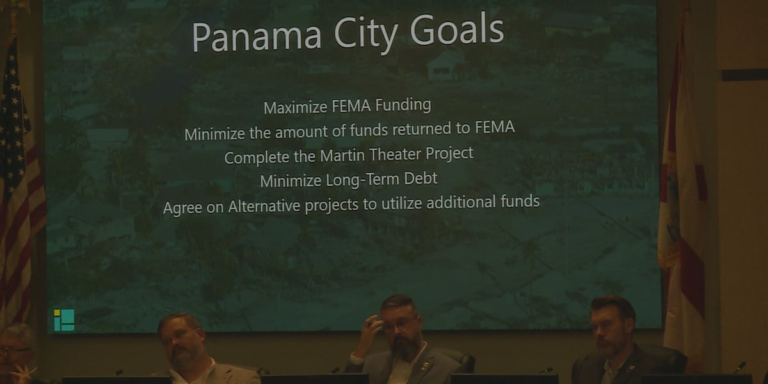

Commissioners spoke for about an hour and a half with officials from the Integrity Group about the best way to maximize FEMA money to rebuild downtown and St. Andrew’s. Some of these projects are already underway, and city officials said they are planning to be reimbursed.

During the presentation, commissioners reviewed funding options for the Martin Theater, Downtown Marina, and St. Andrew’s Marina.

Olivia Schmitt with Integrity Group said Panama City was initially offered $36.5 million, but that number has grown to $40.6 million in FEMA disaster recovery funds. Any money that isn’t spent must be returned. So, city leaders are seeking ways to maximize it.

Three funding options were presented, but commissioners rejected them all.

“The Martin Theater is already under construction,” Panama City Commissioner Josh Street said. “So, we are committed to seeing that project being finished and fully completed.” Street continues. “But we also have some excess funding that we don’t think should go to the Martin; we think it should find its way to the downtown marina or the St. Andrews Marina. So, our conversation tonight was how do we rebuild both marinas and The Martin without increasing our overall debt as a city, and I think we are going to be able to accomplish that,” Street explained.

Commissioners were very clear tonight that they believe the Martin Theater should be funded as it is, without an increase. And they plan to use the FEMA funds to help rebuild both the St. Andrew’s and Downtown Marinas. But ultimately, commissioners tell us their goal is to see the waterfront rebuilt without having long-term debt.

City leaders tell us these disaster relief funds that were dedicated in 2018 belong to the citizens who live here, and they want to see them used. They don’t want to use local tax dollars to see their city rebuilt.

To stay up to date on all the latest news as it develops, follow WJHG on Facebook, Instagram, and X (Twitter).

Have a news tip or see an error that needs correction? Email news@wjhg.com. Please include the article’s headline in your message.

Keep up with all the biggest headlines on the WJHG News app, and check out what’s happening outside using the WJHG Weather app.

Copyright 2025 WJHG. All rights reserved.