Affordable buy-to-let property could be part of the solution to South Africa’s retirement funding crisis. Property investment offers ongoing rental income, protection against inflation, and capital appreciation.

The retirement crisis facing South Africans

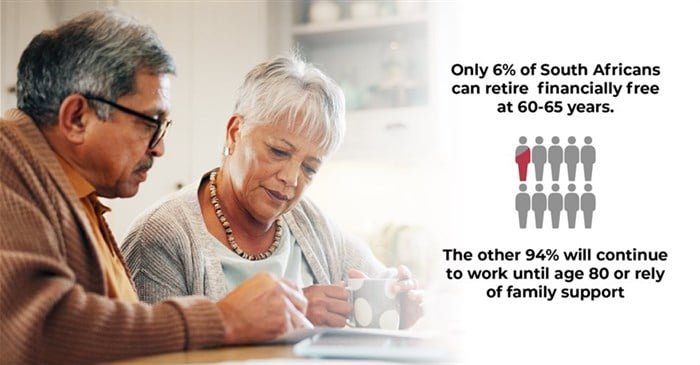

South Africa faces a stark retirement reality: only 6% of people can retire financially free by the traditional age of 60-65. According to Sanlam Corporate’s internal member data, “South Africa’s true retirement age – the age at which most citizens can afford to retire comfortably – is closer to 80” (Source).

The 10X Retirement Reality Report reveals that 94% of working professionals will continue working until age 80 or rely on family financial support (Source). Even more concerning, the average retirement savings in South Africa amount to only R50,000 (Source). That’s far too little to sustain anyone through their golden years.

Why property investment makes sense

Strategic property investment offers a tangible solution to this crisis. Property values, while not guaranteed, are typically less volatile than stocks and shares. Buy-to-let property provides:

- Passive monthly income: Rental payments that continue throughout retirement

- Inflation protection: Property values and rental income typically beat inflation

- Tangible assets: You own something real that can be leveraged or sold

- Intergenerational wealth: Properties can be passed on to loved ones

Women and financial independence

This Women’s Month, it’s particularly relevant to examine women’s financial security in retirement. Women typically live longer than men, meaning they face longer retirement periods with inadequate savings. According to the 10X Retirement Reality Report, only 35% of those who saved for retirement feel “fairly” or “very confident” about their savings lasting long enough (Source).

The data reveals a concerning gender gap: “More than double (11% versus 5%) the number of men than women are diligently following a well-conceived retirement plan” (Source).

However, women are increasingly taking control of their financial futures through property. According to Lightstone, “the proportion of homes owned by women as sole buyers – as opposed to men or mixed couple buyers – has increased from 30% in 2014 to 39% in 2025” (Source). This may indicate growing financial independence, expertise, and participation in the property market.

Getting started with property investment

You don’t need massive capital to begin building wealth through property. Key strategies include:

Start small and scale

Begin with affordable properties in high-rental-demand areas, focusing on those with good yields and low maintenance requirements. Anything over 8% is considered a strong Return on Investment, and IGrow Wealth Investments regularly trump that number. Second, use gearing (bank loans) to leverage your investment power. Remember that the interest portion of your bond repayments is tax-deductible when it’s an investment property and not your home.

Plan for maintenance and management costs, as well as adequate insurance, for peace of mind, and remember that, as with all investments, it’s time in the market that counts more than timing it.

Professional guidance

IGrow Wealth Investments has built success for thousands of clients over nearly two decades, providing guidance on property selection, financing, property management, tax considerations, and protective structures like companies and trusts. So you don’t have to reinvent the wheel, just get informed and get started.

A tangible advantage

Unlike unpredictable stock markets or difficult-to-access traditional retirement plans, property investments grow and appreciate in a more transparent, measurable way. You can see your investment’s value, track rental income, and access equity when needed.

Most importantly, with proper planning, initial investment shortfalls should transform into strong, regular income streams by retirement – income that doesn’t run out if you live longer than expected.

Take action now

Don’t let concerning statistics cast a gloomy shadow on your future. By acting early with strategic buy-to-let property investment, you can:

- Create passive income streams for retirement

- Build tangible assets for your family’s future

- Join a new generation ready to retire securely

The key is starting now, with the proper guidance and a clear investment strategy tailored to your goals and budget.

About IGrow Wealth Investments: With nearly two decades of experience, IGrow Wealth Investments specialises in helping clients build wealth through strategic property investment, offering comprehensive guidance from property selection to portfolio management.