As of June 2025, over 2.5 million Premium Bond prizes were unclaimed

More than £100,000,000 of premium bond prizes remain unclaimed from the National Savings and Investments bank. Of the 2.5 million unclaimed prizes, 11 total over £100,000, the second-highest prize.

In addition, there are 19 prizes worth £50,000, 38 prizes worth £25,000, and 75 prizes of £10,000. Andrew Westhead, retail director at NS&I, said: “The £103m of prizes currently unclaimed represents just 0.28% of the total £37bn awarded by ERNIE over nearly seven decades.”

NS&I said it had paid more than 99% of the prize-winners since starting its tax-free draws in 1957. However, there is criticism that the government-owned bank, which operates the savings scheme, is not doing enough to find the winners. It comes as a lucky North East Premium Bond holder won September’s £1million jackpot.

Premium Bonds prize winners should receive notifications of their winnings via text message, email or post if they have registered their details. Some customers, however, relocate and forget to update their details.

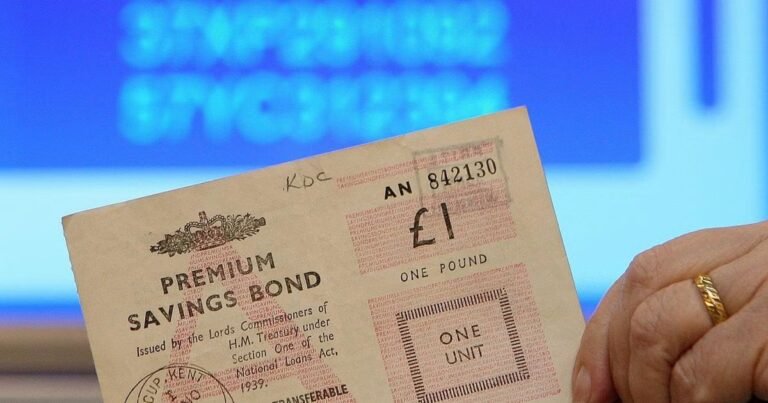

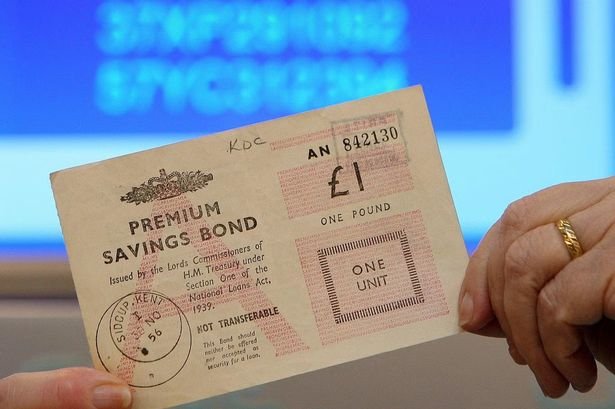

Other bond holdings are not registered. For example, people may be unaware they were gifted bonds as children, or they were never given the paper certificate carrying the account numbers.

NS&I retail director Andrew Westhead said the bank recognised bonds purchased before digitisation were “much harder to trace”.

Mr Westhead added, “These figures are a timely reminder to update your details, talk to your loved ones about your savings and make sure your money stays firmly in your hands, both now and in the future.”

The oldest unclaimed prize was £25 won in November 1957 in South Yorkshire.

Savers can discover if they’ve secured a prize using NS&I’s prize-checking facility. Holders will only require their Premium Bonds holder’s number or NS&I number to view the results. Savers can also obtain the NS&I premium bonds prize checker application, which is accessible through the Apple Store or Google Play, where the identical details will be easily accessible.

The tool won’t just reveal this month’s winnings, but will also highlight any previous unclaimed prizes. Old NS&I bonds, certificates, passbooks, or account paperwork can often be found tucked away in drawers or among old documents.

Customers who stumble upon forgotten savings are urged to utilise NS&I’s tracing service to locate any funds due to them. In the financial year 2024/25, more than £166million was reunited through 52,693 NS&I accounts for holders who had lost touch with their savings and investments using these tools. The figure included over £120million in Premium Bonds savings and unclaimed prizes, £11.4million paid out from old Savings Certificates and £1.3million from old Children’s Bonus Bonds.

How to enter premium bonds draw

Premium Bonds are a type of investment issued by NS&I that can generate interest or a dividend payment at regular intervals. When purchasing these bonds through NS&I you will automatically be entered into a monthly draw which will give you the chance to win a tax-free award of £25,000 to £1m.

When you invest money with Premium Bonds, you don’t acrue interest, but rather access the draws.