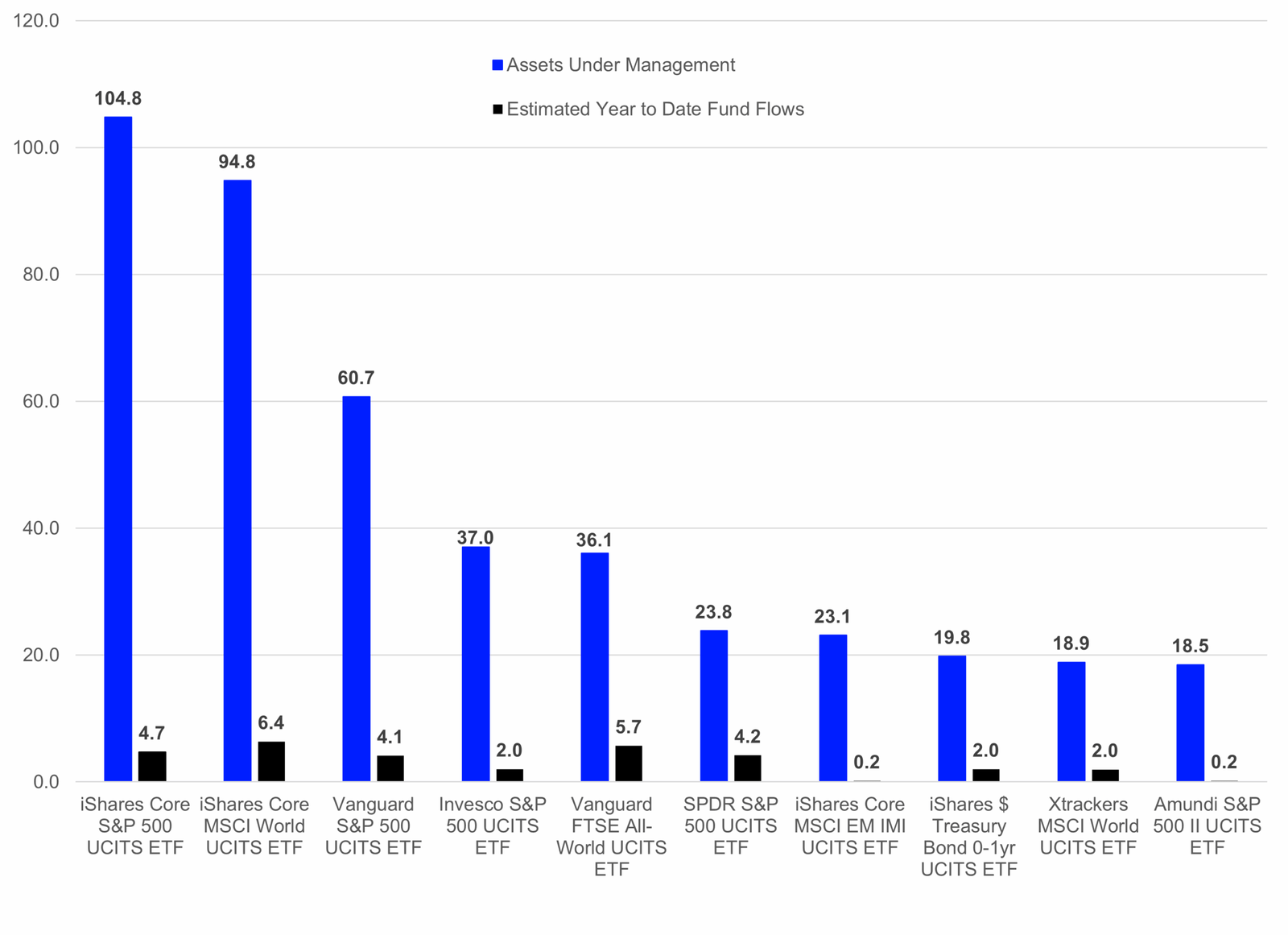

When viewing the 10 largest ETFs by assets under management (AUM) domiciled in Europe, it becomes clear that the two largest ETFs are dominating the industry in terms of AUM. While the (AUM: €104.8 bn) is the only ETF in Europe with assets under management above €100.0 bn, the second largest ETF in Europe— (AUM: €94.8 bn)—is on the way to breaking the €100.0 bn milestone for assets under management.

After the two leading ETFs there is a wide gap in the AUM, as the third largest ETF——accounts for a considerably smaller €60.7 bn in assets under management. As graph 1 shows, there is also a large gap in AUM between the third and fourth largest ETF in Europe. After this the competition on the league table gets closer and the funds can change positions driven by estimated net sales and/or the performance of the underlying markets on a monthly basis.

Graph 1: Assets Under Management and Year-to-Date Estimated Net Flows of the 10 Largest ETFs in Europe – June 30, 2025 (in billion EUR)

Source: LSEG Lipper

This leads to the question of whether the largest ETFs are also taking all the flows. That said, it is somewhat normal that the largest ETFs are accumulating higher inflows than their smaller peers, as it can be assumed that there is much more trading activity, hence liquidity, in these products. When it comes to this, it can be said that the current flow pattern backs this assumption. For example, the largest S&P 500 ETF enjoyed the highest inflows over the course of the first six months of 2025 (+€4.7 bn), while the largest MSCI World ETF enjoyed the highest inflows overall (+€6.4 bn).

That said, one needs to bear in mind that the flows in the different markets are an asset allocation decision of investors. This means the ranking of markets is mostly independent from the overall size of the respective market segment, but the ranking of the ETFs receiving these flows might be dependent on the size of the respective ETFs.

More generally, five of the 10 largest ETFs could be found on the list of the 10 best-selling ETFs, while another three were among the 20 best-selling ETFs overall. This means that only two of the largest ETFs in Europe were not at the top of the list for the best-selling ETFs over the course of the first half of 2025.