Join Our Telegram channel to stay up to date on breaking news coverage

Following the success of its spot Bitcoin and spot Ethereum ETFs (exchange-traded funds), asset management giant BlackRock is reportedly looking to tokenize its ETFs on the blockchain.

According to a Bloomberg report that cited sources familiar with the matter, the firm is considering tokenizing funds that offer exposure to real-world assets (RWA). However, this move would be subject to “regulatory considerations,” the report added.

BlackRock Crypto ETFs Attract Billions Of Dollars At Record Pace

BlackRock already offers multiple crypto-related products. These include ETFs that track the digital asset market leaders Bitcoin (BTC) and Ethereum (ETH), the iShares Bitcoin Trust and the iShares Ethereum Trust.

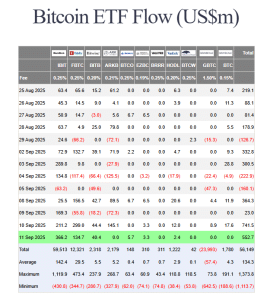

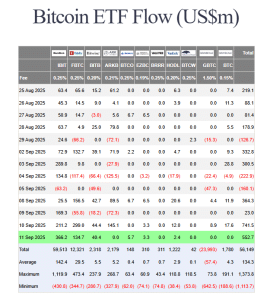

Data from Farside Investors shows that BlackRock’s spot Bitcoin ETF leads the market in terms of cumulative inflows, with its total flows to date standing at $59.513 billion. This is considerably more than the second-largest fund in terms of this metric, which is Fidelity’s FBTC with its $12.321 billion in cumulative inflows.

US BTC ETF flows (Source: Farside Investors)

While BlackRock’s spot Ethereum ETF has been the best performer of all US spot ETH ETFs, it hasn’t gained as much traction as the asset manager’s BTC product. To date, the ETH ETF has seen $12.721 billion in cumulative inflows.

Both BlackRock’s spot Bitcoin and spot Ethereum ETFs reached $10 billion in assets under management in one year or less. This makes them two of only three such products to hit this milestone.

In addition to those ETFs, BlackRock also offers lesser-known “thematic” funds like the iShares Blockchain and Tech ETF, which invests in an index of crypto-related companies.

BlackRock Already In The Nascent Tokenization Space

The reported plans to tokenize its ETFs comes as BlackRock already manages the world’s largest tokenized money market fund called the BlackRock USD Institutional Digital Liquidity Fund (BUIDL).

That fund crossed the $1 billion mark In March, and now accounts for over $2 billion in managed assets.

Tokenized equities, including stocks and ETFs, are still a nascent market despite a recent uptick in interest. While several major players such as Robinhood and Kraken are currently in the market, there is less than $500 million worth of these assets in circulation, data from RWA.xyz shows.

In the past 30 days, there has also been a more than 40% drop in the number of monthly active addresses to around 23,940. Monthly transfer volumes have slid over 22% during this period as well.

While the reported move by BlackRock to tokenize its ETFs will bring the funds on-chain, Bloomberg Intelligence ETF analyst Eric Balchunas questions the “value add” for consumers.

In an X post, he said that tokenization could help make the “back office (plumbing)” in the traditional finance (TradFi) space “more efficient” through the utilization of blockchain technology.

We need to define the trend better: If by ‘tokenization’ you mean the back office (plumbing) of TradFi will be slightly more efficient by utilizing blockchain technology? Then sure, fine, probably will but zzzz. What is implied tho by the hype is getting actual investors to sell… https://t.co/SzXROTB9oi

— Eric Balchunas (@EricBalchunas) September 11, 2025

“What is implied tho by the hype is getting actual investors to sell $VOO et al and buy a token a la the way ETFs stole from MFs,” he wrote.

“I don’t see the value add for the consumer,” Balchunas added.

In a follow-up comment, he said BlackRock’s move to tokenize its ETFs is still “a big lift,” adding that it makes sense to tokenize stuff for people that are already on-chain.

“But the on chain ppl are such a small fraction of the global money which is why the hype sometimes feels too heavy for the impact (at least medium term),” he wrote.

TradFi Firms Move To Secure Dominance Amid Stablecoin Boom, Liquidity Shift

BlackRock is not the only traditional finance firm that is growing its presence in the blockchain space.

In April, the Depository Trust & Clearing Corporation (DTCC) announced an innovative new platform for tokenized collateral management using its AppChain infrastructure.

A couple of months after that in July, Goldman Sachs and BNY Mellon partnered to launch a tokenized money market funds solution.

Earlier this month, the Nasdaq also filed a proposal with the US Securities and Exchange Commission (SEC) to allow trading of listed securities on its main market in tokenized form.

The push into the tokenization space is part of a broader effort by tradFi firms to maintain their dominance as the adoption of stablecoins grows and liquidity starts moving on-chain.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage