US President Donald Trump has announced a 100% tariff on branded drugs imported to the US.

The shockwaves of this decision quickly reached Indian shores. Pharma majors, which have long relied on exports to the US, are now facing an uncertain earnings path. The market reaction was swift, with pharma stocks correcting sharply.

But history tells us that pharma is not a sector that stays down for long. Its defensive nature and steady demand often make it one of the first to bounce back once the dust settles.

For mutual fund investors, this turbulence could be an opportunity. But which pharma funds deserve a spot on your watchlist for 2026?

Here are 3 schemes that have outperformed the pharma index over the last 3 years…

#1 ICICI Prudential Pharma Healthcare & Diagnostics (P.H.D) Fund (G)

The ICICI Prudential Pharma Healthcare & Diagnostics Fund is a sectoral equity scheme that focuses on the pharmaceuticals, healthcare, diagnostics, and related industries.

The fund aims to generate long-term capital appreciation by investing in a portfolio of equity-related securities of pharma, healthcare, hospital, diagnostics, wellness, and allied companies.

As of 31 August 2025, its asset under management (AUM) was Rs 61.6 billion (bn). Its expense ratio is 1.04% under the Direct Plan. In terms of allocation, 95.9% of the assets are invested in equity, and 4.1% in cash & cash equivalents.

The scheme holds a diversified portfolio of 37 stocks. The top 10 stocks account for 63.4% of the portfolio, with Sun Pharma holding the highest weight at 11.7%, followed by Dr. Reddy’s (9.5%), Divi’s Lab (9.2%), Cipla (7.4%), and Aurobindo Pharma (6.5%).

The fund holds 90% of its assets in the healthcare sector. Other sectors are industrial (3.1%), materials (1.4%), and financials (1.1%).

The fund engages in active rebalancing with a turnover ratio of 65%.

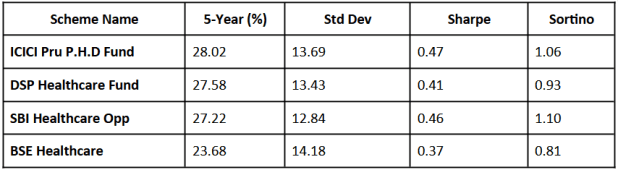

The fund has delivered a rolling 28% compounded annual growth rate (CAGR) over the last five years. This is higher than the 23.7% delivered by the benchmark (BSE Health Care) during this period.

The fund has also shown relatively lower volatility. The fund has maintained a standard deviation of 13.7%, which is lower than the BSE Health Care of 14.2%.

It also ranks higher in risk-adjusted return, with a Sharpe ratio of 0.5, compared to 0.4 of the benchmark.

The fund’s Sortino ratio is 1.1, higher than the benchmark’s 0.8. This means the fund is rewarding investors more effectively for the downside risk they are taking, compared to the benchmark.

#2 DSP Healthcare Fund

DSP Healthcare Fund is a sectoral equity scheme that focuses on pharmaceuticals, healthcare, diagnostics, and related businesses.

As of 31 August 2025, the scheme’s AUM was Rs 31.1 bn. Its expense ratio is 0.6% under the Direct Plan. In terms of allocation, 97.8% of the assets are invested in equity, and 2.2% in cash & cash equivalents.

The scheme holds 29 stocks in its portfolio. The top 10 stocks account for 60.6% of the portfolio, with Cipla holding the highest weight at 9.2%, followed by Sun Pharma (7.9%), Ipca Lab (7.6%), Cohance (7.4%), and Laurus Labs (6.1%).

The fund holds 95.7% of its assets in the healthcare sector, and 1.4% in financials. With a turnover ratio of only 14%, the fund signals its conviction in holding stocks for the long term.

The fund has delivered a rolling 27.6% CAGR over the last five years. This is higher than the 23.7% delivered by the BSE Health Care during this period.

The fund also shows lower volatility. The fund has maintained a standard deviation of 13.4, which is lower than the BSE Health Care index (14.2). With a Sharpe ratio of 0.4, the fund’s risk-adjusted returns closely mirror the benchmark.

The fund’s Sortino ratio is 0.9, higher than the benchmark’s 0.8. This means the fund is rewarding investors more effectively for the downside risk they are taking, compared to the benchmark.

#3 SBI Healthcare Opp Fund (G)

SBI Healthcare Opp Fund also focuses on pharma, healthcare, diagnostics, and allied businesses.

The fund employs a bottom-up stock selection approach, aiming to identify high-quality companies in the pharmaceutical, healthcare, hospital, diagnostics, wellness, and allied sectors.

As of 31 August 2025, the AUM was Rs 39.6 bn. Its expense ratio is relatively low at 0.9%. In terms of allocation, 96.2% of the assets are invested in equity, 0.1% in debt, and 3.7% in cash & cash equivalents.

The scheme holds 30 stocks. The top 10 stocks account for 49.7% of the portfolio, with Sun Pharma holding the highest weight at 10.8%, followed by Divi’s (6.8%), Max Healthcare (6.1%), Cipla (4.8%), and Lonza Group ADR (4.2%).

The fund holds 93.4% of its corpus in the healthcare sector, followed by materials (2.6%).

With a portfolio turnover ratio of only 14%, the fund signals its conviction in holding stocks for the long term.

The fund has delivered a rolling 27.2% CAGR over the last five years. This is higher than the 23.7% delivered by the BSE Health Care during this period.

The fund also shows lower volatility. The fund has maintained a standard deviation of 12.8, which is lower than the BSE Health Care index (14.2). It also ranks higher in risk-adjusted return, with a Sharpe ratio of 0.5, compared to the benchmark’s 0.4.

The fund Sortino ratio is 1.1, higher than the category average of 0.8. This means the fund is rewarding investors more effectively for the downside risk they are taking, compared to the benchmark.

Rolling period returns are calculated using the Direct Plan-Growth option. Returns over 1 year are compounded annualised. Standard Deviation indicates the risk, while the sharpe ratio and sortino ratios measure the Risk-Adjusted Return. They are calculated over 3 years, assuming a risk-free rate of 6% p.a.

The category average of all consumption mutual funds considered.

Please note that returns here are historical returns.

*The top funds here in the table are based on past returns over 5-year returns. The list of schemes is not exhaustive.

Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Source: ACE MF

Conclusion

Despite near-term turbulence from US tariffs, pharma remains a resilient long-term theme.

The three funds in this editorial have good track records. ICICI P.H.D. offers active rebalancing, DSP Healthcare follows a conviction-led, low-turnover approach, and SBI Healthcare Opportunities balances growth with lower costs.

All three have outperformed the benchmark with lower volatility, making them candidates for investors eyeing the recovery in healthcare. For those willing to ride out uncertainty, these funds could be additions to a 2026 watchlist.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.