TAMPA, Fla. — Early-stage investor Space Capital said global investments in core space infrastructure climbed to a five-quarter high of $4.4 billion over the three months to the end of September, amid a breakout year for U.S. satellite manufacturing.

Record activity in the Chinese launch industry also contributed to a 12% quarter-on-quarter increase for what the firm classifies as space infrastructure: the hardware and software used to build, launch and operate assets in orbit.

Beijing-based Galactic Energy, for example, recently raised $336 million in what appears China’s largest disclosed round for a launch startup to support rocket development.

“From what we’re seeing, China’s surge in launch investments underscores the scale of industrial mobilization now underway,” Space Capital CEO Chad Anderson told SpaceNews.

“Launch is typically the first stage of that cycle — as new rockets and reusable platforms come online, the satellite market inevitably follows. From an investment perspective, the past few years have seen several very large but uneven cycles in satellite funding.

“Part of the reason is that many early- and growth-stage satellite rounds in China remain undisclosed, but as more information surfaces, it’s clear that manufacturing investment is now accelerating in parallel, following the same upward trajectory that launch has already established.”

Defense drivers

Defense continues to be the dominant driver in an industry still dominated by the United States, where companies are racing to position themselves for contracts tied to Golden Dome, the Pentagon’s sweeping initiative to harden and integrate national-security space systems.

California-based Apex announced a $200 million funding round Sept. 12, valuing the company at $1 billion as it scales satellite production for both national-security missions and commercial constellations.

According to Space Capital, 60% of all satellite manufacturing funding rounds tracked over the past decade and a half have occurred since 2021, reflecting growing confidence in mass-production models and dual-use hardware that aims to serve defense and commercial demand.

The trend shows no signs of slowing.

“While we can’t say for certain that Q4 will show additional acceleration in satellite manufacturing or other verticals, the overall trajectory in core space infrastructure — particularly satellite manufacturing and logistics, which have been the biggest beneficiaries of Golden Dome so far — is clearly upward heading into 2026,” Anderson said.

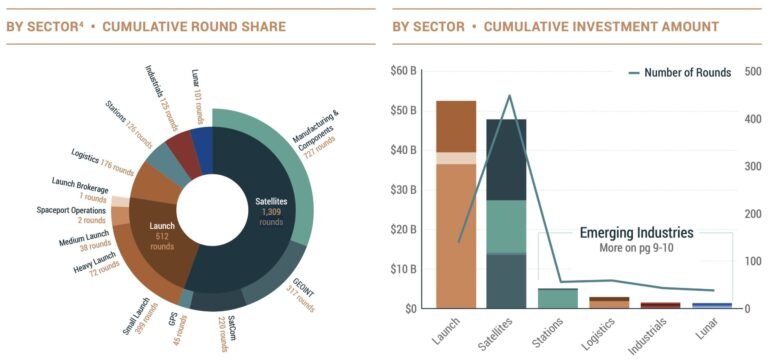

The emerging industries subset of the firm’s infrastructure category, including space stations and on-orbit logistics, has also expanded rapidly to represent 22% of total rounds, up from low single digits five years ago.

While satellite-related companies lead infrastructure by deal activity, Space Capital noted that the launch market has attracted more capital, totaling $52.4 billion since 2009, compared to $47.7 billion for satellites.

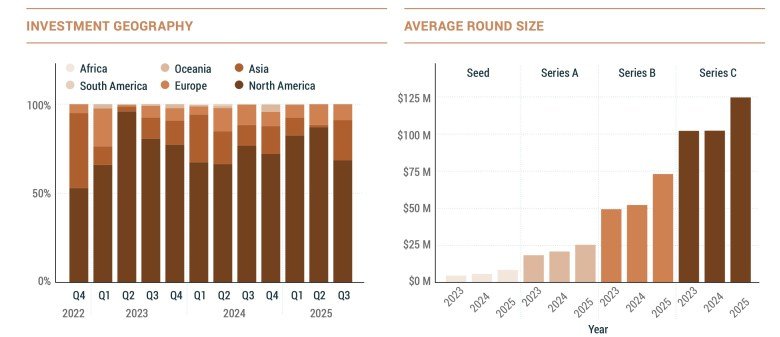

Average round sizes for infrastructure companies have also risen across every stage since 2023, with the sharpest increase this year as investors concentrate larger checks in fewer, more technically proven ventures.

Even so, of the 651 infrastructure companies that have raised seed rounds since 2009, only 15 have progressed to a Series E.

The report said the slowdown in later-stage funding suggests investors are concentrating capital on a smaller number of companies earlier in their development.

Space Capital counted 14 investor exits in the third quarter of 2025, worth a combined $24.2 billion, driven largely by acquisitions such as Intelsat’s multibillion-dollar sale to SES. There were also two initial public offerings: U.S.-based space technology company Firefly Aerospace and Axelspace, a Japanese Earth-observation company.

These deals have already helped make 2025 the second-highest year on record for infrastructure exit value and a new high for deal count.

The highest year on record for infrastructure exits by value remains 2018 with $46 billion across 18 deals, driven by large-scale transactions such as Collins Aerospace, Microsemi and Orbital ATK.