Fund management group Premier Miton believes it has created a vehicle ideal for those who want to earn a half decent – and regular – income from their investments in retirement.

It’s called Premier Miton Cautious Monthly Income, a £227 million fund which, through investing in a mix of equities and bonds, provides an annual income equivalent to a tad above 5 per cent.

Anthony Rayner, who runs the fund with David Jane, says the idea is ‘to generate a consistent and growing income’ for retirees without them having to sell down their investments.

It’s an approach which the two managers have applied to the fund for nigh on ten years – and it has been rather successful.

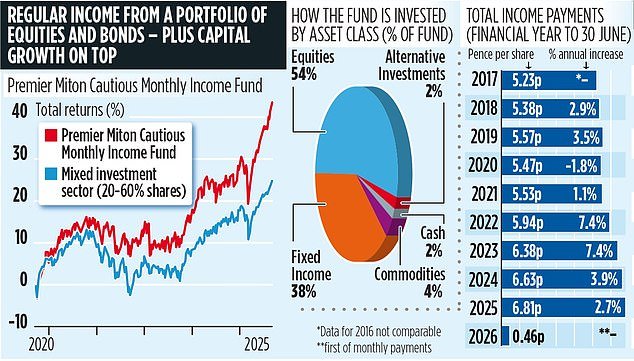

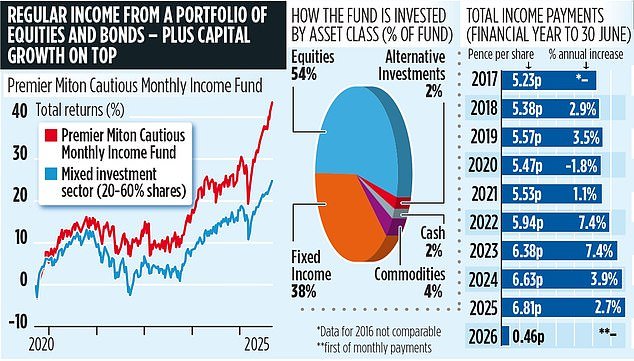

Only in the financial year to the end of June 2020 did the fund fail to grow its annual income – a result of Covid and lockdown – and even then the reduction in income was minimal at 1.8 per cent.

In the last full financial year to June 30, 2025, the fund paid investors income of 6.81p a share: 2.7 per cent higher than the year before and 30 per cent larger than the equivalent payment in the year to end of June 2017. The fund’s current share price is hovering around £2.25.

The ‘consistent’ part of the income jigsaw is a result of the managers working out the likely income from the fund’s investments for the year ahead, and then agreeing to pay a fixed income for the first 11 months.

The final monthly payment for June is invariably higher as the managers return any surplus income to investors.

So, for example, in the year to the end of June 2025, investors received 0.444p per share of monthly income for the first 11 months. Then in June, they were paid 1.9261p per share. For the current financial year, the monthly income has been set at 0.455p – 2.5 per cent ahead of last year.

‘For those who want to retire and earn an income from their investments, it’s a compelling proposition,’ says Rayner.

The fund has monthly inflows of £2 million-£3 million, with money coming primarily (but not exclusively) from financial advisers looking for suitable investment homes for clients approaching – or already in – retirement.

The fund’s income is underpinned by a diverse portfolio, comprising of 87 equity holdings, 103 bond positions and a smattering of stakes in commodity and property assets. Holdings in individual companies rarely top 1 per cent, with collective equity exposure currently accounting for 54 per cent of the fund’s total assets.

Two thirds of the fund’s income comes from its bond holdings, with the biggest positions in bonds offered by Lloyds Banking Group and wealth management group UBS.

Although the focus is on income, the managers are also keen to generate capital returns for investors. It means income-orientated stocks such as BP (6.05 per cent dividend yield), Canadian-listed Gibson Energy (7.1 per cent) and Rio Tinto (6.1 per cent) sit alongside growth stocks such as US giants Broadcom, Meta and Netflix.

‘We’re pragmatic managers,’ says Rayner. ‘We like to hold small positions in stocks, preferably those with share price momentum, and will trim them if they go on to make us profits. The profits we take will then be invested elsewhere, further diversifying the portfolio.’

The resulting overall fund returns – income plus capital – are solid, which is what retirees seek. The past one, three and five overall returns have been 13.7, 32 and 42.8 per cent. These are above the average for its sector.

Annual fund charges are reasonable, at just below 0.9 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.