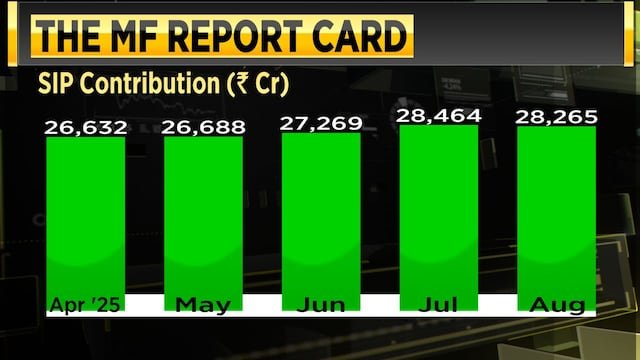

Systematic Investment Plan (SIP) contributions in India have continued to rise steadily, with inflows increasing month after month. Contributions started at ₹26,632 crore in April 2025 and reached ₹29,361 crore in September, marking a record high.

Half-year inflows have remained consistently above previous records, raising questions about whether the trend has peaked or may continue to grow.

Kailash Kulkarni, CEO of HSBC Mutual Fund, noted that the growth over the past 18 months has been significant.

“In April 2024, SIP contributions stood at ₹20,371 crore. This represents roughly ₹9,000 crore of growth in about 18 months,” he said.

Kulkarni highlighted two main drivers of this growth: increasing recognition of SIPs as a disciplined, long-term investment option, and recommendations from satisfied investors that encourage newcomers to start regular investing.

He explained that while short-term experiences may vary, long-term investors generally report positive outcomes.

The geographic distribution of SIP investments is also broadening. Around 40% of new SIP registrations come from the top 30 cities, with the remaining 60% from smaller towns. Kulkarni observed that new investors often begin with smaller amounts and gradually increase contributions through SIP top-ups or additional SIPs.

Regarding market valuations and potential corrections, Kulkarni said SIP investors typically focus on long-term goals rather than market timing.

He added that while younger investors may pause SIPs due to trends on fintech platforms, experienced investors generally maintain consistent contributions.

Other reasons for SIP stoppages include family emergencies or completion of a pre-decided investment period.

Kulkarni also noted that while SIP contributions have grown, overall equity inflows have experienced some decline.

He attributed this to investor caution amid flat market returns, geopolitical uncertainties, and strong performance of alternative investment options such as gold.

With growing awareness, disciplined investing habits, and rising participation from smaller cities, Kulkarni expects the upward trend in SIP contributions to continue.

Watch this video for more

Also Read | What is a crypto SIP and how to start one