What’s the story

SBI Mutual Fund has invested ₹100 crore in eyewear retailer Lenskart Solutions, ahead of its upcoming initial public offering (IPO).

The investment was made through SBI Optimal Equity Fund (AIF) and SBI Emergent Fund (AIF) at a transfer price of ₹402 per equity share.

Neha Bansal, one of the promoters of Lenskart and sister of CEO Peyush Bansal, sold 24.87 lakh equity shares as part of this transaction.

Neha’s stake reduces to 7.46%

Following the transaction, Neha’s stake in Lenskart has reduced from 7.61% to 7.46%.

It’s worth noting that this share sale isn’t part of the IPO’s Offer-for-Sale (OFS).

Last week, Avenue Supermarts (DMart) founder Radhakishan Damani had also invested around ₹90 crore in Lenskart through a pre-IPO transaction.

Lenskart’s ₹7,278 crore IPO to open on October 31

Lenskart’s ₹7,278 crore IPO will open for public subscription on October 31.

The company has set a price band of ₹382 to ₹402 per share, valuing it at over ₹69,700 crore at the upper end.

The offering includes a fresh issue of shares worth ₹2,150 crore and an OFS of 12.75 crore equity shares by promoters and investors.

IPO proceeds to be utilized for strategic initiatives

Lenskart intends to use the IPO proceeds for several strategic initiatives.

These include capital expenditure for opening new company-operated stores in India, lease payments for these stores, strengthening technology and cloud infrastructure, brand marketing and business promotion to enhance brand awareness.

The funds will also be used for potential unidentified inorganic acquisitions and general corporate purposes.

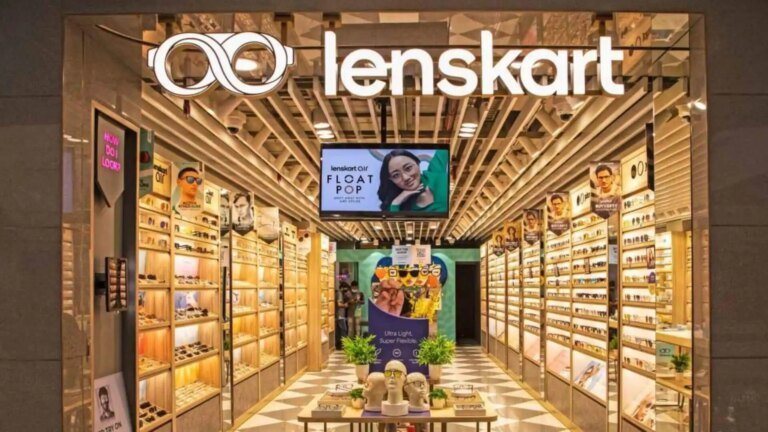

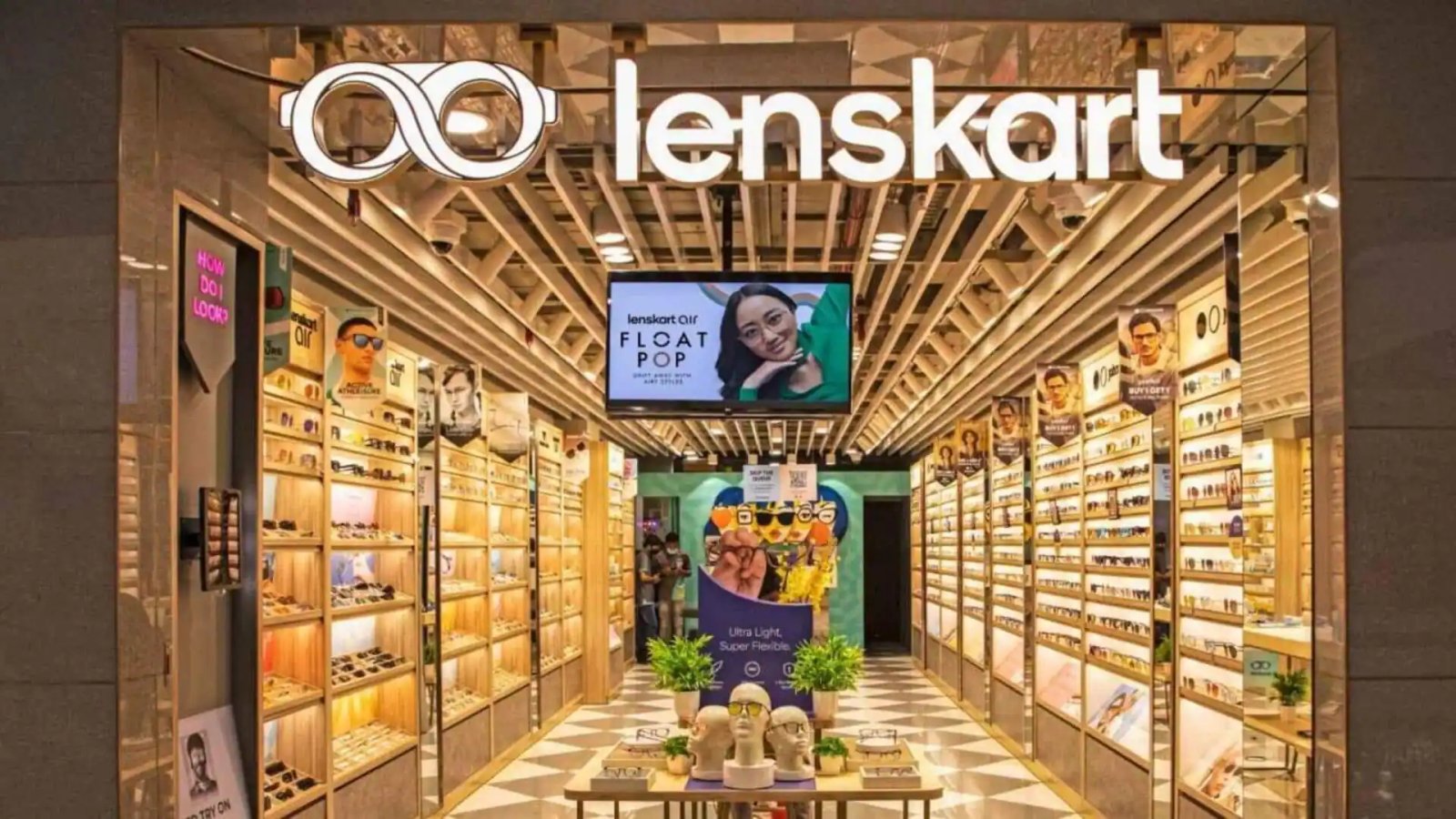

Lenskart’s journey and international expansion

Founded in 2008, Lenskart started as an online eyewear platform in 2010 and opened its first physical store in New Delhi in 2013.

The brand caters to diverse consumer segments through multiple sub-brands.

As part of its international expansion, Lenskart recently agreed to acquire the remaining 80% stake in Stellio Ventures, owner of the Meller eyewear brand, for about ₹406 crore.