Mr. A has been investing in a few mutual funds for the past eight years, without adding any new schemes. However, when he tried recently to invest in a new scheme from a different mutual fund company, he hit a roadblock.

The asset management company’s website displayed a message stating his ‘know your customer’ (KYC) details needed to be validated. His current KYC status was ‘registered’. Mr. A was left confused as he did not know the difference.

While those who invest via mutual fund distributors (MFDs) or brokers usually get the support they need, this is a common experience among do-it-yourself investors.

View Full Image

Sebi’s three-tier system

According to the Securities and Exchange Board of India’s (Sebi’s) Master Circular on KYC norms dated 12 October 2023, all KYC registration agencies (KRAs) are required to verify investors’ existing KYC records and assign a KYC status. The norms were implemented from 1 April 2024.

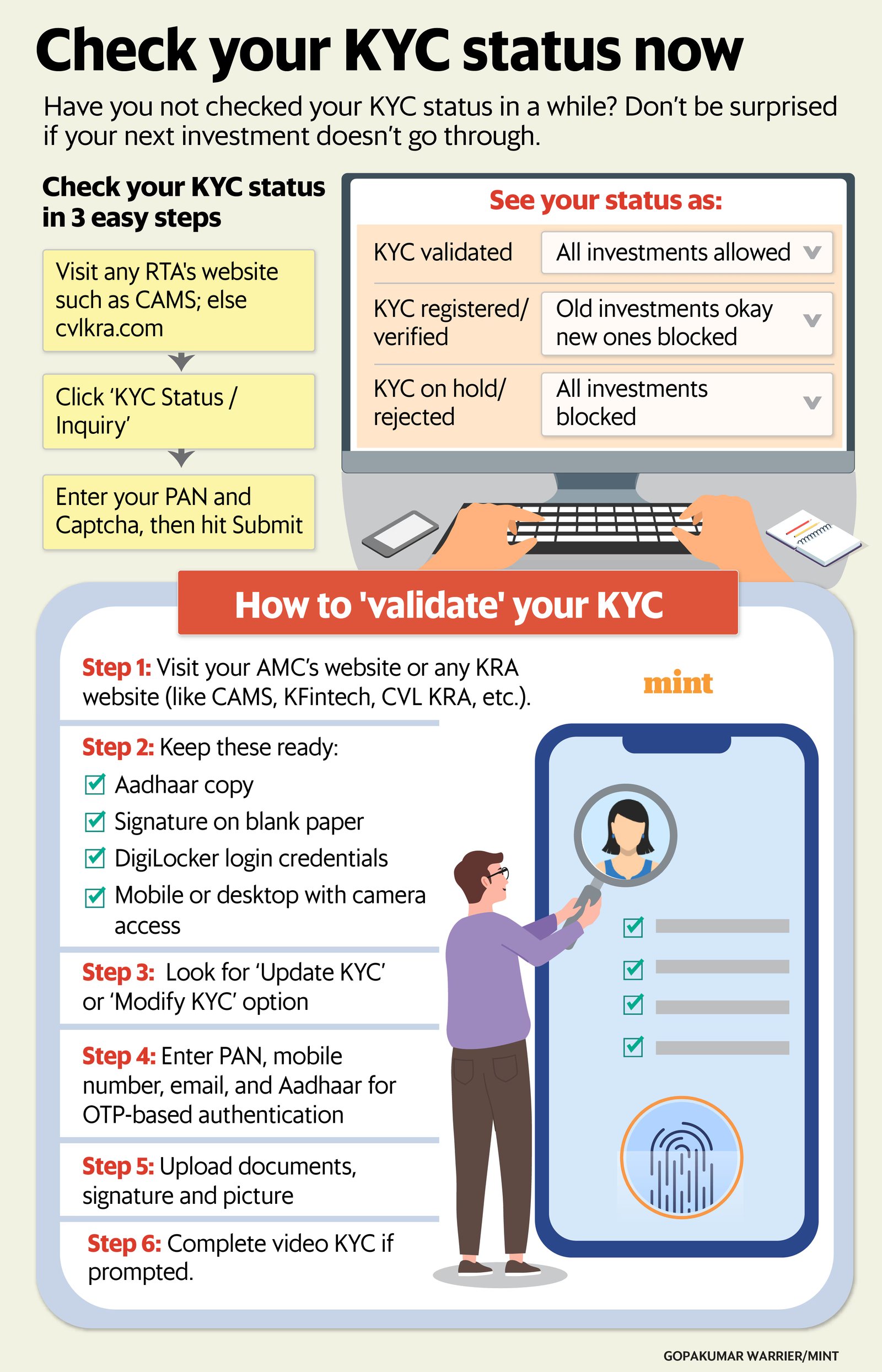

Your KYC status could be one of the following: ‘validated’, ‘verified/registered’, or ‘on hold’. This now determines whether you can invest in a new mutual fund scheme.

- If your KYC is validated, you can invest freely in your existing funds or in new ones, without taking any additional steps.

- If it is verified or registered, you can continue investing with your existing AMCs, but you’ll need to revalidate your KYC to start investing with a new fund house.

- If your KYC status is ‘on hold’ or ‘rejected’, the website will display the reason for it.

Common issues include an unverified mobile number or email ID, PAN not linked with Aadhaar, or deficiencies in KYC documents. Once you resolve the specific issue, your KYC status will be changed to ‘validated’, allowing you to invest freely across mutual fund houses.

How to check your status

To check your KYC status, visit the website of any mutual fund or RTA where you hold investments.

- For instance, on the CAMS website, go to ‘KYC Status Check’, or visit www.cvlkra.com and click on ‘KYC Inquiry’.

- Enter your 10-digit PAN and the Captcha code, then click Submit.

- Your KYC status will appear as KYC Validated, KYC Registered, or KYC On Hold.

If you need to validate or update your KYC, there are two ways to do it.

Online: You can complete the process through your AMC’s website or by visiting a KRA’s website – CAMS or KFintech.

- Keep your Aadhaar copy, a scanned signature on blank paper, DigiLocker credentials, and a mobile phone or desktop with camera access ready.

- Look for the ‘Update KYC’ or ‘Modify KYC’ option.

- Enter your PAN, mobile number, email ID, and Aadhaar for two-factor authentication via OTPs.

- If prompted, complete the video KYC process.

Offline: You can also visit a mutual fund office, broker, or bank branch with your PAN, Aadhaar, and a passport-size photo, fill out the KYC form, and submit it in person.

Once your KYC status is validated, you’re all set. If it remains unvalidated, like in Mr. A, you’ll be restricted to continuing only your existing mutual fund investments. Fresh investments or SIPs will be blocked.

To avoid such disruptions, it’s best to validate your KYC now.