Five spot XRP ETFs have now been listed on the Depository Trust and Clearing Corporation website. The funds could be set for a debut in the market later this month as regulatory challenges clear.

XRP ETFs Show Up on DTCC – What to Expect

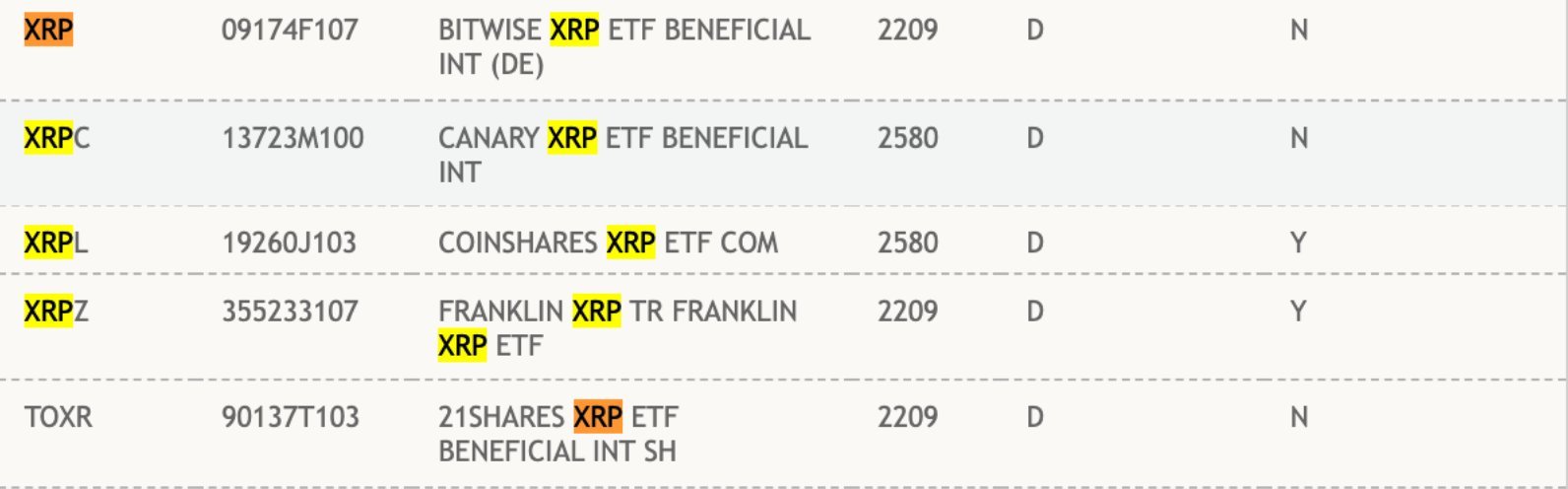

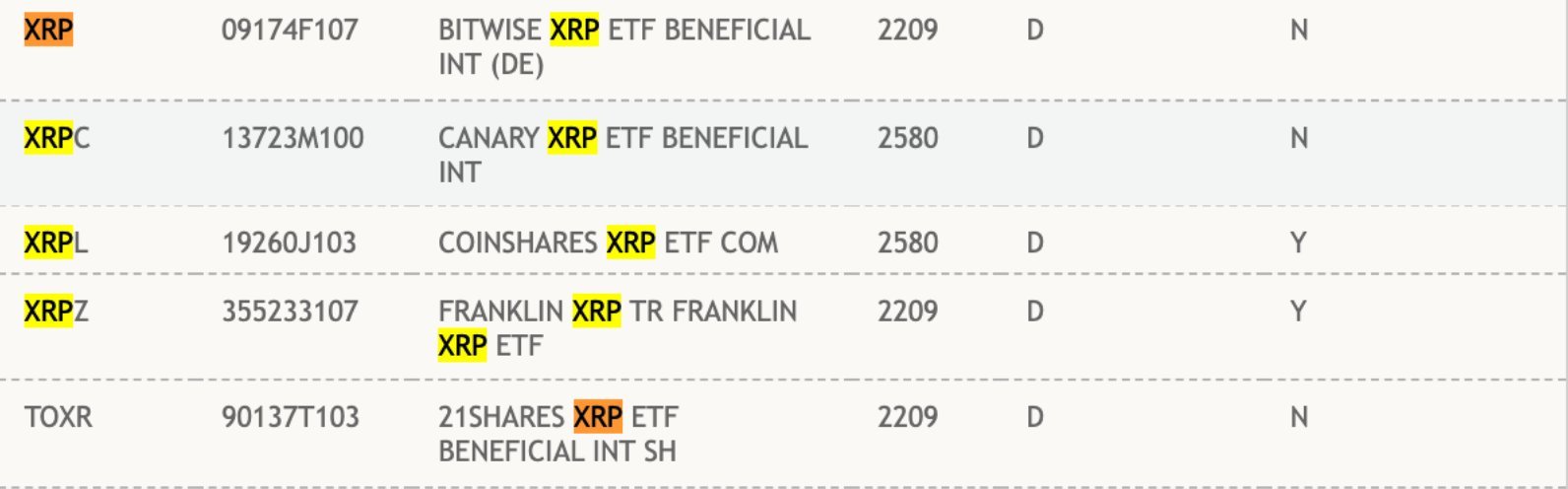

According to DTCC data, there are listings of the fund by Franklin Templeton, Bitwise, Canary Capital, 21Shares, and CoinShares. This, in other words, means that the official approval may come within weeks.

The newly listed products include the Franklin XRP Trust (XRPZ), 21Shares (TOXR), Bitwise ETF (XRP), Canary (XRPC), and CoinShares (XRPL). Typically, it is a signal that the trading and settlement is on the verge of being finalized.

Last week, Franklin Templeton updated its S-1 filing with the U.S. SEC. This is in line with plans to launch its XRP ETF before the end of the month. As pointed out by Bloomberg ETF analyst James Seyffart, the firm’s latest amendment allows the product to automatically go into effect once all conditions are met.

Meanwhile, Bitwise has also filed what analysts describe as its final amendment for approval. The XRP fund by Canary Capital is also moving in the right direction after the firm withdrew its “delaying amendment.”

This will also make its application effective automatically once Nasdaq finishes processing its accompanying 8-A filing. Analysts say it could even launch this week.

Next in line are expected to be filings by CoinShares and 21Shares. That completes a wave of coordinated filings that could see multiple XRP funds go live in a single month.

Government Shutdown Resolution Boosts Launch Outlook

The likelihood of such launches has been further strengthened by recent political developments. The Senate in the U.S. voted to end the prolonged government shutdown and approve a bipartisan funding package that allows agencies like the SEC to resume normal operations.

The new rule eliminates the roadblock that had put reviews of all new financial products, including ETFs, on hold.

As explained earlier in October, the SEC confirmed it would not process or approve new applications during the shutdown. With the reopening of the government, pending filings like that of the XRP funds can go forward.

In fact, funds that have already been launched have gained traction from investors. Earlier this year, highly leveraged offerings such as the Teucrium 2x Long Daily (XXRP) and Rex-Osprey (XRPR) gathered large inflows. The XRPR fund now has more than $100 million under management.

But analysts said if the five spot XRP ETFs really launch this month, it would mark a turning point in the adoption of XRP.