Dividends are an effective way to generate passive income while staying invested in the stock market.

Dividend-paying exchange-traded funds (ETFs) are a simple way to invest in dozens, hundreds, or even thousands of companies while collecting passive income. High-yield dividend ETFs are especially useful for investors looking to supplement retirement income or incorporate passive income as a key element of their financial plan.

Here’s why the Vanguard High Dividend Yield ETF (VYM 1.13%) and the Schwab U.S. Dividend Equity ETF (SCHD +0.11%) are buys in November, as well as some key differences between the two funds.

Image source: Getty Images.

Different approaches to investing in high-yield dividend stocks

The Vanguard High Dividend Yield ETF and the Schwab U.S. Dividend Equity ETF have identical, ultra-low expense ratios of 0.06% — which is just $0.06 for every $100 invested.

The Vanguard ETF has a 30-day SEC yield of 2.5%, which is significantly higher than the S&P 500‘s 1.2% yield. But the Schwab ETF yields a whopping 4%.

The big difference between the two funds is that the Vanguard ETF includes more financial and tech companies, whereas over half of the Schwab ETF is in energy, consumer staples, and healthcare stocks.

|

Sector |

Vanguard High Dividend Yield ETF |

Schwab U.S. Dividend Equity ETF |

|---|---|---|

|

Financials |

21.6% |

9.4% |

|

Technology |

13% |

8.3% |

|

Industrials |

13% |

12.3% |

|

Healthcare |

12.4% |

16.1% |

|

Consumer discretionary |

10.1% |

8.5% |

|

Consumer staples |

9.3% |

18.5% |

|

Energy |

8.5% |

19.3% |

|

Utilities |

6.4% |

0.04% |

|

Telecommunications |

3.7% |

4.7% |

|

Basic materials |

2% |

2.9% |

Just one of the ten largest holdings in the Vanguard ETF yields over 3%. In fact, two of them (Broadcom and Walmart) yield under 1%). Whereas five out of the ten largest holdings in the Schwab fund yield over 3% and all ten yield at least 2% — showcasing that the Schwab ETF is more focused on stocks with high yields, whereas the Vanguard fund prioritizes dividend growth.

Value-focused ETFs can hold up well during market downturns

Even when factoring in dividends, which gives the Schwab fund an advantage, the Vanguard ETF has produced better total returns over the past year, three years, and five years largely thanks to its concentration on more cyclical sectors like financials. Over the last year, healthcare, consumer staples, and energy have all significantly lagged the S&P 500. So much so that the Schwab fund is down 2.2% compared to a 9.9% gain for the Vanguard ETF.

Over the last decade, however, the two funds have produced almost identical total returns — 184.4% for the Schwab fund and 179.7% for the Vanguard ETF. Zooming out shows why it’s important for investors to view historical performance within the context of what was happening in the market at the time.

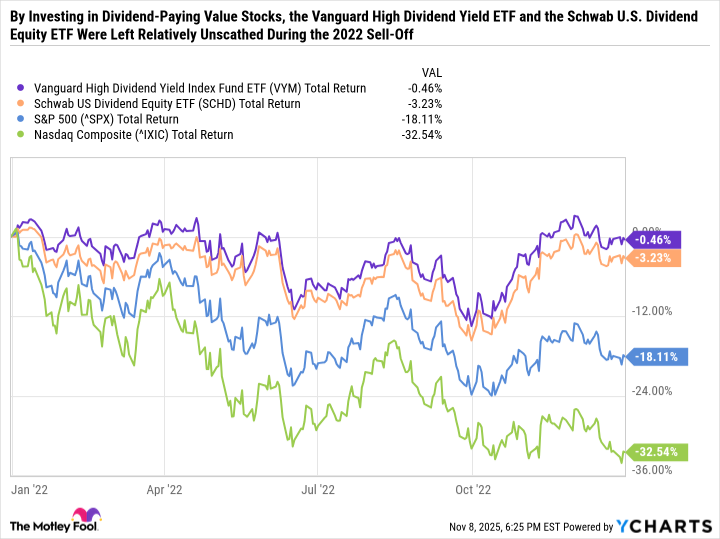

Stodgy sectors tend to drastically underperform during periods when the growth-focused Nasdaq Composite is crushing the S&P 500. But if you look at a year like 2022, for example, when many growth stocks were selling off, both dividend-paying ETFs held up very well because of their concentration in value-oriented sectors.

VYM Total Return Level data by YCharts

Dividend stocks and ETFs don’t hold a candle to the shimmer and shine of red-hot growth stocks. But top dividend-paying companies tend to be valued more for what they are already earning than for what they could one day earn.

The Vanguard High Dividend Yield ETF has a price-to-earnings (P/E) ratio of just 20 and the Schwab U.S. Dividend Equity ETF sports a P/E of 16.9. For context, the P/E ratio of the Vanguard S&P 500 ETF, which is the largest S&P 500 ETF by market cap, is 28.3 and the Invesco QQQ Trust — which mirrors the performance of the Nasdaq-100, has a P/E ratio of 34.5.

Boost your passive income stream with high-yield ETFs

Reasonable valuations and reliable dividends make the Vanguard High Dividend Yield ETF and the Schwab U.S. Dividend Equity ETF good choices for risk-averse investors looking to preserve capital and generate passive income.

The Vanguard ETF is the better choice for investors looking to mix in more growth-focused companies and sectors, while the Schwab fund will appeal to investors looking for an outsize yield.