The global universe of sustainable mutual funds and exchange-traded funds registered net outflows of about USD 55 billion in the third quarter of 2025. The vast majority of the outflows stemmed from redemptions in a range of UK-domiciled BlackRock funds following a client pension fund’s decision to transfer assets into custom environmental, social, and governance mandates managed by BlackRock.

Excluding these BlackRock funds, global sustainable funds still recorded estimated outflows of USD 7.2 billion in the third quarter, compared with restated inflows of USD 6.2 billion in the previous quarter. Fixed income was the only asset class gathering new money, with net subscriptions of about USD 12.5 billion globally.

The universe comprises open-end funds and ETFs focused on sustainability, impact, or ESG factors.

European ESG Passive Funds See Withdrawals. Active ESG Funds Attract Inflows in Europe

Excluding USD 48 billion of withdrawals related to the range of UK-domiciled BlackRock funds previously mentioned, European sustainable funds still experienced outflows of USD 3.1 billion in the third quarter, primarily driven by withdrawals from passive strategies, while active sustainable funds attracted USD 6.0 billion in inflows.

European sustainable funds continue to face headwinds amid a complex geopolitical environment, where sustainability concerns are overshadowed by priorities such as economic growth, competitiveness, and defense. The situation is further complicated by lingering regulatory uncertainties amid an evolving policy landscape, including the Omnibus Package and the ongoing review of the Sustainable Finance Disclosure Regulation.

Persistent performance challenges also continue to dampen investor appetite for sustainability-focused strategies. There has, however, been one bright spot this year: renewable energy stocks, which have rebounded, mainly driven by the rising energy demand from data centers powering artificial intelligence. As of the end of September, the Morningstar Global Renewable Energy Index posted a year-to-date gain of 21.0%, compared with an 18.6% return for the Morningstar Global Target Market Exposure Index and an 11.5% rise for the Morningstar Global Energy Index.

US Sustainable Funds Lose Investors in Q2, But Assets Rise

Meanwhile, sustainable funds in the US continued to experience net outflows for the 12th consecutive quarter, though the total was slightly lower, at USD 5.1 billion, in the third quarter. Restated outflows in the second quarter totalled USD 5.9 billion.

The continued redemptions can be partly explained by the anti-ESG backlash, which has intensified under the Trump administration. Despite the continued withdrawals, US sustainable fund assets still grew to USD 367 billion, matching their 2021 peak.

Meanwhile, sustainable funds in the rest of the world, in aggregate, attracted over USD 1 billion in the third quarter.

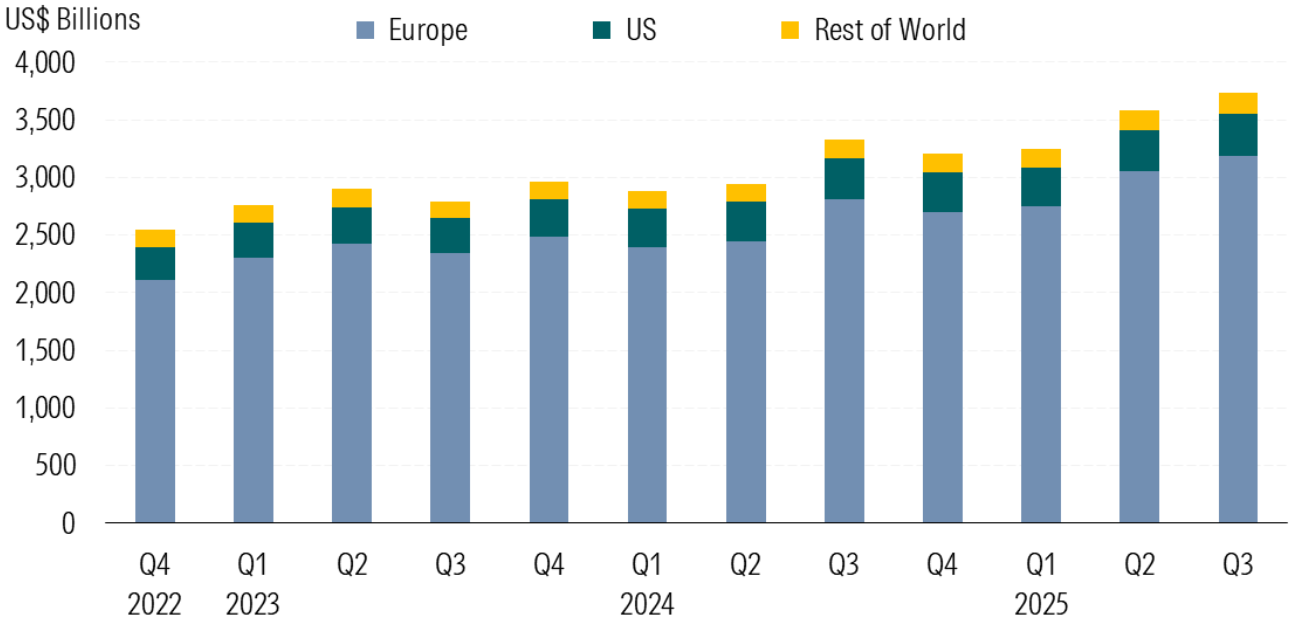

Global ESG Fund Assets Edge Higher to USD 3.7 Trillion in an Up Market

As of September 2025, global sustainable fund assets edged up by about 4% to USD 3.7 trillion from the restated USD 3.6 trillion three months earlier. Asset growth was supported by stock and bond market appreciation.

Europe accounts for 85% of global sustainable fund assets, followed by the US with 10%, and the rest of the world making up the remainder. Sustainable funds represent approximately 19% of the overall European open-end funds and ETF universe, compared to just 1% in the US.

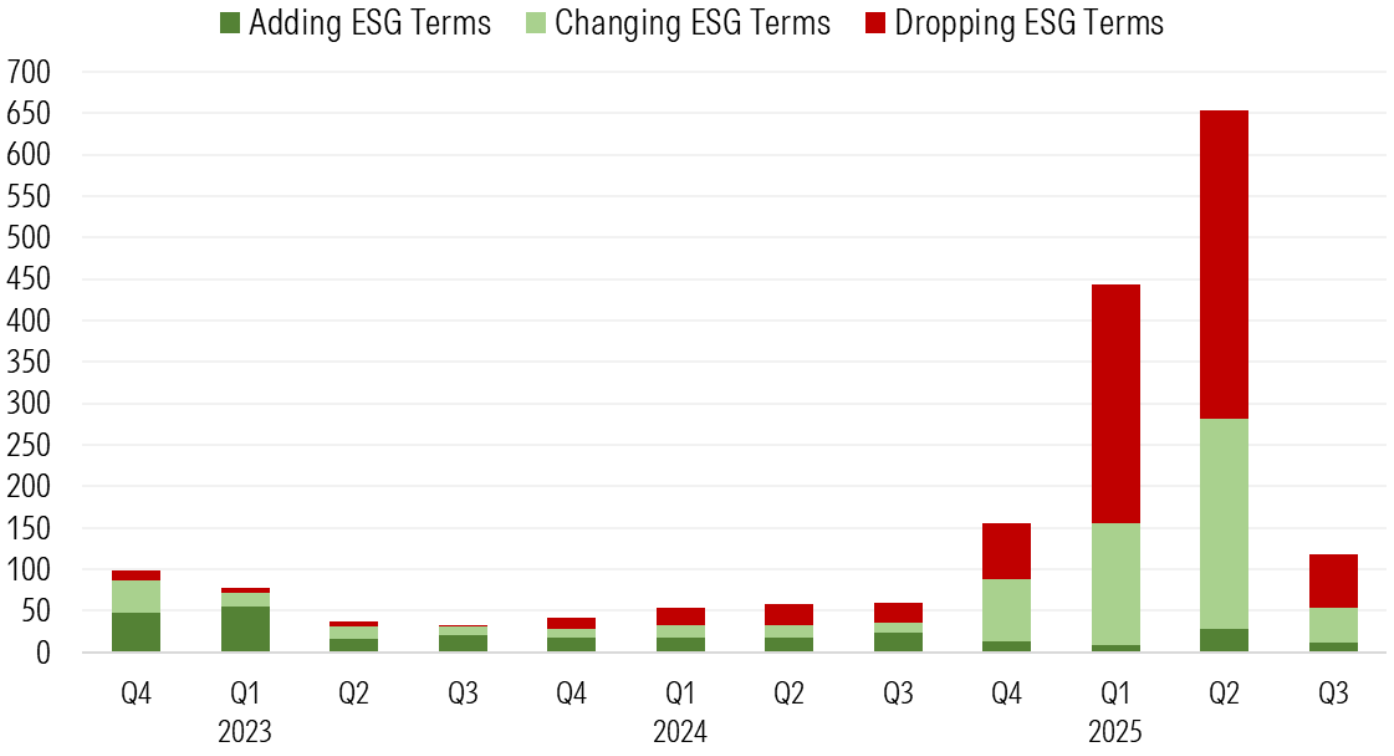

Renaming Activity in Europe Winds Down

After a busy first half of the year, during which asset managers rushed to implement the EU’s ESMA fund naming guidelines ahead of the May 21 deadline, fund renaming activity has since slowed. In the third quarter of 2025, we identified 118 renamed funds, including 64 that dropped their ESG-related terms altogether, 43 that replaced an ESG-related term with another, and 11 that added ESG-related terms.

In total, we estimate that at least 1,500 funds, or 28% of our universe, representing about USD 1.07 trillion in assets under management, have been renamed since the beginning of 2024.

Notably, the majority of funds removed the acronym “ESG” or the term “sustainable” from their names. However, many opted to replace these with “transition” or alternative terms that still signal differentiation and, in practice, continued consideration of ESG factors. These include “screened,” “select,” “committed,” “advanced,” and “tilt.” The vast majority of these terms have been added to passive fund names, mostly to signal ESG-based exclusions, which continue to appeal to certain investors.

Read the full report: Global Sustainable Fund Flows: Q2 2025 in Review | Morningstar