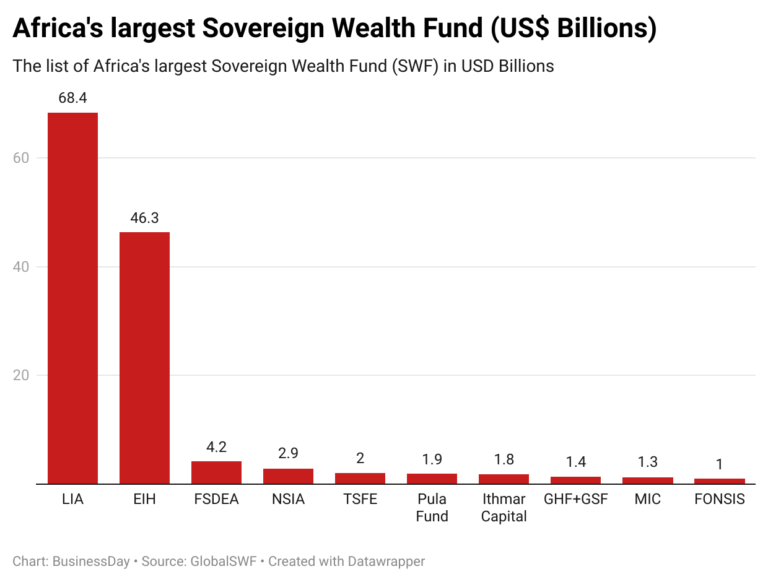

In 2025, the assets under management of Sovereign Wealth Funds (SWFs) across the world will have grown to $14.3 trillion. However, African SWFs account for just under one percent of this figure.

BusinessDay tracks the largest SWFs in Africa based on their assets under management as of December 2025. There are currently 13 national SWFs in Africa, with a cumulative $131.09 billion in assets under management.

-

Libyan Investment Authority (LIA) – $68.35 billion

Libya’s LIA is the largest SWF in Africa, with $68.35 billion in assets under management. It was established in 2006 to manage Libya’s oil revenue surplus at the time.

According to reports, the LIA holds about 400 assets through five different subsidiary funds. These funds include The Libyan Foreign Investment Company, The Libyan Internal Investment and Development Fund, The Libya Africa Investment Portfolio, The long-term investment portfolio, and the Oil Investment Company.

According to the fund’s website, about 30 percent of its assets are in publicly listed equities across the world. Another 30 percent of the assets are in money market instruments, with the remaining 40 percent stake held as cash deposits at the Central Bank of Libya.

2. Ethiopian Investment Holdings (EIH) – $46.32 billion

Despite being the newest SWF in Africa, Ethiopia’s SWF (EIH) is already the second-largest SWF in Africa.

EIH, established in 2022, has $46.32 billion worth of assets under management. According to the fund’s website, it is invested in 40 assets based entirely in Ethiopia. Some of its assets include a 25 percent stake in the Ethiopia Securities Exchange (ESX), Ethiopian Airlines Group, Ethiopian Shipping and Logistics, Ethiopian Toll Roads Enterprise, and Ethiopian Railway Corporation.

It holds stakes across different sectors, including the Commercial Bank of Ethiopia, Ethiopia’s largest bank, and Ethio Telecom.

3. Fundo Soberano de Angola (FSDEA) – $4.19 billion

Angola’s SWF, the FSDEA, or the Angola Sovereign Fund, was created in 2011 with an initial capital of $5 billion. It was created to replace the previously existing Oil for Infrastructure Fund.

Essentially, the fund receives funds from Angola’s oil revenues, and these funds are channeled to generate long-term returns. According to GlobalSWF, about 22 percent of the fund’s assets are alternatives.

Alternative assets include real estate, hedge funds, private equity, and infrastructure. About 50 percent of FSDEA’s investment portfolio is domiciled in North America, with more than 43 percent of the assets being in fixed income.

4. Nigeria Sovereign Investment Authority (NSIA) – $2.86 billion

Nigeria’s NSIA was founded in 2011 by then-President Goodluck Jonathan with an initial capital of $1 billion. Since then, the SWF has received an additional $1.1 billion from the Federal Government. However, $150 million was withdrawn by the Federal Government in 2020.

Read Also: How Nigeria invests its $3 billion sovereign wealth fund – Businessday NG

The fund’s $2.86 billion is spread across three funds: the Stabilisation Fund, the Nigeria Infrastructure Fund, and the Future Generations Fund. NSIA’s equity investees include MTN Nigeria, InfraCorp, NG Clearing, Kasi Cloud, Legit Car Africa, and Extension Africa.

It is also invested heavily in hedge funds and long-only equity investments, with private equity investments.

5. The Sovereign Fund of Egypt (TSFE) – $2 billion

The Sovereign Fund of Egypt was established in 2018 and holds about $2 billion in assets. It has four funds under management, including the TSFE Infrastructure and Utilities Sub-Fund, TSFE Healthcare and Pharmaceuticals Sub-Fund, TSFE Tourism, Real Estate and Antiquities Sub-Fund, and TSFE Financial Services and Fintech Sub-Fund.

TSFE’s portfolio includes the National Egyptian Railway Company, Arab Investment Bank, Erada, and Elazaby Pharmacy, among others.

6. Pula Fund – $1.92 billion

Botswana’s Pula Fund is the oldest SWF in Africa. Established in 1993, it was created to preserve and manage diamond export revenue for Botswana. Although most of the funds were eroded in 2008 due to the global economic crisis, it still holds $1.92 billion in assets.

7. Ithmar Capital – $1.84 billion

Morocco’s Ithmar Capital was established in 2011 to support the Moroccan economy. Together with four other SWFs, namely, Mubadala, Al Ajial Investment Fund, Saudi PIF, and Qatar Holding, Ithmar created a joint venture that invested in real estate projects in Morocco.

Ithmar also owns a stake in Taghazout Bay in Morocco.

8. Ghana Petroleum Funds – $1.42 billion

The Ghana Petroleum Funds combine the Ghana Heritage Fund (GHF) and the Ghana Stabilisation Fund (GSF). They were created in 2011 to manage Ghana’s petroleum revenue.

Collectively, the GHF and the GSF manage $1.42 billion in assets.

9. Mauritius Investment Corporation (MIC) – $1.26 billion

Mauritius Investment Corporation was established in 2020 by the Bank of Mauritius. As of December 2025, it has $1.26 billion in assets under management.

The MIC is fully invested in the Mauritian economy, with holdings in the country’s manufacturing, real estate, arts and entertainment, and agriculture sectors, among others.

10. Fonds Souverain d’Investissements Stratégiques (FONSIS) – $1 billion

Senegal’s FONSIS is the 10th largest SWF in Africa with $1 billion assets under management.

It was established in 2012, and presently has five subsidiaries, including the WE Fund, Kajom Capital, Polimed, IR Capital, and Oyass Capital.