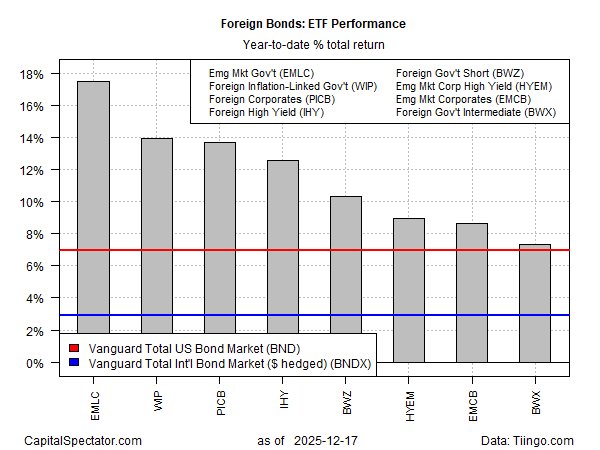

Echoing the strong run in foreign equities in 2025, bond markets ex-US are also having a good year. Using a set of ETFs to track the major international buckets of fixed-income securities shows across-the-board outperformance over a popular US benchmark through Wednesday’s close (Dec. 17).

The leading offshore performing sector this year: government bonds issued in emerging markets (without hedging foreign-currency risk) via the VanEck Emerging Markets Bonds ETF (NYSE:), which is up 17.5% year to date. That’s more than twice the gain for the US benchmark: Vanguard Total Bond Market ETF (NASDAQ:), which holds a mix of US government securities and investment-grade corporates.

Even the weakest foreign bond group – government bonds in developed markets ex-US – is posting a slight return premium over BND this year.

A key tailwind for gains in foreign bonds in 2025 from a US-based investor perspective is the weak . The , which tracks the value of the greenback relative to a basket of the world’s leading currencies beyond America, has slumped more than 9% year to date.

A factor behind the slide in the dollar: by the Federal Reserve, which has reduced the relative allure of US bonds vs. foreign competition. All else equal, global investors favor higher yields and so the narrowing gap in US rates vs. offshore rates has probably redirected flows accordingly in some degree.

Fiscal concerns may be another factor persuading investors to raise holdings of foreign bonds, and thereby diversify away from US assets. Driving this trade: a large, persistent US budget deficits and record-high national debt has elevated uncertainty about the government’s financial management and long-term stability, if only in relative terms to recent history.

Political pressure on the Federal Reserve is another factor cited by some analysts. According to this line of thinking, the appearance of political interference by the White House raises questions about the degree of Fed’s independence and credibility to fight inflation.

Another factor favoring international diversification: Trade and economic uncertainty related to US tariffs. The reasoning here is that higher tariffs reduce the incentive to trade with America, which in turns lessens demand for dollars, if only the margins.

There are other factors that determine the dollar’s value in currency markets, of course, including a variety of agendas at central banks around the world. But one thing is clear: the dollar has weakened this year, and that’s been a bullish tailwind for foreign bonds.