In the past 15 months, despite the frontline large-cap indices nearing or even touching their previous highs, the broader markets are still witnessing considerable churn with mid and small-caps mostly on a corrective mode.

Companies that are reasonably consistent in delivering steady cashflows and healthy dividend yield once they become mature are preferred for such environments. However, many sectors, especially from the large-cap space that fall into this category have had a rough run in the past 18 months. These include fast moving consumer goods, information technology and consumer discretionary segments.

Despite this underperformance from key segments over the past year and a half, dividend yield funds have largely done well over this phase and in general over the long term.

Five funds in the category have a track record in excess of 10 years, while a couple more have been operational for at least five years.

Read on for more on how dividend yield funds have managed to churn their portfolios smartly, straddle market caps while having a leash on risks and invest in newer avenues for better returns and yields.

Yielding more

Some of the relative older funds in the dividend yield category are ICICI Prudential Dividend Yield, Franklin India Dividend Yield, Aditya Birla Sun Life Dividend Yield, UTI Dividend Yield and Sundaram Dividend Yield. HDFC Dividend Yield and LIC MF Dividend Yield have been around for a little over five years. Four other schemes in the category are more recent in their operations.

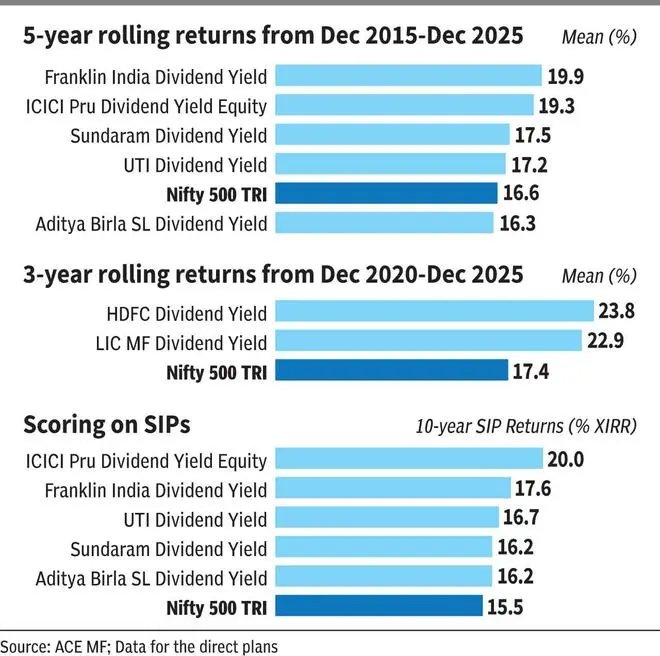

Since dividend yield funds invest across market caps, we take the Nifty 500 TRI as the benchmark for gauging their performance over the years.

When 5-year rolling returns over December 2015 to December 2025 are considered, the mean returns scored by four of the five dividend yield funds – ICICI Prudential, Franklin India, Sundaram and UTI – ranged between 17.2 per cent and 19.9 per cent.

The Nifty 500 TRI delivered mean returns of 16.6 per cent over the aforementioned period.

Only Aditya Birla Sun Life Dividend Yield fell behind marginally, at 16.3 per cent on five-year rolling over the 10-year timeframe indicated earlier.

For HDFC and LIC MF dividend funds, we considered 3-year rolling returns over the past five years (December 2020 to December 2025). They returned 23.8 per cent and 22.9 per cent, respectively, on an average over this period. The benchmark Nifty 500 TRI delivered 17.4 per cent in this timeframe.

When monthly SIPs over the past 10 years are taken for the five longer track record funds, the returns (XIRR) are in the range of 16.2 per cent to almost 20 per cent.

An SIP in the Nifty 500 TRI would have given 15.5 per cent in the same timeframe.

One key aspect to check for dividend yield funds is their ability to contain downsides during market corrections.

The downside capture ratio of the seven funds taken up here range from 52.8 to 95.6, going by data for the direct plans from December 2020 to December 2025. This data clearly show that their NAVs fall less than their benchmark during periods when indices fall. A score of 100 shows that a fund moves in line with its benchmark.

Mixing segments smartly

As mentioned, some of the dividend paying defensives have been on the decline in recent years.

However, the better performing dividend yield funds upped stakes in banks and financial services companies that had a good run in the past 15 months. In addition, funds increased exposures to power and pharmaceutical stocks that delivered reasonably in this timeframe.

One avenue explored by funds has been real estate investment trusts (REITs), which have delivered 14-31 per cent returns in the past one year and also delivered dividends in excess of 5 per cent. Franklin India Dividend, for instance, had almost 10 per cent exposure to REITs/InvITs in its recent portfolio.

Though dividend yield funds tend to invest across market caps, there has been a tendency to increase large-cap exposure for a few funds, which provided stability and also better performance. ICICI Prudential Dividend Yield, Sundaram Dividend Yield and HDFC Dividend Yield are funds that followed this route with 67-74 per cent exposure to large-cap stocks.

For investors, Franklin India Dividend Yield and ICICI Prudential Dividend Yield are the best in the category and can be considered for the long term via the SIP route to coincide with specific goals.

It is important to note that dividend yield strategy could underperform in a secular growth market.

Published on December 20, 2025