In some years, a fund’s style is destiny. Value and growth stocks often drive the ranks of equity funds, with the deepest-value funds outperforming when value leads and high-octane growth names screaming ahead in growth-led rallies. That was especially true in a year like 2022, when a US-centric fund’s placement on the value-growth spectrum told you much about its returns, as high-growth names suffered the most during that year’s global equity market selloff.

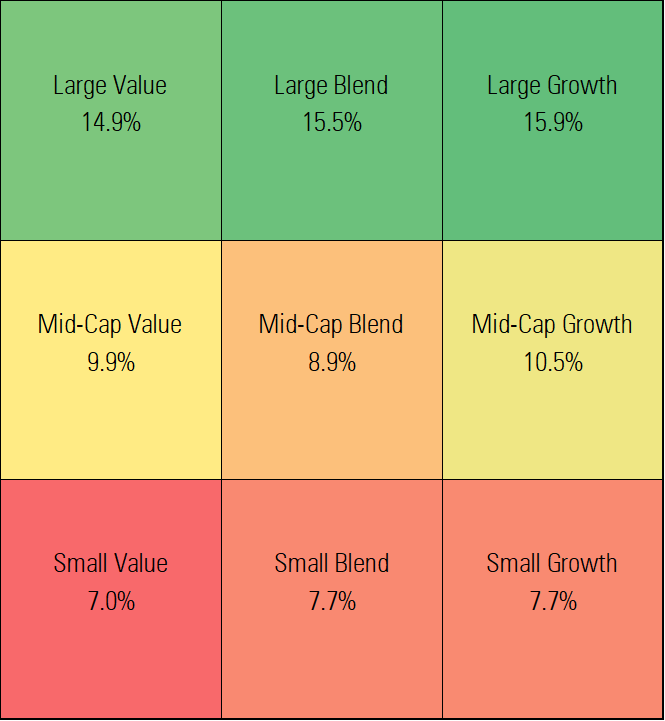

Not so in 2025. Value-versus-growth mattered less. While large-growth Morningstar Category funds edged out their large-blend and large-value peers—returning around 16% on average—the gap was narrow. And value-growth tilts explained almost nothing in the mid- and small-cap tiers.

What mattered more was exposure to size, the artificial intelligence infrastructure buildout, and a willingness to lean into risk.

In 2025, bigger was better. But this wasn’t simply another chapter in the saga of the Magnificent Seven stocks—Apple, Amazon.com, Alphabet, Meta, Microsoft, Nvidia, and Tesla. True, Alphabet soared 66.0%, and Nvidia jumped 39.0%, but the rest lagged the Morningstar Large-Mid Index’s 17.7% return.

Instead, there was a broader strength among larger-cap companies. Index funds packed with the market’s biggest players—iShares Top 20 U.S. Stocks ETF TOPT, Invesco S&P 500 Top 50 ETF XLG, iShares S&P 100 ETF OEF, and iShares Russell Top 200 ETF IWL—all returned 19% or more. Mega-caps flexed their muscle, and funds that favored them rode the wave.

Cap-Weighted Champions

Several large-cap funds run by Capital Group thrived. American Funds American Mutual AMRMX bet on Broadcom and Eli Lilly, which gained more than 50% and 40%, respectively. Its aerospace picks, RTX and GE Aerospace, also took flight. American Funds Washington Mutual AWSHX owned those too, plus a stake in Nvidia.

T. Rowe Price Blue Chip Growth TRZBX, with as much as three-quarters of its assets in mega-caps—including a hefty 16% in Nvidia—landed in the top third of the large-growth category.

What many of these winners shared was exposure to a sector that remained red-hot in 2025: semiconductors.

The Chip Effect

As the world scrambled to build out infrastructure for artificial intelligence, semiconductor stocks like KLA, Micron, and Taiwan Semiconductor delivered windfalls, in addition to Nvidia and Broadcom. In the Morningstar Large-Mid Index, semiconductors gained over 45% and were the biggest contributor to its overall return.

This boom boosted large-value funds that veered off the benchmark to buy in. LSV Disciplined Value ETF LSVD, Capital Group Dividend Value ETF CGDV, and BNY Mellon Equity Income DQIAX scored top-quartile returns, aided by their chip stakes. But most large-value funds, tied to indexes with relatively small semiconductor weightings, found less joy in the rally.

Instead, it was the banks that helped them. Big financial firms surged by around 40%, and funds that overweighted the sector reaped the benefits. Davis Funds—Clipper, Davis New York Venture NYVTX, and Davis Select US Equity ETF DUSA—have long had a bias toward banks. That tilt finally paid off, pushing them into the top decile. BNY Mellon Dynamic Value DAGVX gained from banks, too. So did Parnassus Value Equity PARWX, which also cashed in on semiconductors.

Metals and mining offered another edge. Funds that stocked up on gold and copper stocks—names like Newmont and Freeport McMoRan—glistened. John Hancock Disciplined Value JVLIX, Neuberger Large Cap Value NBPIX, and Columbia Select Large Cap Value SLVAX all earned bragging rights, thanks in part to mid-single-digit allocations to the sector.

AI Arms Race Crosses Cap Lines

The AI boom didn’t stop at large caps. Managers across the market-cap spectrum had to think hard about how to play it.

In mid-caps, Parnassus Mid-Cap PARMX and Victory Pioneer Select Mid Cap Growth PGOFX made savvy bets on SanDisk and Western Digital—both data storage suppliers vital to AI infrastructure. Their allocations (at one point, up to 4% of assets combined) helped them beat four-fifths of their category peers. Both also held semiconductors.

For small-cap funds, biotech and aerospace offered the best chance to stand out. BlackRock Advantage Small Cap Core BDSKX loaded up on both, notching a near-15% return and finishing among the year’s elite. Fidelity Small Cap Growth FCPGX also enjoyed strong results by taking a bold swing on biotech, putting more than 10% of its portfolio into the industry. The risk paid off: Within small-cap indexes, the industry surged 40% to 50%, on average.

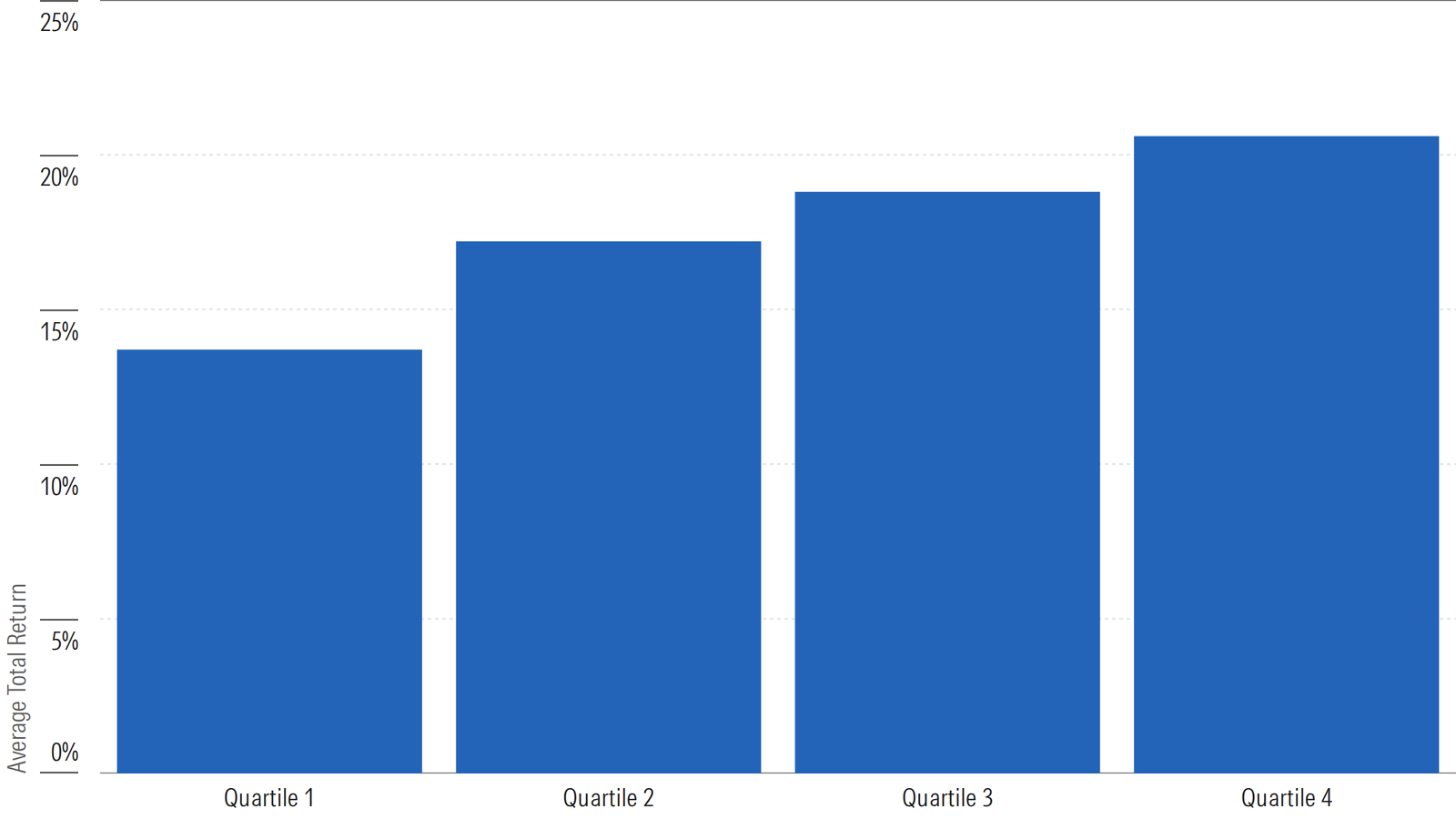

The Reward for Risk

Risk was in vogue in 2025, and the funds that chased it were rewarded. The Invesco S&P 500 High Beta ETF SPHB jumped over 30%. Funds that stuck to more cautious or low-volatility strategies, such as Boston Trust Walden Small Cap BOSOX and Calvert Equity CSIEX, struggled. AI skeptics or investors wary of AI beneficiaries’ valuations—such as the team managing GQG Partners US Quality Value Fund GQHIX and GQG Partners US Select Quality Equity GQEIX—delivered single-digit gains or losses for the year.

In 2025, conviction beat caution. Second thoughts were a liability.