Spot Bitcoin ETFs have recorded their largest single-day inflow since October, signalling renewed institutional interest in Bitcoin.

Notably, the surge in Bitcoin ETF inflows comes as BTC price action shows renewed strength after weeks of consolidation.

This combination of ETF capital inflows and stable market sentiment is reshaping expectations for the Bitcoin price in 2026.

Spot Bitcoin ETFs record strongest inflows in months

According to Coinglass data, US spot Bitcoin ETFs reported $697.20 million in net inflows on January 5.

This marked the largest daily inflow since October and reversed a recent period of muted or negative ETF flows.

The inflows were broad-based, with a majority of Bitcoin ETFs seeing huge inflows.

Only the Grayscale Bitcoin Trust ETF (GBTC) and the WisdomTree Bitcoin Fund (BTCW) did not see any significant inflows.

Such widespread participation suggests institutional confidence in Bitcoin rather than short-term speculative positioning.

BTC institutional demand on the rise

Bitcoin ETFs serve as a primary gateway for institutional exposure to BTC.

Rising ETF inflows indicate that large investors are increasing allocations through regulated investment vehicles.

This type of demand is structurally supportive for the Bitcoin price, as ETF inflows require direct spot BTC purchases.

Sustained ETF demand also tends to reduce circulating supply, tightening market conditions over time.

Whale accumulation reinforces bullish Bitcoin signals

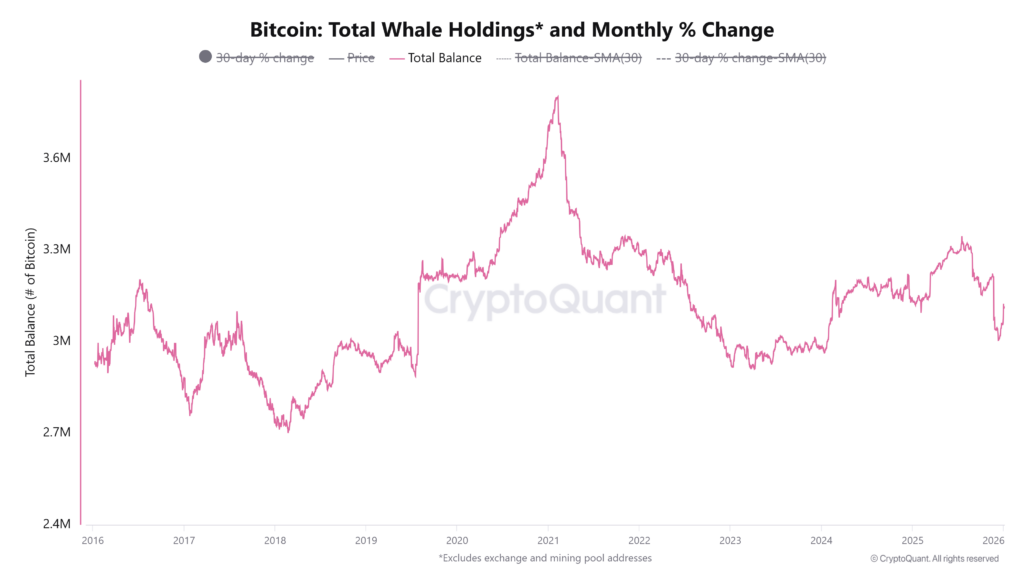

Alongside ETF inflows, on-chain data shows significant Bitcoin accumulation by large holders.

The total Bitcoin whale holdings have risen to over $3.11 million from a low of around $3 million on December 12, 2025, suggesting that whales are accumulating the cryptocurrency after a period of offloading.

This accumulation phase has occurred while smaller retail BTC holders reduce exposure.

Historically, similar divergences between whale buying and retail selling have preceded upward Bitcoin price moves.

Bitcoin price remains resilient amid global uncertainty

Furthermore, the Bitcoin price has remained stable despite heightened geopolitical tensions and macro uncertainty.

On-chain metrics indicate limited panic selling, suggesting that investors are maintaining their long-term conviction.

Derivatives data also reflects calm market behaviour rather than excessive leverage or speculative excess.

This stability reinforces the idea that the current Bitcoin strength is driven by fundamentals rather than hype.

Bitcoin price forecast

The ETF inflows have aligned with a technical breakout, with Bitcoin moving above a key consolidation range near $90,000.

Such alignment between price action and capital flows often strengthens trend continuation.

If Bitcoin ETF inflows remain positive and whale accumulation continues, BTC price could retest resistance near the mid-$90,000 range.

A sustained break above this level would open the door toward psychological targets near $100,000.

However, any sharp reversal in ETF flows could slow momentum and lead to renewed consolidation.

Overall, the combination of Bitcoin ETF demand, institutional accumulation, and calm market conditions suggests a cautiously bullish Bitcoin price outlook in the near term.