Join Our Telegram channel to stay up to date on breaking news coverage

The XRP price has surged 2% in the last 24 hours to trade at $2.15, as U.S. spot XRP exchange-traded funds (ETFs) recorded their first net outflow day since launch, with around $40.8 million exiting the products.

This ended a multi-week streak of uninterrupted inflows that began in mid-November 2025, according to data from SoSoValue. Despite the pullback, cumulative net inflows for XRP ETFs remain strong at about $1.2 billion, and total assets under management are still above $1.5 billion, making them some of the best-performing crypto ETPs on the market.

The outflow day came alongside heavy selling across major crypto-linked ETFs. Farside Investors reported that spot Bitcoin ETFs saw $486 million in net outflows, their largest daily drawdown since November, while spot Ether ETFs recorded $98 million in outflows.

Spot XRP ETFs saw the first-ever net outflows of $41 million on Wednesday.

This effectively ended their 36day no-outflow streak, during which the funds accumulated a total inflow of $1.25 billion.

“However, the scale is modest, less than 3% of cumulative inflows since launch… pic.twitter.com/XiJBQRViy0

— Danny Kunwoong Park (@ParkKunwoong) January 8, 2026

This marked a shift from the strong inflows seen at the start of the year. Bitcoin ETFs had previously attracted $471 million on Friday and $697 million on Monday before reversing with $243 million in outflows on Tuesday and the larger Wednesday decline. Ether ETFs followed a similar pattern, with inflows earlier in the week before turning negative.

XRP ETF Momentum Slows After Weeks of Strong Inflows

Smaller crypto ETFs showed more resilience. Spot Solana ETFs continued to post steady, modest inflows, while Chainlink ETFs moved to flat flows after several days of small gains. Dogecoin ETFs recorded no net movement on Tuesday and Wednesday after starting the year with inflows of $2.3 million and $1.6 million.

The XRP ETF outflow follows weeks of strong demand. By late December, XRP ETFs had logged 29 consecutive inflow days, even as other crypto ETFs experienced year-end outflows. Analysts previously attributed XRP’s popularity to its long market history, strong investor familiarity, and recent performance.

XRP entered 2026 as one of the best-performing major cryptocurrencies, supported by ETF inflows, bullish sentiment, and declining exchange balances. However, market analysts caution that strong ETF demand does not guarantee continued price gains. The first outflow day may signal a shift toward more balanced and normalized flows.

XRP Price Holds Above Key Support After Bullish Breakout

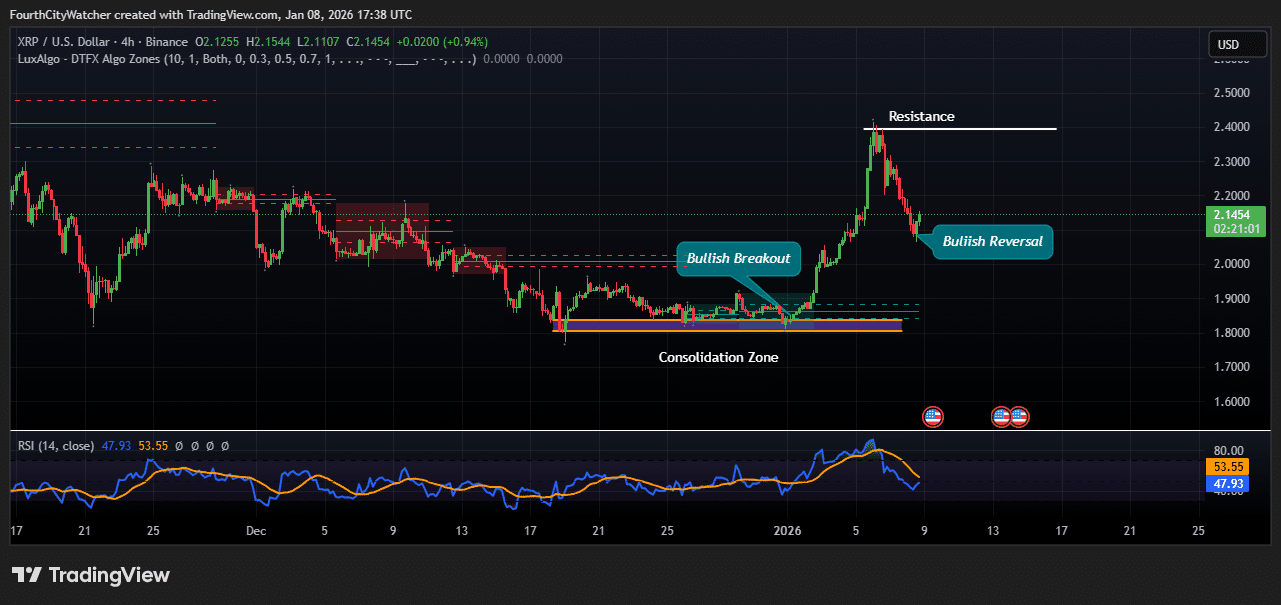

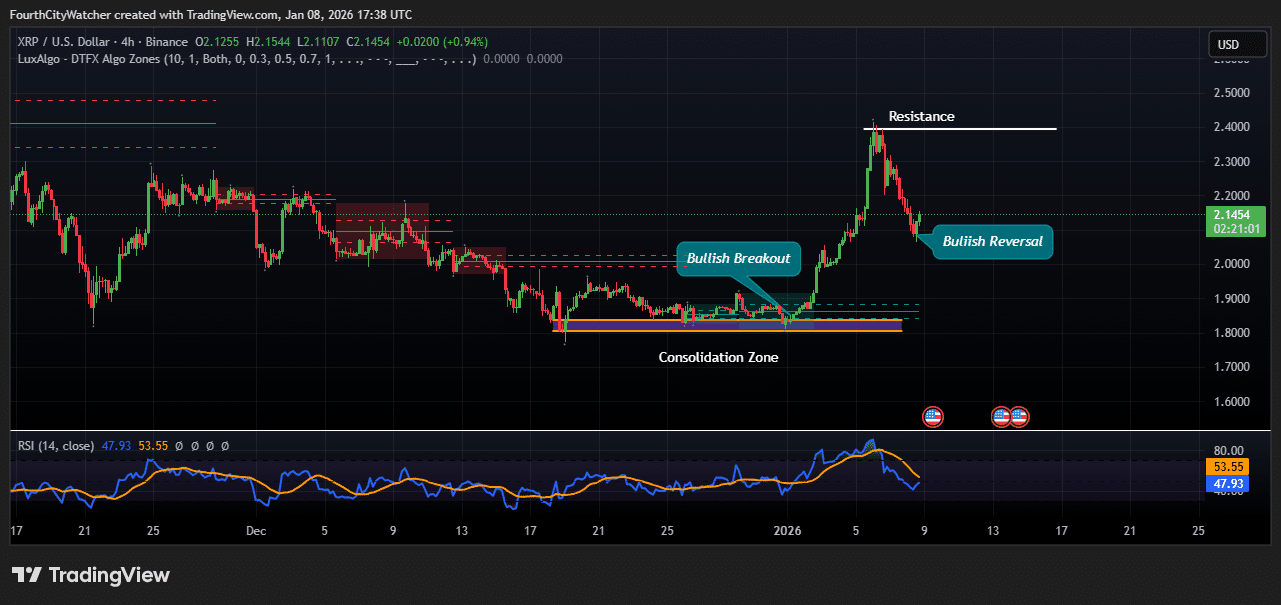

The XRP/USD 4-hour chart shows a clear move from sideways trading into a short-term bullish trend. For several weeks, XRP was stuck in a consolidation zone between $1.80 and $1.95. During this time, selling pressure slowly weakened, and buyers started to gain control.

The breakout happened when XRP pushed above this range, leading to a strong rally toward the $2.40–$2.45 resistance area. This level acted as a major selling zone, causing a pullback. However, instead of falling back into the old range, the price found support around $2.05–$2.10, forming a bullish reversal pattern.

The Relative Strength Index (RSI) also supports this view. After reaching overbought levels during the rally, the RSI has cooled to around 47–53. This is healthy because it reduces the risk of a sharp drop and leaves room for another move higher. The RSI is not in a bearish zone, which means momentum is still neutral to slightly bullish.

Right now, the most important support level is $2.00–$2.05. As long as XRP stays above this area, the bullish structure remains intact. If the price moves above $2.30, it could push back toward the $2.45–$2.50 resistance zone. A strong break above that level would increase the chances of further upside.

On the downside, a fall below $1.95 would weaken the bullish outlook and suggest that XRP may return to sideways trading.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage