Highlights:

• NFO Opens on January 16, 2026 and Closes on January 30, 2026

• Both Investment strategies adopt long-short approaches designed to navigate volatile and uneven market conditions.

• These investment strategies aim to deliver risk-adjusted returns with lower volatility through active use of derivatives, asset allocation, and bottom-up stock selection.

• These offerings are launched under SEBI’s Specialised Investment Funds (SIF) framework, positioned between mutual funds and PMS/AIF products.

• Through SIFs, investors can access advanced strategies in a regulated and investor-friendly structure.

ICICI Prudential Mutual Fund today announced the launch of two new investment strategies under its Specialised Investment Funds (SIF) segment: iSIF Equity Ex-Top 100 Long-Short Fund and iSIF Hybrid Long-Short Fund. The New Fund Offer (NFO) for both investment strategies will be open for subscription from January 16, 2026 to January 30, 2026.

These investment strategies are designed for investors seeking more adaptive portfolio’s in an environment marked by market swings, shifting leadership, and heightened volatility.

Why Specialised Investment Funds (SIFs)?

To address the structural gap between mutual funds and PMS/AIF products, SEBI introduced the Specialised Investment Funds framework where the minimum investment threshold is ₹10 lakh per PAN per SIF. SIFs are positioned as a middle ground, combining the transparency and regulatory oversight of mutual funds with enhanced flexibility, including the use of long-short strategies and unhedged derivatives (upto a certain limit).

Speaking at the launch, Sankaran Naren, ED & CIO, ICICI Prudential AMC, said: “Through the iSIF segment, we are offering investors investment strategies that are differentiated and those that can adapt to the evolving market condition by using approach which is permissible within the long-short investment strategies. The aim here is to deliver better risk-adjusted outcomes across market cycles.”

About iSIF Equity Ex-Top 100 Long-Short Fund

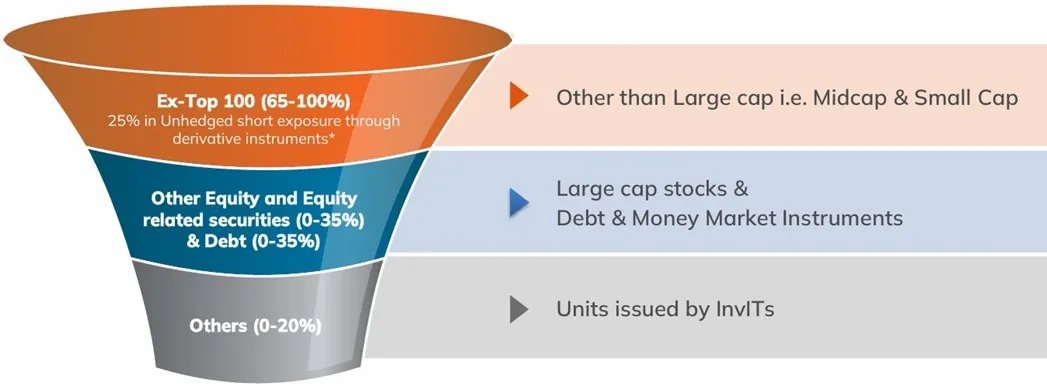

iSIF Equity Ex-Top 100 Long-Short Fund is an open ended investment strategy investing in equity and equity related instruments including limited short exposure in equity through derivative instruments of Ex – top 100 stocks. Ex- Top 100 stock means all companies other than large cap companies as identified and disclosed by AMFI. The investment strategy seeks to capture growth opportunities in the mid- and small-cap universe while managing their inherently higher volatility through long-short positioning and derivative strategies.

The investment strategy takes long positions in fundamentally strong companies and selectively shorts overvalued stocks, with the objective of participating in broader market opportunities while reducing downside risk. It follows a bottom-up stock selection approach supported by extensive in-house research across sectors. However, the asset allocation and investment approach will be as per Investment Strategy Information Document. The benchmark for this offering is Nifty 500 TRI.

Investment Approach

*Please note that the investment approach will be as per ISID.

About iSIF Hybrid Long-Short Fund

iSIF Hybrid Long-Short Fund is an interval investment strategy investing in equity and debt securities, including limited short exposure in Equity and Debt through derivatives. It seeks to combine long-short equity positions, fixed income investments, and derivative strategies to generate smoother outcomes irrespective of overall market direction.

The investment strategy aims to manage volatility by actively adjusting net equity exposure based on market valuations, trends, and internal models, while also participating in special situations such as IPOs, QIPs, buybacks, and tactical debt opportunities. By blending asset allocation with long-short strategies, the Investment Strategy seeks to deliver better risk-adjusted returns over the medium to long term. However, the asset allocation and investment approach will be as per Investment Strategy Information Document The benchmark for this offering is CRISIL Hybrid 50+50 Moderate Index.

Investment Approach

The above representation is for illustration purpose and actual result may vary. The portfolio of the investment strategy is subject to changes within the provisions of the Investment strategy information document of the investment strategy. The asset allocation and investment approach will be as per the Investment strategy information document. ^ An option strategy, usually deployed in a range bound market. It helps in generating income in the form of premiums. A covered call is constructed by holding a long position in a stock and then selling (writing) call options on that same asset. #- These are open equity position which are not hedged through arbitrage. The investment strategy may also take exposure to derivative instruments from time to time. The exposure to the derivative instruments shall be computed in accordance with the SEBI prescribed norms.

Various Alpha Generation Strategies

Stock and Sector Selection: Active stock and sector allocation based on market outlook, relative valuations, and fundamental conviction.

Derivative Strategies: Use of derivative strategies such as covered calls, options, and other permitted structures with a view to enhance returns and manage risk.

Carry-Based Debt Strategies: Investments in carry-oriented debt instruments including corporate bonds, commercial papers (CPs), and certificates of deposit (CDs).

Capital Market Opportunities: Participation in IPOs, QIPs, block deals, buybacks, and other instruments as permitted by SEBI regulations.

Riskometer & Disclaimers:

iSIF Equity Ex-Top 100 Long-Short Fund

iSIF Hybrid Long-Short Fund

*The Risk Band is as per AMFI specification. The above product labelling assigned during the New Fund Offer (NFO) is based on internal assessment of the characteristics of the investment strategy or model portfolio and the same may vary post NFO when the actual investments are made.

Disclaimer of BSE Limited (BSE) and National Stock Exchange of India Limited (NSE Limited): It is to be distinctly understood that the permission given by BSE/NSE Limited should not in any way be deemed or construed that the ISID has been cleared or approved by BSE/NSE Limited nor does it certify the correctness or completeness of any of the contents of the ISID. The investors are advised to refer to the ISID for the full text of the Disclaimer clause of the BSE/NSE Limited.

The asset allocation and investment approach will be as per respective ISID.

Investments in Specialized Investment Fund involves relatively higher risk including potential loss of capital, liquidity risk and market volatility. Please read all investment strategy related documents carefully before making the investment decision.