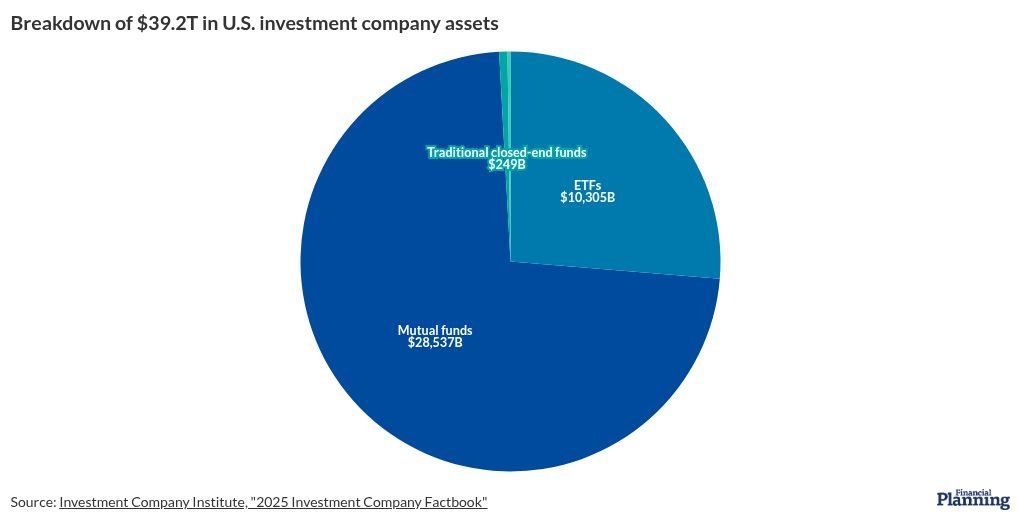

Though assets continue to flow out of mutual funds into more tax-efficient vehicles, the threat of capital gains taxes may be keeping trillions of dollars locked in limbo, a new study found.

Processing Content

Over the past five years, roughly a quarter of assets in the typical mutual fund consisted of unrealized capital gains, according to

None of those findings will likely surprise financial advisors, many of whom have been leading investors

“This has been playing out for a while, but it’s becoming even more exacerbated,” she said, noting the companies’ tools

The study resonated as well with William Connor, a partner at SAX Wealth Advisors, a Parsippany, New Jersey-based registered investment advisory firm that is a subsidiary of accounting firm SAX. Connor said Goldenring’s findings provide helpful data on a problem he has educated his high net worth and ultrahigh net worth clients about for years. Investors of any type can easily get frustrated when they’re fortunate to have long-term positions in some of the most valuable stocks, only to be unable to tap into that economic benefit and potentially get hit with taxes from the distributions of other capital gains among shareholders in the mutual fund.

“That’s always been a challenging one to explain to clients,” Connor said. “One of the best ways I can help them is to help them save money on taxes, help them make more tax-efficient investments.”

READ MORE:

Notable preliminary statistical findings

Goldenring’s paper has not been published in a peer-reviewed journal. However, its analysis of Morningstar Direct data on unrealized gains from mutual funds’ shareholder reports between 2019 and 2024 through an artificial intelligence large language model tool revealed that the average mutual fund is carrying about 25% of its assets under management in the form of unrealized gains. And, the study noted, that estimate didn’t track further unrealized gains stemming from the assets’ cost basis for tax purporses, since the funds do not disclose that data, meaning that the estimate likely understates the level of appreciation.

Other notable findings from the research include:

- Unrealized gains can lock in investors. An increase of one standard deviation (a statistical measure of how data disperses from the mean) in unrealized gains is associated with annual outflows that are 1 percentage point lower, or 7% below the average rate. “This suggests that investors facing substantial unrealized gains in their shares do not switch, even when lower-cost, more tax-efficient alternatives are available,” the study said.

- Locked-in investors face higher fees. An increase of one standard deviation in unrealized gains correlates with a reduction in discount waivers for investors of 0.6 percentage points, or 7% beneath the mean rate. “Managers exploit this tax lock-in by extracting higher fees. When unrealized gains are high, managers have higher fees and, likewise, lower fee waivers, which are temporary reductions in fees that lower the net expense ratio paid by investors,” the study said. “This pattern indicates that managers recognize when investors are locked in and adjust their fee accordingly.”

- “Twin” fund comparisons show the available alternatives. Even before the expanding launch of dual ETF share classes of mutual funds, many of the traditional products had ETF or SMA “twins” offering tax-efficient equivalents to investors. At least 94% of the mutual fund and SMA twins had one portfolio manager in common, and 91% of the ETF and mutual fund pairs had at least one as well. Within that group, 39% of the SMAs and 34% of the ETFs came from the exact same management team. In addition, the average twin SMA version of a mutual fund carried the same 17 of the top 20 holdings in the traditional structure. “The twin structure provides an ideal setting for analyzing investor behavior because they are indistinguishable along key dimensions including management and portfolio composition,” the study said. “These twins isolate how vehicle structure and resulting tax treatment affect investor decisions.”

READ MORE:

What to do about the unrealized capital gains

But the overarching takeaways from Goldenring’s paper stem from what she describes as the effects of “lock-in and fragility,” which present “a distinct tax consideration that shapes investors’ decision to stay or switch” from the mutual funds.

The first factor likely rings familiar to many advisors. Investors in taxable accounts stay with mutual funds that have accumulated capital gains in order to defer the distribution of them and the subsequent taxes from that income. When other investors in the products tap into the burgeoning methods of conversions

“High fund-level unrealized gains thus play a dual role,” Goldenring wrote. “While they create stability by deterring switching through high exit taxes, they also amplify fragility when outflows occur by generating large distributions that can trigger further switches in a self-reinforcing cycle. This lock-in mechanism creates a form of customer captivity, and thus [mutual fund] pricing power. When investors face high switching costs due to their unrealized gains, funds can charge higher fees without triggering exits. Consistent with this, I find that funds with higher unrealized gains charge significantly higher fees, controlling for performance and fund characteristics. This provides a direct link between tax lock-in and the fee disadvantage of [mutual funds] relative to ETFs and SMAs: the same unrealized gains that keep investors locked in enable managers to extract rents through higher fees.”

And that problem, she continued, was “starkly illustrated” when Vanguard in 2020 lowered account minimums for the cheapest versions of target-date funds, triggering capital gains distributions for investors. The

While clients’ day-to-day decisions may not bring such hefty implications, advisors can educate them about the issue through that episode, Goldenring’s paper and other resources on ETFs and SMAs.

The finding about 25% of mutual fund holdings being unrealized capital gains “doesn’t shock me at all,” Connor said, noting that can apply to many types of assets. Besides the solutions discussed in the paper, planners’ toolkit to deal with unrealized gains also includes

“This is one of the reasons frankly we don’t buy a lot of mutual funds anymore,” Connor said, pointing out that many ETFs charge a fraction of the expenses of traditional mutual funds that could pose capital gains taxes. “It’s money that’s not going anywhere, so maybe people pay less attention to what that fee is. … It’s a challenge with the way the tax code is set up that this tends to freeze these assets.”