Trustnet finds that active UK equity funds have struggled to outperform index approaches in recent years.

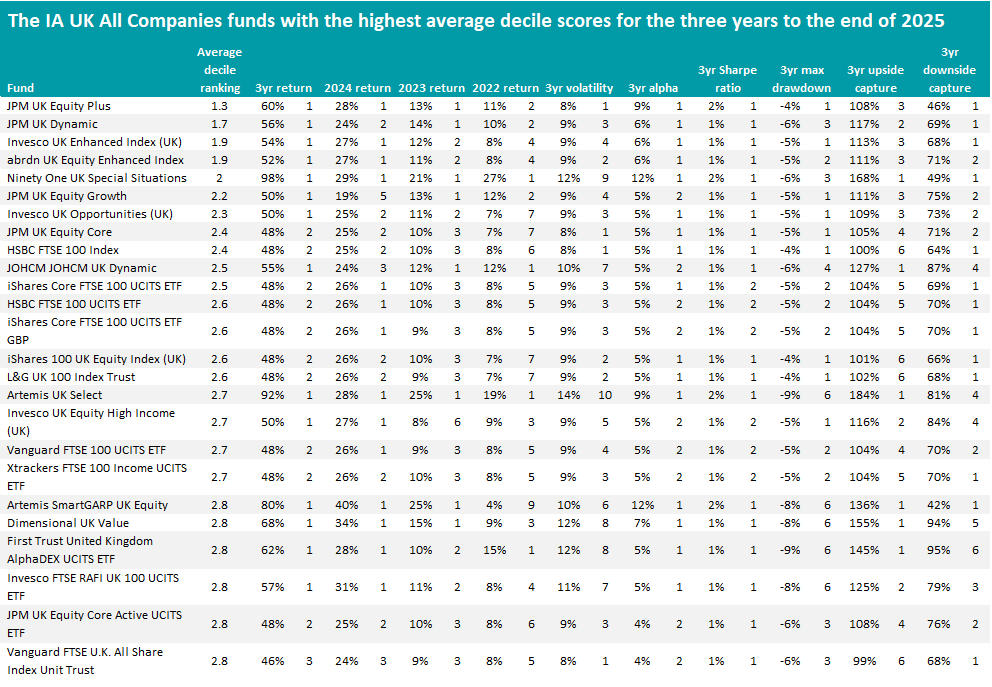

Passive funds and those taking an ‘enhanced index’ approach have led the IA UK All Companies sector on a broad spread of metrics over recent years but some active funds including JPM UK Equity Plus, Ninety One UK Special Situations and Artemis SmartGARP UK Equity have held their own, Trustnet research shows.

The IA UK All Companies sector posted an average total return of 15.4% in 2025, making it the 14th best out of the 56 peer groups in the Investment Association universe. This is up from 19th place in 2024 and 22nd in 2023. But within the peer group, which have been the best-performing funds over this period?

Trustnet runs this series at the start of each year and scores funds on 10 key metrics: cumulative three-year returns to the end of 2025 as well as the individual returns of 2023, 2024 and 2025 (to ensure performance isn’t down to one standout year), three-year annualised volatility, alpha generation, Sharpe ratio, maximum drawdown and upside and downside capture, relative to the sector average.

Funds are then ranked on their average decile for the 10 metrics to identify those most consistently at the very top of their sector. Put simply, the lower a fund’s average decile score, the stronger it has been on multiple fronts over the past three years.

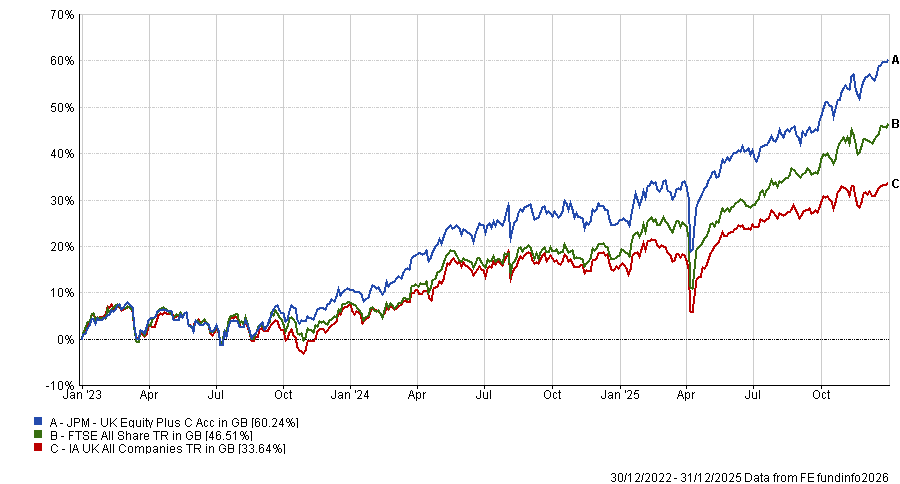

Performance of JPM UK Equity Plus over three years to end-2025

Source: FE Analytics. Total return in sterling between 1 Jan 2023 and 31 Dec 2025.

Coming in first place with an average decile score of just 1.3 is JPM UK Equity Plus. The fund has made a first-decile total return of 60.2% over the three years under consideration, as well as being in the top 10% of its sector for its 2025 and 2024 performance, volatility, alpha, Sharpe ratio, maximum drawdown and downside capture.

Managed by Callum Abbot and Anthony Lynch, the £533m fund uses a long/short strategy to enhance returns from UK stocks while maintaining 100% net market exposure. It takes short positions (up to 30% of assets) in companies expected to underperform and uses this to increase long positions (up to 130% of assets) in its highest conviction ideas.

The managers assess each company by asking whether it is a good business, attractively valued and has an improving outlook. They combine quantitative screening tools with fundamental research to identify opportunities, then construct a portfolio within strict limits (+/-6% on sectors, +/-4% on individual stocks versus the index). This approach allows the fund to express stronger negative views than traditional long-only funds whilst doubling down on best ideas.

Analysts at Titan Square Mile, which gives the fund an A rating, said: “This fund benefits from a disciplined investment approach that is executed in a consistent and risk-controlled manner. We believe it could appeal to investors seeking a solid and reliable UK equities strategy that does not give them too many surprises.”

Source: FinXL. Total return in sterling between 1 Jan 2023 and 31 Dec 2025.

As well as JPM UK Equity Plus, another four funds managed by JP Morgan Asset Management have made it onto this year’s shortlist. These are JPM UK Dynamic, JPM UK Equity Growth, JPM UK Equity Core and JPM UK Equity Core Active UCITS ETF.

JPM UK Equity Plus, JPM UK Dynamic and JPM UK Equity Growth are actively managed funds, while the remaining two take an enhanced index approach.

Enhanced index funds aim to outperform the market by using a combination of passive tracking and small, active adjustments based on quantitative data, meaning they are neither purely passive or purely active.

In addition to JPM UK Equity Core and JPM UK Equity Core Active UCITS ETF, another four of the top funds in this research – Invesco UK Enhanced Index, abrdn UK Equity Enhanced Index, First Trust UK AlphaDEX UCITS ETF and Invesco FTSE RAFI UK 100 UCITS ETF – use an enhanced index approach.

When combined with the nine funds that have a pure passive approach (such as Vanguard FTSE U.K. All Share Index Unit Trust, iShares Core FTSE 100 UCITS ETF and L&G UK 100 Index Trust), only 10 active funds have made it into the 25 outperforming on the 10 metrics used in this research.

Of these, Ninety One UK Special Situations has made the highest three-year return at 98.1%. The £787m fund is managed by Alessandro Dicorrado, whose value approach screens for deeply out-of-favour companies where share prices have fallen 50% from their peak, then conducts rigorous analysis to identify those with at least 50% upside potential based on mean reversion.

This means the fund typically underperforms during growth-driven markets but can significantly outperform when sentiment shifts back towards attractively valued stocks – as has been the case with the UK in recent years.

Dicorrado said at the start of 2026: “Following strong performances across regions in 2025, at the start of a new year most equity markets are trading closer to their long-term average price-earnings ratios – though the US remains a notable outlier in relative-valuation terms and UK equities in aggregate still appear relatively cheap compared with global peers.

“The UK continues to be a fertile hunting ground for value investors, in our view, given its combination of diverse industries and sectors alongside increasingly favourable capital allocation (in particular to share buybacks).”

Artemis SmartGARP UK Equity is another noteworthy entrant on the list, as its 39.9% return in 2025 was the highest in the IA UK All Companies sector. Manager Philip Wolstencroft developed Artemis’ SmartGARP process, which screen companies on eight factors (including valuation, growth, investor sentiment and macro) to find those growing faster than the market but trading on lower valuations.

In his latest outlook, Wolstencroft said: “Until 2021, it looked like this fund was a more volatile version of active funds in general. However, the reality is that under the bonnet, there was a big divergence. We moved into value stocks while the rest of the industry migrated to expensive ones. This set the scene for the dramatic subsequent divergence.”

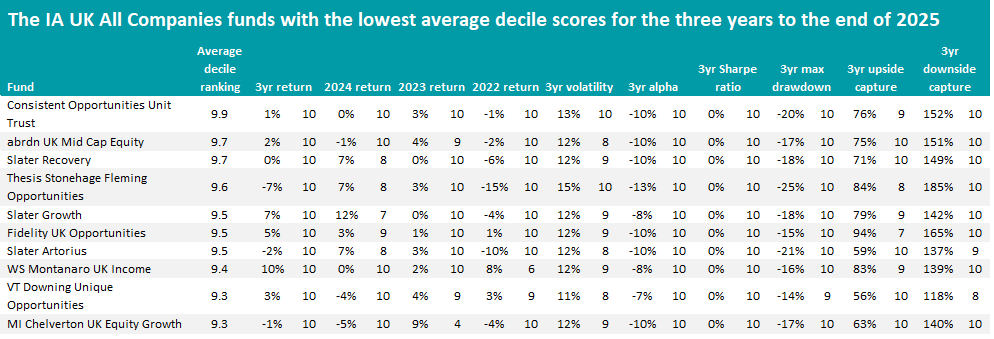

Of course, not every fund can outperform. The table below shows the funds with the highest average decile scores in the IA UK All Companies sector.

Source: FinXL. Total return in sterling between 1 Jan 2023 and 31 Dec 2025.

Consistent Opportunities Unit Trust is at the bottom of the peer group, with an average decile score of 9.9. It is currently in the bottom decile for every metric examined, aside from upside capture (where it’s ninth decile).

The fund tends to invest in smaller, undervalued UK companies. However, this part of the market has underperformed in recent years – IA UK Smaller Companies, for example, was ranked 45th out of 56 sectors in 2025 after making just 4.2%.