- This initiative aligns with the UAE National Strategy for Artificial Intelligence 2031, reinforcing National Bonds’ commitment to innovation and responsible technology adoption.

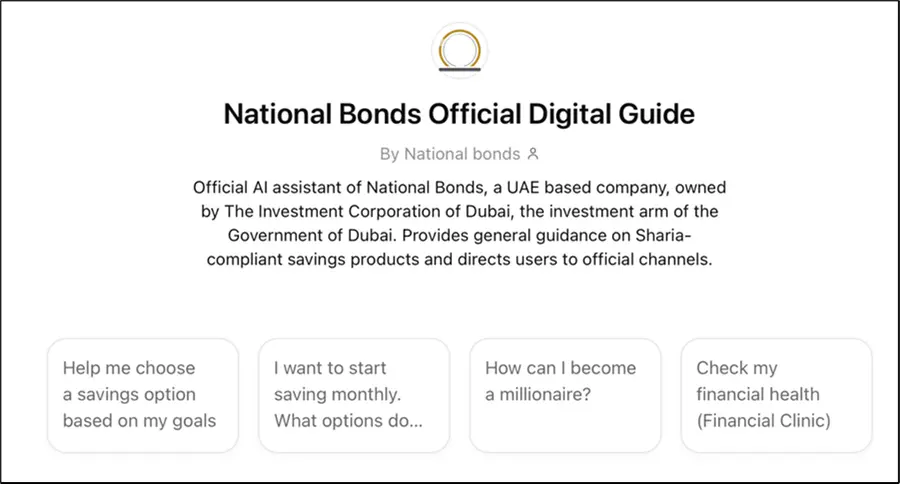

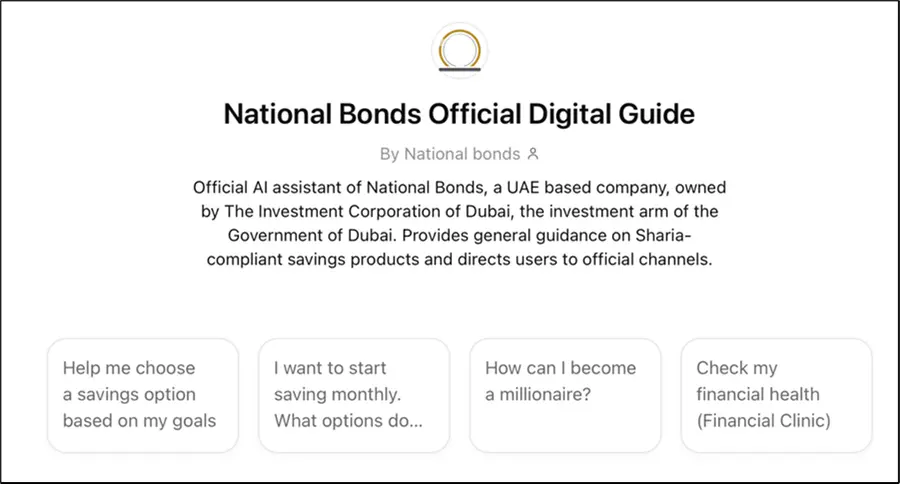

Caption: Interface of National Bonds Digital Guide on ChatGPT

Dubai, United Arab Emirates: National Bonds, the UAE’s Sharia-compliant savings and investment company, has introduced an AI-powered Digital Guide on ChatGPT to simplify savings and investment discovery. The initiative reflects a strategic move to embed artificial intelligence into its customer engagement approach, positioning National Bonds as the first financial institution in the UAE to offer an AI-powered guide of its kind.

This initiative aligns with the UAE National Strategy for Artificial Intelligence 2031, reinforcing National Bonds’ commitment to innovation, responsible technology adoption, and improving access to information through user-centric digital solutions.

Available through ChatGPT, the Digital Guide offers an interactive and intuitive way for the public to explore National Bonds’ savings and investment solutions. It provides easy access to publicly available information, enabling users to better understand available options and plans, grasp key financial concepts, and raise general inquiries, while functioning as an informative, guidance-oriented platform that connects users to National Bonds’ official channels for any further inquiries.

Mohammed Qasim Al Ali, Group CEO of National Bonds, said: “At National Bonds, using AI to simplify experiences has become part of our DNA. We see artificial intelligence as a practical tool that removes friction from everyday interactions and makes access to information simpler and more intuitive for people. With millions using AI platforms like ChatGPT every day to seek information and guidance, our presence on these platforms has become increasingly important”.

He added: “This AI-powered Digital Guide represents a first step in a broader digital engagement journey for National Bonds, reflecting our strategic focus on transparency and accessibility, while remaining aligned with regulatory frameworks. Our goal is to make the savings experience clearer, easier, and more approachable for everyone”.

This initiative builds on National Bonds’ ongoing investment in digital innovation to make financial solutions more accessible and foster a culture of financial literacy, following last year’s launch of its new mobile application.

National Bonds AI-Powered Digital Guide is available HERE.

About National Bonds Corporation Sole Proprietorship PSC:

National Bonds Corporation is a Sharia-compliant savings and investment company owned by the Investment Corporation of Dubai, established in 2006. It is licensed and supervised by the Securities and Commodities Authority and is audited by the Dubai Government Audit Department, Sharia Supervisory Board as well as reputable International external auditors. The company provides UAE nationals, UAE residents, and non-residents with an opportunity to build and fortify their savings safety net, as well as invest in programs that offer competitive returns with lower risk. Its goal is to encourage disciplined savings habits for people across the 7 Emirates, in line with the UAE Government’s Vision for a financially secure and sustainable future. National Bonds offers an exciting AED 36 Million Rewards Program to all savers, with monthly and quarterly prizes ranging from AED 1 million to various luxury cars. www.nationalbonds.ae