Key Points

-

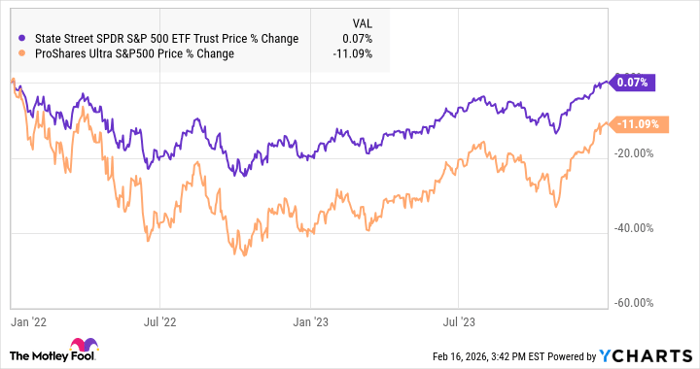

Even when the market fully recovers from a downturn, a leveraged ETF often doesn’t.

-

The S&P 500 returned to its late-2021 levels by the end of 2023, but the leveraged ProShares Ultra S&P 500 fund was still 11.7% underwater.

-

These ETFs are designed for short-term trading, not long-term investing.

Imagine you’re at a casino, and someone offers you a deal: every time the roulette wheel lands on black, you win double. Sounds amazing, right? But there’s a catch. Every time the ball lands on red, you lose double too.

That’s basically a leveraged exchange-traded fund (ETF) in a nutshell.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

The math problem nobody warns you about

Leveraged ETFs tend to be volatile assets, and their prices reset daily. This cycle creates a mathematical effect called “volatility decay,” which sounds boring but is actually a silent killer of your returns.

Here’s a simple example:

-

Day 1: The S&P 500 (SNPINDEX: ^GSPC) drops 10%. Your 2x leveraged ETF, perhaps the ProShares Ultra S&P 500 (NYSEMKT: SSO), drops 20%. Ouch, but OK.

-

Day 2: The S&P 500 gains 11.1% (back to even). Your 2x ETF gains 22.2%. Sweet!

A person chews on their pen while frowning at a computer screen.

Image source: Getty Images.

You’d think you’re back to even too, right? Nope. Your 2x ETF is still down about 2.2%. The market recovered; you didn’t. Now multiply that by months and years of normal market zigzags.

For example, the S&P 500 fell 19.5% in the inflation-stricken year of 2022, while the ProShares Ultra fund dropped 39.3%. The market posted a 46.4% return the following year, landing almost exactly where it was two years earlier. The leveraged fund only saw a 24.3% recovery, leaving a big gap to the prices seen at the end of 2021:

The good years aren’t good enough

In a smooth bull run, leveraged ETFs look like genius plays. But markets don’t move in straight lines. They hiccup, correct, panic over tweets, and occasionally have full-blown tantrums. Every uncomfortable wiggle chips away at your leveraged position.

Leveraged ETFs are designed for day traders and short-term tactical moves. Think hours or days, not years. The fund companies literally tell you this in the fine print. They’re specialized trader tools, not solid long-term investments.

Boring old index funds may not make you feel like a Wall Street genius, but they also won’t make you cry into your coffee after a choppy quarter.

Should you buy stock in ProShares Trust – ProShares Ultra S&p500 right now?

Before you buy stock in ProShares Trust – ProShares Ultra S&p500, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ProShares Trust – ProShares Ultra S&p500 wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 18, 2026.

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.