Balanced funds can be an investor’s best friend. If you can handle some ups and downs, up to about a 20% drop in value, and you’re planning to invest for at least 10 years, these “set it and forget it” funds can be an easy way to grow your money without constant monitoring.

Few firms do simple and effective as well as Vanguard. Best known for its low costs and no-frills approach to investing, it has several funds on Morningstar’s list of Best Balanced Funds.

But which one is the best fit for you? Fund names aren’t always helpful. “Wellington” might tell you who is managing the fund, but it doesn’t tell you what’s on the managers’ investment menu (beef Wellington, anyone?). Morningstar Categories and Medalist Ratings can help clarify how a fund invests beyond its name. In this article, we’ll look at the four Vanguard balanced funds with Morningstar Medalist Ratings of Gold or Silver that are 100% analyst-driven.

Vanguard Wellington VWELX has the highest Process Pillar rating among Vanguard’s balanced funds. This reflects Morningstar analysts’ strong confidence in the fund’s time-tested active investment approach. While the fund has seen several manager changes over the years, its strategy has remained intact and has been executed consistently by subadvisor Wellington Investment Management for more than three decades.

Vanguard Balanced Index VBINX and LifeStrategy Moderate Growth VSMGX showcase the firm’s indexing expertise, building portfolios from market-cap-weighted stock and bond indexes. True to Vanguard’s reputation, both are among the lowest-cost balanced fund options available, exactly what you’d expect from the company Jack Bogle built.

Vanguard Global Wellington VGWLX, launched in 2017, is the newest of the group. It has gotten off to a strong start and shares many of the strengths of its US-focused counterpart, Wellington. At just $2 billion in assets, it’s also the smallest of the four funds, well behind the next smallest, LifeStrategy Moderate Growth, at more than $20 billion. As Global Wellington grows, its fees are likely to come more in line with its peers.

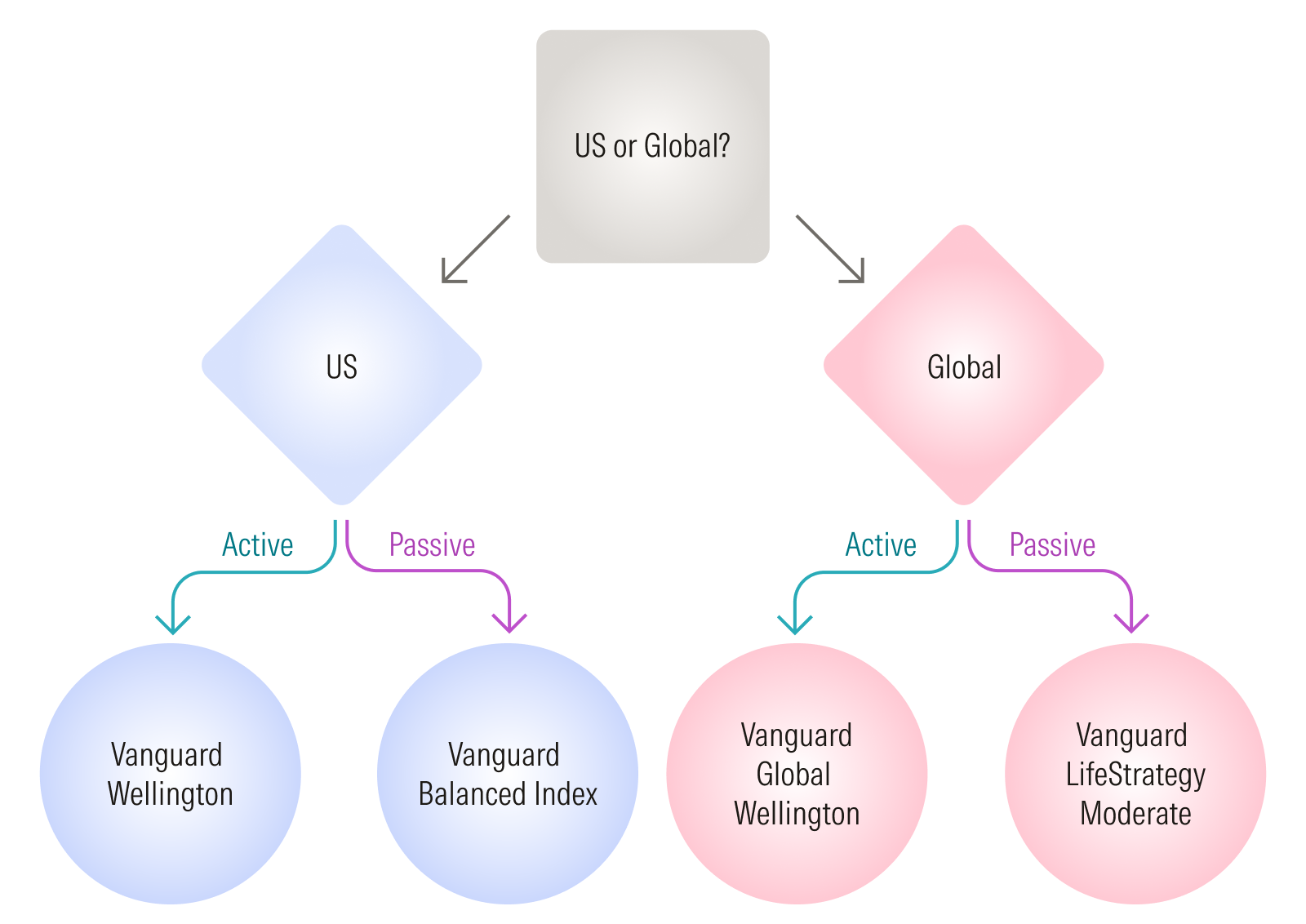

A Quick Guide to Picking the Vanguard Balanced Fund That Fits Your Style

Stay Home or Go Global?

The first choice investors need to make is whether to pick one of the balanced funds that’s invested 100% in the US or one that’s diversified across the globe. US-focused balanced funds have been hard to beat since the 2008 financial crisis, thanks to chart-topping performance from technology companies like Nvidia NVDA, but as we saw in the first quarter of 2025, non-US stocks can still outperform under the right circumstances. And investing outside the US can also enhance overall portfolio diversification.

Do You Believe in Active Management?

Whether staying home or traveling abroad, Vanguard has an option that features standout active management teams from Wellington Management and an option that features its signature low-cost passive investment approach. While index investing has delivered strong long-term results, skilled active management at a reasonable price offers the potential for market-beating returns (with the inverse also being true). Since all four balanced funds launched, the Wellington-managed options have outpaced their index-based siblings, thanks to smart stock selection and solid bond management. In contrast, the balanced funds with passive bond sleeves struggled during the sharp interest rate hikes of 2022, highlighting the value of active oversight in turbulent markets. With interest rates more normalized now, it could be a closer contest going forward.

A Closer Look at the US Balanced Funds

Vanguard Wellington and Vanguard Balanced Index both focus exclusively on the US but take slightly different approaches to asset allocation. Wellington uses a target allocation of 65% stocks, 5 percentage points higher than Balanced Index, and benchmarks its stock sleeve to the S&P 500 index. In contrast, Balanced Index uses the broader CRSP US Total Market Index, which includes small caps. As of March 31, 2025, Wellington held no small-cap stocks, while Balanced Index had about 5% in smaller companies.

On the fixed-income side, both focus solely on investment-grade bonds to provide better defense against falling stock markets. Wellington uses the Bloomberg US Credit A or Better Bond Index, though its managers will own a decent amount of out-of-benchmark corporate credits that sit in the lowest rung of investment-grade quality to capture higher returns. Duration is kept within a year of the bogy, which has a longer duration than the Bloomberg US Aggregate Bond Index used by many peers, including Balanced Index. At the end of March, its effective duration of 6.57 years was almost a year longer than Balanced Index’s 5.85-year effective duration. If those differences hold, Wellington’s bond sleeve would be more sensitive to changes in interest rates.

A Closer Look at the Global Balanced Funds

The global balanced funds share several important structural differences. Global Wellington maintains a target allocation of 65% stocks and uses the FTSE Developed Index as its equity benchmark, which excludes emerging markets. In contrast, Vanguard LifeStrategy Moderate Growth includes emerging markets through its allocation to Vanguard Total International Stock Market Index VGTSX. For example, as of March 31, Global Wellington had no exposure to China, while in LifeStrategy Moderate Growth, China was the fourth-largest country holding with a 3% allocation.

Another key difference lies in their treatment of US versus non-US equity exposure. LifeStrategy Moderate Growth does not use global market-cap weights to determine its regional mix. Instead, it has followed a strategic 60% US and 40% non-US stock split within its equity sleeve since 2018. At the time, this represented an overweighting to US equities relative to market-cap-weighted indexes, but today it stands about 4 percentage points underweight compared with the MSCI ACWI Index.

Global Wellington, on the other hand, takes a more flexible, bottom-up approach. Its managers let company-level research determine regional allocations. This valuation-sensitive strategy has typically resulted in a meaningful underweighting to US stocks. Non-US stocks have historically made up 40% to 50% of its equity sleeve. As of the latest data, that figure stood at 44%, about 7 percentage points above the Morningstar Category average and 13 points higher than its FTSE Developed Index benchmark.

On the bond side, LifeStrategy Moderate Growth stands out for its large allocation to non-US investment-grade bonds. Nearly a third of its bond sleeve is invested in Vanguard Total International Bond ETF BNDX.